Silver Appears Overbought, But Long-Term Outlook Good

Commodities / Gold and Silver 2016 Jul 13, 2016 - 12:02 PM GMTBy: Clive_Maund

The long-term outlook for silver is very positive indeed, but over the short to medium term it looks set to react, says technical analyst Clive Maund.

The long-term outlook for silver is very positive indeed, but over the short to medium term it looks set to react, says technical analyst Clive Maund.

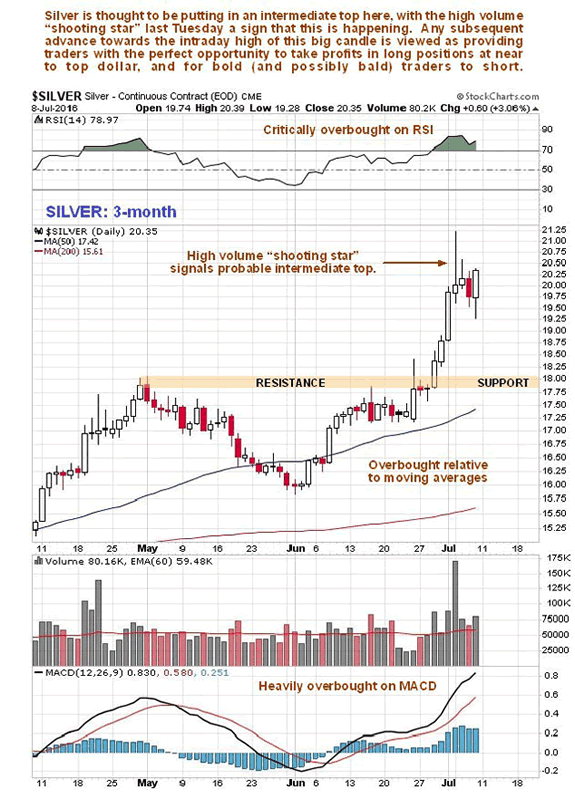

On its short-term 3-month chart (below), we can see that, after rising sharply late last month, a sizeable bearish "shooting star" appeared on the chart on heavy turnover at the start of this month, at a time when silver was critically overbought, which indicates a high probability that silver will react back soon.

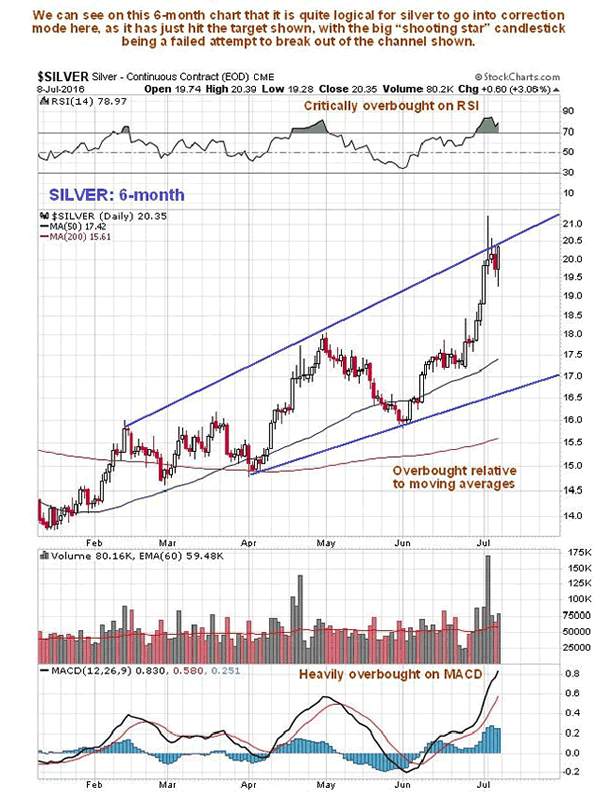

On the 6-month chart we can see why silver might react back here—it has just arrived at the top of an expanding uptrend channel in a very overbought state. Thus, a reaction back looks likely, and this would be a healthy development that sets it up for the next up-leg. Given the current COT structure it would not be unreasonable for it to drop back to the support shown in the $18 area over the short- to medium term.

