Resistance Holding Gold Stocks after Brexit

Commodities / Gold and Silver Stocks 2016 Jun 25, 2016 - 06:23 PM GMTBy: Jordan_Roy_Byrne

What a last 24 hours for markets! At one point Gold was up $100/oz, S&P futures were limit down and the British Pound was down over 8%! The volatility has subsided, perhaps temporarily and Gold settled around $1320/oz with Silver settling below key resistance at $18. The miners predictably gapped up but the strength was sold. As miners remain below 2014 resistance we expect Gold to retest $1300/oz before moving higher.

What a last 24 hours for markets! At one point Gold was up $100/oz, S&P futures were limit down and the British Pound was down over 8%! The volatility has subsided, perhaps temporarily and Gold settled around $1320/oz with Silver settling below key resistance at $18. The miners predictably gapped up but the strength was sold. As miners remain below 2014 resistance we expect Gold to retest $1300/oz before moving higher.

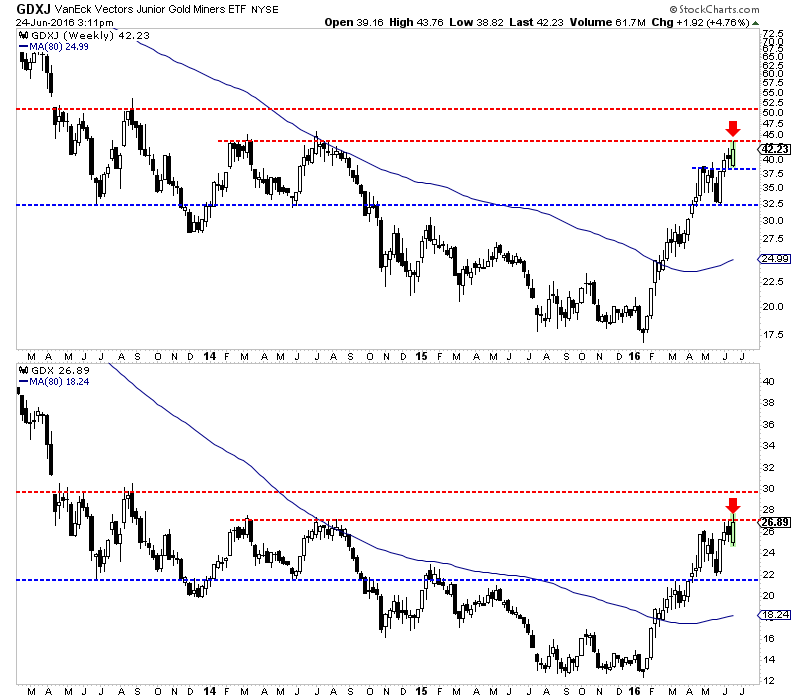

The chart below plots the weekly candlestick charts of GDXJ (top) and GDX. The miners gained 5% to 6% on the week thanks to Brexit but note that miners sold off today after testing 2014 resistance. GDXJ, which has resistance at $43-$45 reached $43.76 today before declining and GDX, which has resistance at $27-$28, reached $27.71 before declining.

GDX, GDXJ Weekly Candles

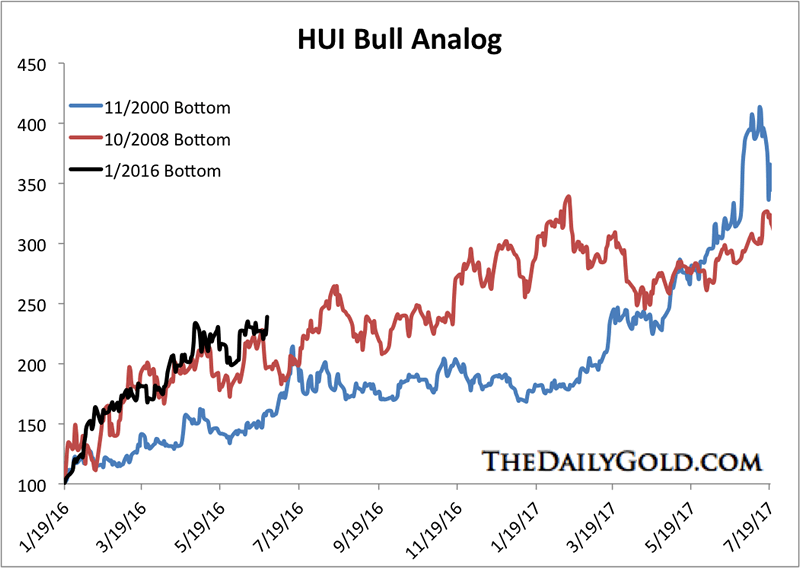

We should also note that the miners remain stretched when viewed through the lenses of history. Specifically, Brexit pushed the rebound above the 2008-2009 rebound.

HUI Bull Analog

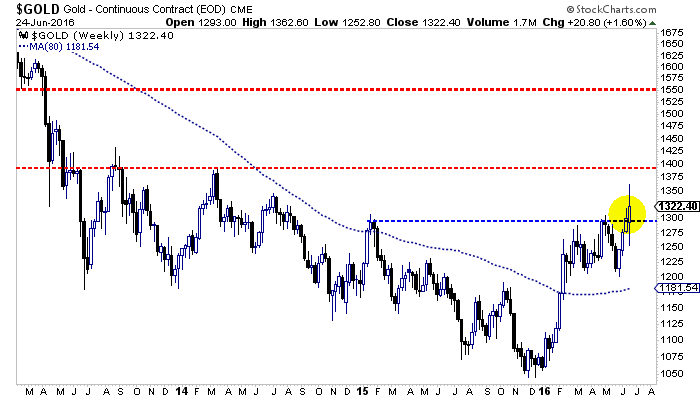

Given the action in the miners today and their historically overbought condition, coupled with Gold selling off from much higher levels, I expect Gold to retest $1300/oz next week. A retest is only that and nothing more. While Gold has technically not formed a reverse head and shoulders bottom, it nevertheless has a potential measured target of $1550/oz. There is some resistance at $1330 and $1380 to $1400. However, there is very little resistance from $1400 to $1550.

Gold Weekly Candles

News events rarely change market trends as the market typically leads news but Brexit could be an indication of a new bullish development for precious metals. That would be the long-term disintegration of Europe which would be very negative for the Euro, the world’s second largest currency. This news propelled Gold through $1300 and could be the catalyst to take it towards $1400 over the next few months. Meanwhile, the gold stocks could back and fill just a bit before again testing 2014 resistance levels.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.