A New Balance Of Power In The Gold Market

Commodities / Gold and Silver 2016 Jun 23, 2016 - 05:50 PM GMTBy: John_Rubino

Gold analyst Michael Ballanger just posted an article noting how much things have changed — perhaps for the better — in the gold market. Here’s an excerpt:

Gold analyst Michael Ballanger just posted an article noting how much things have changed — perhaps for the better — in the gold market. Here’s an excerpt:

Commercial Traders Have Just Gone Over the Top

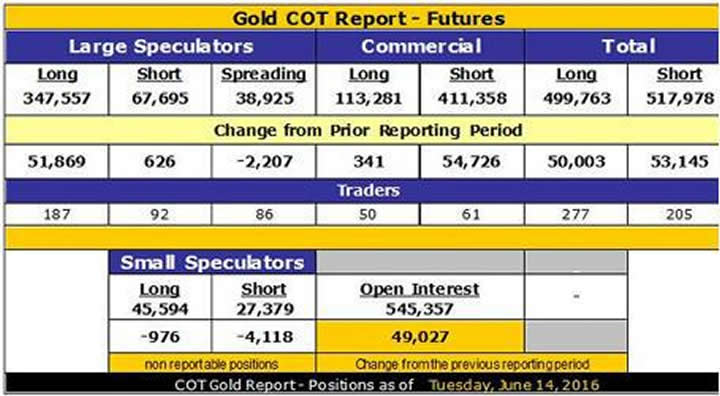

(24hGold) – With Friday’s Commitment of Traders Report, the ridiculous has just metastasized into the sublime as the Commercial Cretins have just gone “over the top” and added another 5.4M “ounces” to their synthetic gold short position. At 298,077 contracts declared short, they are now carrying the largest short position in Crimex history. The scary part is that these figures don’t include the big rise in open interest yesterday and you just KNOW that it ballooned out due to more Cartel shorting.

While these numbers are synonymous with prior tops like in 2008 and 2011, the difference today lies in two realities: 1) The Shanghai Gold Exchange is keeping the Crimex and LBMA (London Bullion Market Association) thieves at bay through some voracious arbitrage, and 2) Raw demand from the Far East and from Western investment pools are keeping inventories tight. If this was back in 2011-2015, the market would be limit down on Monday as the criminals have their way with us. However, this is a NEW bull market and dips are to be bought while holding onto your core position for dear life as I have been trying to do with my GDXJ (Market Vectors Junior Gold Miners ETF) position. I can’t tell you how many times I have had to lock myself in the wine cellar during trading hours because the temptation to “SELL!” was so overwhelming.

The bullion banksters and their well-armed trading desks have now arrived into somewhat of a “pickle” in that the movie reel that they thought would play out with the bad guys winning and gold following through to the downside on what should have been another Freaky Friday where gold and silver get clobbered. Since it DIDN’T, they now have to await selling from the Asian markets in order to give them the slightest chance of a downside flush this coming week.

What IS a certainty is that the PMs are trading in a totally bizarre fashion, and anyone who fails to pay attention to Commercials are indeed paying no attention to “that man behind the curtain” who most certainly is pulling levers and spinning dials frantically in order to secure the desired effect while being short nearly 30 Moz of phony, synthetic gold that closed within a whisker of a new closing high for the move. There must be carloads of Pepto and adult diapers being handed out to the Cretins as the wait in agony for the Sunday night opening.

Let’s expand on that “voracious arbitrage” idea: The Shanghai exchange is a physical market, where buyers go to get actual gold and silver. So prices there are set by sellers with metal to move and buyers who want to take delivery. On the Western paper exchanges, the players mostly gamble on price movements using futures contracts, with very little actual metal changing hands.

But if the price set in the Shanghai physical market is higher than in the paper markets — reflecting the different aims of the respective sets of traders — then it becomes profitable for holders of long futures contracts in the West to demand delivery of the metal, ship it to China and sell it at the higher Shanghai price.

Once this process gets going it will quickly clear out the inventories of the Western exchanges, leaving nothing for future arbitrageurs. The exchanges will then force those wanting delivery to accept cash instead, in effect defaulting on their promises. Then it’s game over, with the big futures manipulators no longer a factor in pricing.

Presumably from then on gold and silver prices will reflect rising physical demand in the East (and in the West from individual stackers). And gold will begin its long climb to the $10,000 or so price necessary to balance the amount of fiat currency created during the inflation of the Money Bubble.

This phase change could take a while, creating the possibility of some more nasty corrections while the paper players retain the upper hand. And once it gets going it could be steady and relatively peaceful or a “punctuated equilibrium” move where the failure of an exchange or bullion bank sends gold from $2,000 one day to $6,000 the next. Either way, the dominance of physical exchanges implies that much higher prices are coming.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.