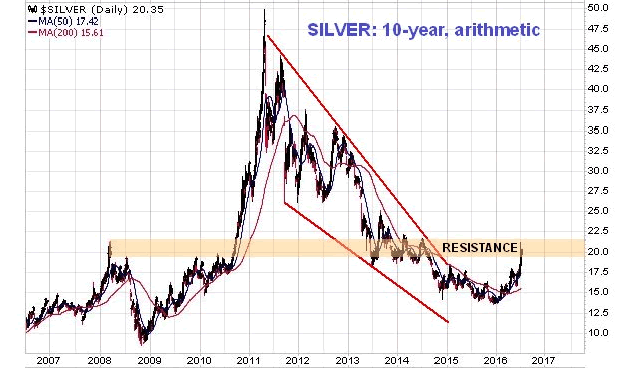

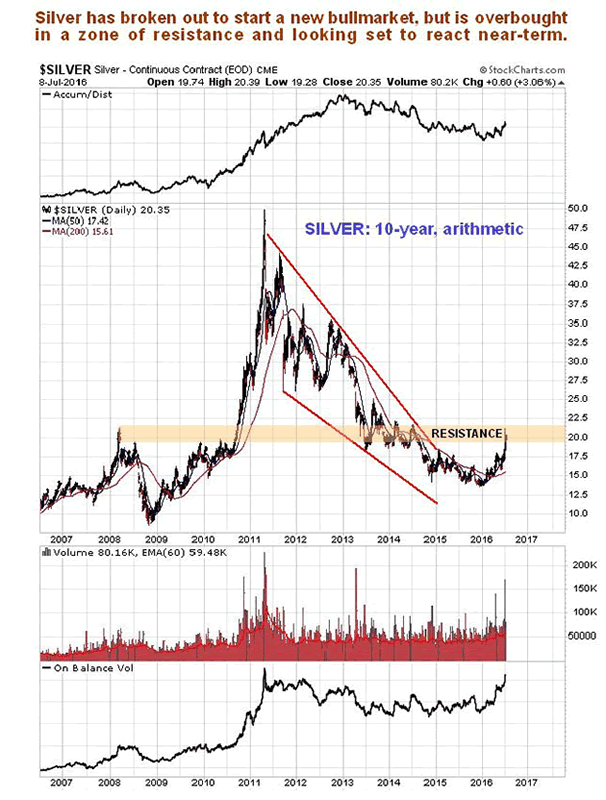

The long-term 10-year arithmetic chart gives us a much broader perspective. This is actually a very positive chart overall, for as we can see silver's bear market phase from 2011 has definitely ended. However, it has risen quite sharply in recent months to arrive at a zone of significant resistance, so it would be quite normal for it to consolidate or react back here, before breaking above this resistance and continuing higher.

Silver has also broken out to start a new bull market on its 10-year log chart. . .

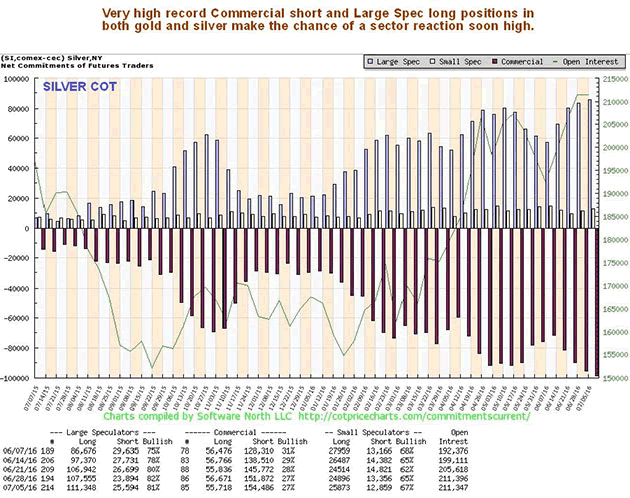

As with gold, Commercial short and Large Spec long positions in silver have built up to a very high record level, making a reaction back soon a high probability. . .

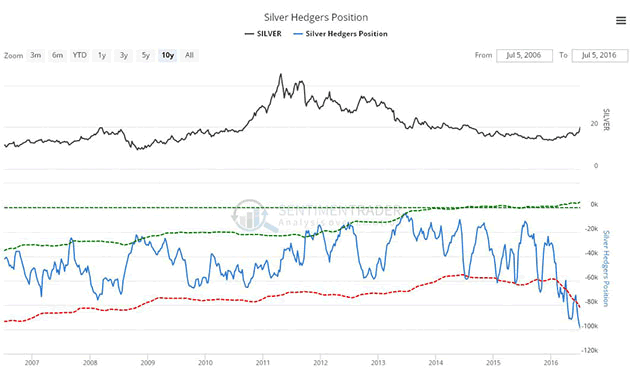

The COT chart shown above, which only goes back a year, probably doesn't drive home just how extreme the current situation is. If not, then the following chart should get the job done. The long-term Hedgers chart shown below, which is a form of COT chart, shows that Hedgers positions are now at frightening bearish extremes. When the reading reaches the red dotted line it is at a normal bearish extreme, which often, but not always, leads to a drop in the silver price. When the reading is way below it, as now to an unprecedented extent, the situation is critical, and please note that I didn't create this chart, sentimentrader did, and they are not known for being anything other than totally objective.

Chart courtesy of www.sentimentrader.com

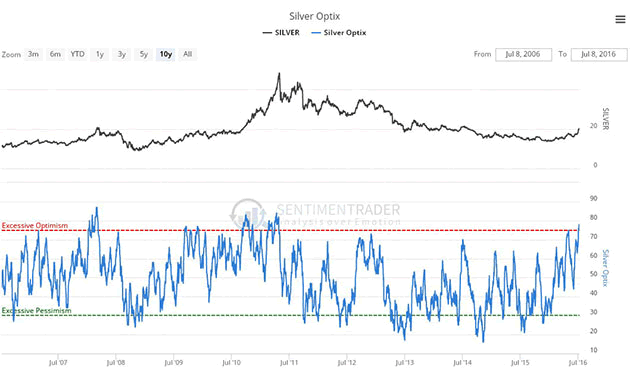

The silver optix or optimism chart shows that bullishness towards silver is now at extreme levels, and while this doesn't always lead to an immediate reversal, taken together with the other factors that we have observed, it does suggest that caution is in order with respect to silver's immediate prospects.

Chart courtesy of www.sentimentrader.com

Your reaction to all this depends first of all in whether you follow the logic of it and agree with it or not, and second on what sort of investor or trader you are. If you are a long-term investor, you may simply decide to ride out any correction, but if on the other hand you are aggressive trader, you may want to cash in longs and even consider opening some shorts in the sector, but, whichever, it still looks like a good idea to take some money off the table here if you are long the sector, taking advantage of the comparatively high prices now prevailing.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosures:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation or editing so the author could speak independently about the sector. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts provided by Clive Maund

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.