Golden Fireworks - Gold Price Forecast

Commodities / Gold and Silver 2016 Jul 06, 2016 - 07:05 AM GMTBy: Bob_Loukas

This is a follow up post to last month’s blog post – Gold is Ready to Perform and is an excerpt of the weekly premium report.

This is a follow up post to last month’s blog post – Gold is Ready to Perform and is an excerpt of the weekly premium report.

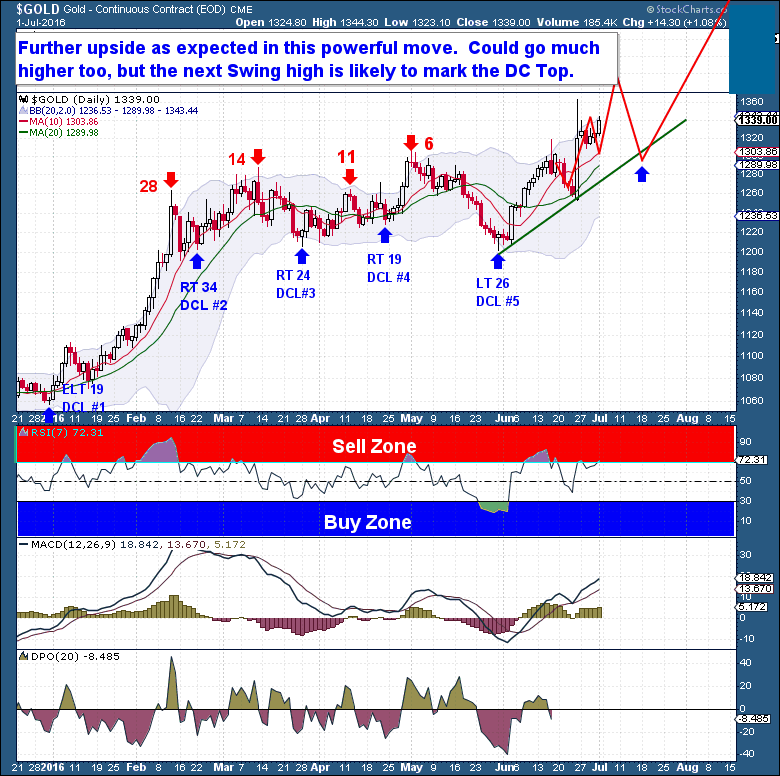

Gold surged on the Brexit vote a week ago, then then spent the early part of this week consolidating the gains. The net gain since the Brexit vote has been impressive, but Gold has still not regained the intraday high from the day after the Brexit vote. Since spiking to 1362 the morning after the vote, Gold has been filling and confirming the Brexit surge.

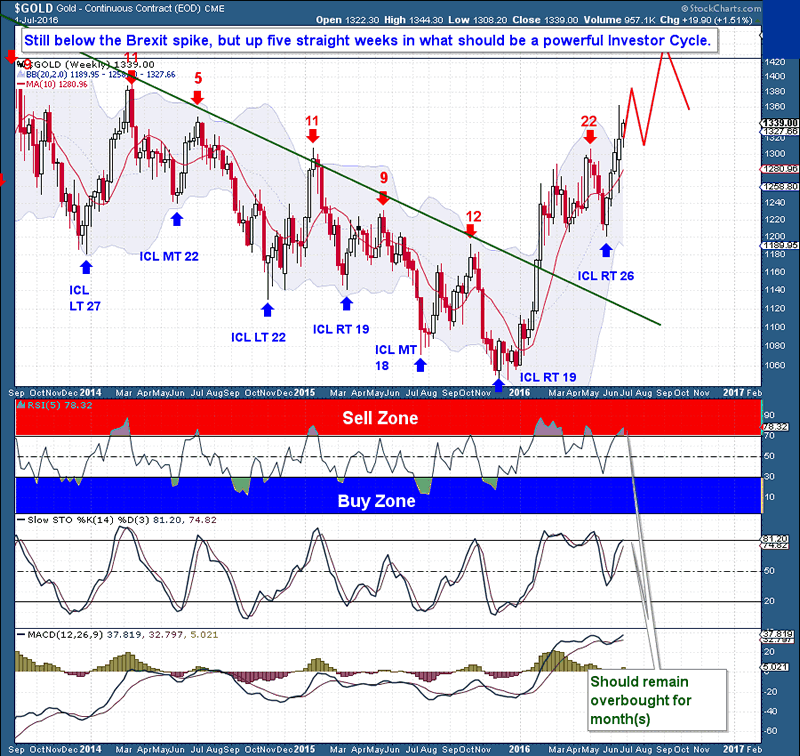

The initial spike after the Brexit vote was clearly an over-reaction, but the bullish action since has confirmed that the move higher is real. With Gold now approaching the Brexit intraday high, I believe that we should see another 2-5 day rally before the Daily Cycle peaks and turns lower. At this stage of the Cycle, any Swing High will likely mark the DC top.

At the end of 2015, the precious metals Miners were undervalued in relation to Gold by a historical amount, and the January-May Gold Investor Cycle (IC) allowed them to play catch-up. I have shown the Gold:Miners ratio chart numerous times in the past to illustrate how Miners typically catch the first real bid during bear market turns. And that’s what happened during the 1st IC. Now, the other precious metals can make their own runs.

