The Big Silver Long - What Gives?

Commodities / Gold and Silver 2016 Jul 10, 2016 - 05:27 PM GMTBy: Dr_Jeff_Lewis

As Chris Powell of GATA made famous: "Price action makes market commentary".

As Chris Powell of GATA made famous: "Price action makes market commentary".

Control the price of anything and you get control of the story. The U.S. Commodities Future Exchange (COMEX), a subsidiary of the Chicago Mercantile Exchange (CME), is central to price discovery – and nothing else can compete.

Price action on the big silver ETF, SLV does not (yet!) factor into a price that begins and ends with a trading structure that is rigged to the tune of a few traders who dominate one side of the trade.

Nor does the mining sector have direct influence, though it’s very easy (and therefore tempting) to envision scenarios where signals from mining equities seem to anticipate impending moves.

Sales from the U.S. Mint or industrial production or usage data have no bearing yet. There is no news of significant supply surplus.

Perhaps overnight trading or the Asian markets will matter one day. But for now, the overall (paper) trade volume outside of the COMEX is but a fraction of what occurs during New York hours. And yes, that is paper trading – the tail wagging the dog.

But that is not anything new. The entire fiat system is awash with derivatives and similar patterns, though none so egregious and visible than silver. The metals and commodities, fit with the story of what we see across the board. The dollar, deflation, the return of the liquidity crunch.

It’s as if the story is somewhere along the lines of, “Let’s make some political wiggle room for more easing – or printing – to justify the only thing that we, (the central banks) know how to do.”

So, we remain in limbo – lock down mode.

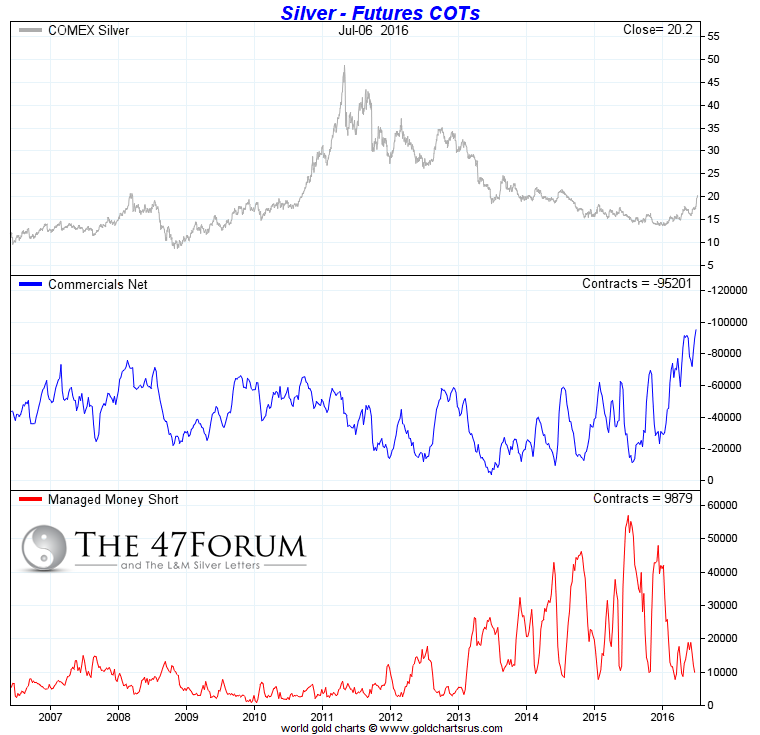

This chart is an graphic illustration of the dance between the commercial net shorts and the managed money technical funds.

Recently, a friend and fellow subscriber, wrote to me the following comment and question about what I thought of the bullishness or bearishness of JPM’s alleged physical long.

The premise came from Ted Butler’s many observations (read the premise here) and insight into the structural framework at this, the primary level, of silver price discovery.

My response was:

Sadly, in the end, it’s all bearish to me. The whole fiat Ponzi wake up call cannot, and most likely will not, end well.

(The reflection of the madness can be seen in the growing social unrest).

I think we’ll be ‘happy’ that we had something left over relatively unencumbered.

As for the JPM physical long speculation…

Someone has been buying while prices were falling in the aftermath of April-May 2011. Who, other than very deep pockets, can actually afford to accumulate against the grain like that? (Outside of our small village of silver investors.)

This was much different than the buying that went on from the 2009 to the 2011; for then it was buying on rising prices that ultimately put pressure on physical inventory.

It certainly seems in line with the way these guys operate – anything for a profit and above the law.

One could be right about JPM ultimately using their physical hoard to further quell prices – when or as ‘needed’.

Though I can’t help but wonder how they will use physical silver to suppress paper (COMEX) prices.

In fact, as I've speculated recently, buying Eagles and Maple Leafs is a perfect of way of burying the corpse if they intend to squeeze their fellow short counterparts...(it's not a new strategy in the history of futures manipulation).

In other words, what’s the vehicle for delivering on all that metal? Price is a COMEX-derived affair, yes?

It’s not like real physical supply and demand conditions have had any meaningful impact on paper price over these last 40+ years.

Longs must stand for delivery while the shorts must come up with the metal to fulfill the promise.

How do they go about feeding all the metal required to close out those positions without disruption?

Let’s say they do start delivering metal on all those shorts…

How do they do that quietly? And what then?

Are they going to come right back in and short the move up all over again? Wouldn’t everyone see it once market started moving? How would the rest of the big 8 deal with the margin calls on their underwater positions -- more than $2 Billion of open losses at the time of this writing according to Butler.

The footprints would be all over the COT report.

Again, ultimately, how does one unload all that metal onto a futures market without being disruptive or drawing attention?

That’s a lot of questions, I know. But ones we should be asking.

Politically and systemically, JPM and the other big four (net shorts) are enmeshed with the fourth, fifth, and sixth branches of government. (The Fed, Treasury, and Exchange Stabilization Fund). These giant banks are, for all intents and purposes ‘The Fed’.

So yes, sure; ultimately, they are more or less one degree separated from THE central power.

Maybe, (along with the Fed), they are simply one more nodal point in the greater world currency matrix – which is an elite and fantastic farce, led by the BIS, World Bank, or IMF?

Maybe the real question is how do they keep THAT going? How do they keep the dollar reserve paper Ponzi going?

That seems like a bigger, much more complicated, high stakes, and delicate ‘mission’.

Black Swans (or a murder of crows) have essentially blotted out the sky. It is perhaps somewhat revealing in the way these guys come out of the kitchen singing a different song.

Take Alan Greenspan for example. He’s a gold bug all over again. To me that says it all right there. It’s a big game at that level – so far detached from reality that it eventually blows up like it always has, and probably always will – as soon as enough people forget about the last time.

Silver prices are determined by giant promises that based on a fiction which will never come true until it’s too late to do anything about it.

To receive early notification for new articles, click here.

Or to view our products and services, click here.

By Dr. Jeff Lewis

Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com

Copyright © 2015 Dr. Jeff Lewis- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dr. Jeff Lewis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.