Brexit, Cycles and The Revolt Against Globalism

Stock-Markets / Cycles Analysis Jun 29, 2016 - 06:24 AM GMTBy: Clif_Droke

Everywhere one turns there is evidence of widespread rage and frustration. The peoples of Europe and the Americas in particular are aggrieved at their political lot and are becoming increasingly angry. What was once a simmering resentment has become a boiling cauldron of discontent.

Everywhere one turns there is evidence of widespread rage and frustration. The peoples of Europe and the Americas in particular are aggrieved at their political lot and are becoming increasingly angry. What was once a simmering resentment has become a boiling cauldron of discontent.

The latest token of this growing anger is the outcome of Britain's vote to leave the EU. The majority of British voters have decided they've had enough of austerity and have expressed their unhappiness in no uncertain terms, much to the consternation of global financial markets. This in turn has inspired other European countries to pursue independence from the Union.

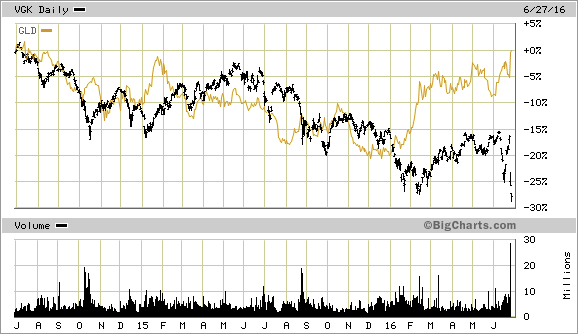

The powerful tailwinds of global deflation are reflected in the following graph of the Europe ETF. While European equity prices have suffered the effects of investors' uncertainty over the future of the EU, gold prices and other financial safe havens have benefited - and should continue - to benefit from it.

In the U.S., a growing resentment of internationalist policies has spawned the surprising successful Donald Trump presidential campaign. Even Texas has rekindled its long-time passion for self-determination.

The spirit of the times is undeniably one of revolt with independence and freedom from excessive government the rallying cry. The contrast between today's world spirit and that of just 10-20 years ago is indeed stark. At that time the prevailing spirit was one of unity, cooperation and enthusiasm for the burgeoning global economy. Today it's quite the opposite: multiplied millions have had enough of the globalism experiment and are inclined to turn inward rather than outward.

What brought about this stunning change of opinion and how did it happen? Students of history will no doubt recognize the undeniable cyclical nature of human affairs and will readily discern the answer. The long-term cycles which govern the economy and mass human emotion are the primary catalysts in the worldwide populist uprising.

Bureaucrats and elected leaders the world over are puzzled by the growing resentment of the taxpayers and their repudiation of globalism. As history repeatedly shows, however, government tends to be tone deaf to the will of the people at pivotal points in world affairs. This time is proving to be no exception. The latest news headlines demanding a "re-do" of the Brexit vote underscore the rejection of majority will on the part of government. Yet government still wonders why their subjects are in a rebellious mood. As many commentators have recently observed, why even bother holding elections if the majority will is only going to be ignored? Why not dispense with the illusion of the democratic process and openly declare government by decree?

The global growth of the rebellious spirit can be traced to the 120-year Grand Super Cycle made famous by Samuel J. Kress. According to Kress, at the end of each 120-year cycle bottom there is a revolutionary change that accompanies the transition into a new Grand Super Cycle. Not for naught is it sometimes called the Revolutionary Cycle. The previous 120-year bottom in the late 1890s witnessed the efflorescence of the Industrial Revolution in the U.S.; the prior bottom in 1774 saw the American Revolution for independence from England.

Before his passing, Mr. Kress prophesied that the latest 120-year cycle bottom in 2014 would see the establishment of socialist government in the U.S. and the demand for more democracy in other countries. His prediction is starting to be justified as evidenced by the fact that other countries across the globe are fervently trying to throw off the shackles of decades of socialist policies; meanwhile in the U.S. government's role in everyday affairs is expanding apace.

Each phase of the Grand Super Cycle, ascending and descending, has its own peculiar characteristics. The rising phase of the cycle is characterized by economic expansion, optimism, goodwill and trust of government. The descending phase, is marked by economic contraction, pessimism, distrust of institutions and cynicism toward government. Based on the foregoing descriptions, it's easy to see which side of the cycle we've been on in recent years.

A common question concerning the long-term cycle is, "If the 120-year cycle bottom in 2014, why are we still seeing the manifest tokens of a declining cycle?" The answer is that the residual downside force from such a huge cycle will naturally take time to dissipate. Just as a speeding freight train can take miles to reach a complete stop and the tailwinds from a hurricane can linger for hours after the storm passes, the destructive effects of a bottoming cycle can continue for weeks, months, or even years after the cycle has bottomed (depending on the cycle's magnitude). According to Kress, the cycles have a standard deviation (plus-or-minus) of 1-2 percent. A 2 percent standard deviation of the latest 120-year cycle bottom equates to 2.4 years from the cycles nominal bottom of September/October 2014. If there is any validity to the long-term Kress cycle, that would mean we likely wouldn't witness a lifting of the deleterious effects of the cycle until sometime next year.

In the mean time we should expect to see in the coming months a crescendo of the rebellious spirit as the momentum behind the anti-globalist movement reaches explosive proportions. Although only time will provide the final verdict, it can be conjectured that what we're now witnessing is the final "blow-off" phase of the revolutionary mindset which began in the wake of the 2008 credit crisis. As is true of most momentum blow-offs, the final move just prior to exhaustion of the trend tends to make a spectacular showing.

When all is said and done, and the dust has cleared, what can we expect as the final outcome of the Great Global Rebellion? The future is anyone's guess and God only knows what the ultimate result will be. Using history as a template we can, however, make a reasonable conjecture and review some possible scenarios. One such possibility is that the U.S. ultimately ends up in the throes of greater government control than ever, thus continuing the trajectory of the last several decades of federal creep while fulfilling Kress's prediction.

Another potential outcome is that the peoples of the world continue in their determined effort to throw off the shackles of technocratic rule and move toward a path of self-determination. If both scenarios are realized, as per Kress, this would represent a stunning reversal of the prevailing global paradigm of the last 120 years.

Once the tailwinds of the 120-year cycle bottom have completely abated the markets should be in a good position to commence a synchronized (and much needed) global re-inflation phase as the newly formed Grand Super Cycle becomes established. When it finally happens it will be a most welcome change from the rebellious spirit that has characterized the last several years.

The Stock Market Cycles

For the summer months only, the book "The Stock Market Cycles" is available at a special discount to readers of this commentary. The book reveals the key to interpreting long-term stock price movement and economic performance, namely the famous Kress series of yearly cycles. This work was undertaken based on popular demand and was written in a style that casual readers and experts alike can enjoy and understand. The book covers each one of the yearly cycles in the Kress Cycle series, starting with the 2-year cycle and ending with the 120-year Grand Super Cycle.

The book also covers the K Wave and the effects of long-term inflation/deflation that these cycles exert over stock prices and the economy. Each chapter contains illustrations that show exactly how the yearly cycles influenced stock market performance and explains where the peaks and troughs of each cycle are located and how the cycles can predict future market and economic performance. Order your autographed copy today: http://www.clifdroke.com/books/Stock_Market.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.