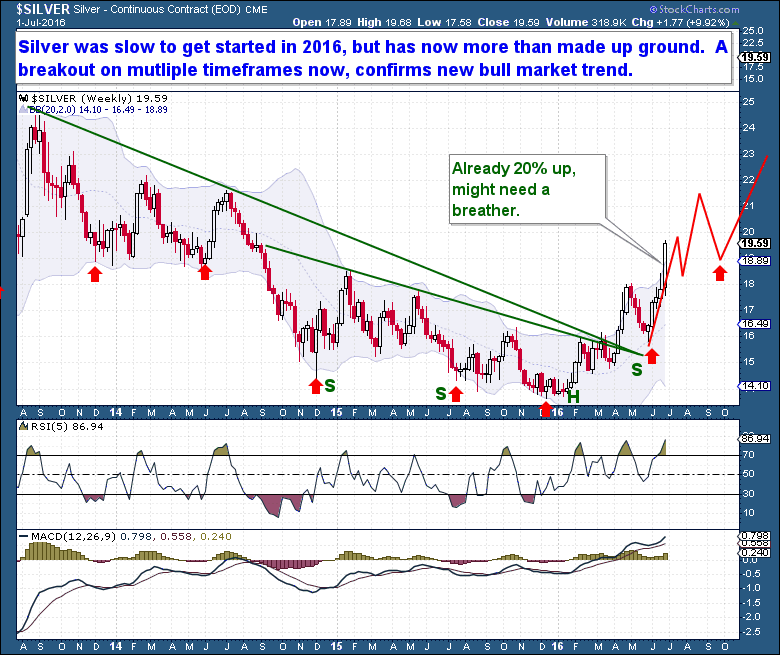

Silver has taken off as only Silver can. It has already become significantly overbought, but the current move is showing no sign of stopping, and could become epic. It’s important that we recognize the move for what it is, maintain our composure and hold through the dips where appropriate. Silver is still trading at a historically massive discount to Gold, but it doesn’t need to catch up all at once. There is plenty of time for it to do so in coming Cycles.

Platinum and Palladium were also big winners this week. They have been underpriced (relative to Gold) and both saw broad-based buying. And as the end of the bear market has become clearer to investors, the entire precious metals sector has received an increasing flood of money.

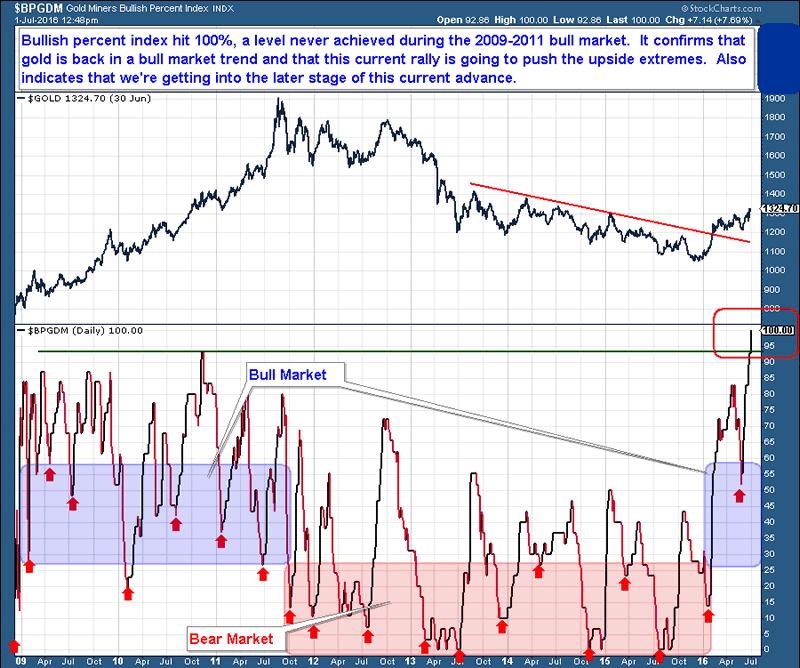

The Miners are seeing buying across the board, and even the laggards and lessor quality names have begun to see bids. And that’s fine. Increasing participation confirms the bull market and tells us that we’re still very likely only in its early innings.

Recent history has not seen the precious metals Miners bullish percentage index ($BPGDM) pegged at 100, and the fact that it is now is a clear sign that we’re comfortably into the bull market’s next phase. It’s also, however, a warning that we’re likely beginning to approach the next DC top.

There is not much room for alternative analysis. The entire Gold sector is in the prime portion of the Cycle, and speculators have begun to lift the market higher. We’ve prepared for this outcome, and must be aware that short term, violent, counter-trend hits are possible at any time, as over-leveraged speculators bail on positions. Each of us needs to avoid being chased out of positions by making sure they are correctly sized, and that leverage is appropriate.

As predicted when the DC started (some $100 ago), we are likely to have another 6-10 weeks higher in the current Investor Cycle. My minimum target is $1,420, but my expectation is that the IC will top somewhere between $1,450 and $1,480. Be smart about your entries and exits – it is best to buy during dips and sell some during rips, as opposed to becoming excited during surges and adding leverage at the end of intraday moves. Most investors will be best served by not watching the tape too closely and by being content with the positions they have.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

NOTE: For the first time ever The Financial Tap offers you a Full 14 day, no risk, money back Trial. It’s just $99 thereafter for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

By Bob Loukas

© 2016 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.