Keep an Eye on ‘Bitcoin’ as the Next ‘Financial Crisis’ Starts!

Stock-Markets / Bitcoin Jul 18, 2016 - 06:17 PM GMTBy: Chris_Vermeulen

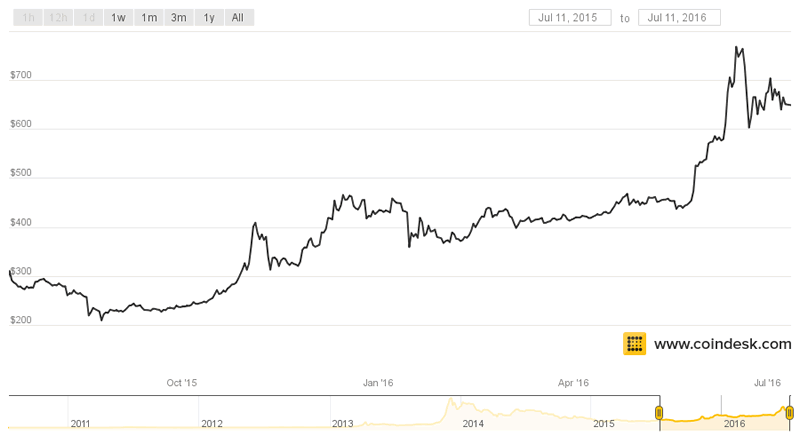

‘Bitcoin’ is on a tear away rally. Its’ performance, over the last year, has been outstanding and it has outperformed most ‘asset classes’, by a wide margin. It is probably the only asset class which beats out both gold and silver, in 2016. Why is it shooting into outer space?

‘Bitcoin’ is on a tear away rally. Its’ performance, over the last year, has been outstanding and it has outperformed most ‘asset classes’, by a wide margin. It is probably the only asset class which beats out both gold and silver, in 2016. Why is it shooting into outer space?

People look at alternate asset classes when their confidence in traditional assets fades. Since the beginning of the year, both the stock and the commodity markets have been on a roller coaster ride while catching both the bulls and the bears, on the wrong side.

The macroeconomic situation of the world does not give confidence to the astute investors which is evident by the return of the legendary George Soros, who has come out of retirement to short the overblown markets. Similarly, other hedge fund managers are stocking up on gold, which supports our view that a ‘financial crisis’ is right around the corner.

The “Brexit” results have also opened up a possibility of another round of easing by the central banks, around the world. The Bank of England will most likely resort to an easing schedule during the next meeting which will be followed by the European Central Bank and the FED. Post victory in the elections, the Japanese Prime Minister Shinzo Abe is likely to push the Bank of Japan to announce another round of ‘easing’.

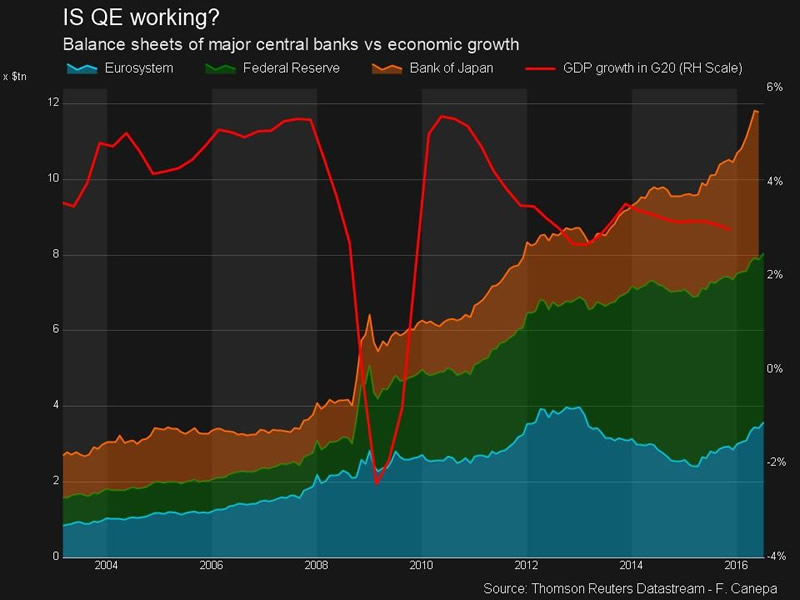

Since the last ‘financial crisis’, the combined central banks have pumped massive amounts of money into the system and they continue to do so, at a rapid pace, nonetheless, the world is closer to a ‘financial crisis’ than ever before.

The FED’s money printing policy had led the commodity Guru Jim Rogers to remark: “The FED will continue to print money until there are no trees left in America.”

‘Bitcoin’ is doing the opposite of central banks:

Compare this with the cryptocurrency ‘bitcoin’. Unlike the traditional currencies, the ‘Bitcoin’ has an upper limit of 21 million coins, post which no more Bitcoins can be mined.

Every subsequent mining will become difficult and will reduce the reward associated with mining each block. Satoshi Nakamoto programmed that post-mining of 210,000 blocks, the rewards will be halved.

Initially, the reward was 50 ‘Bitcoins’ for every block, which was halved by the end of 2012, at which time the reward was reduced to 25 ‘Bitcoins’ per block.

The next round of halving took place, last week, when the rewards were reduced to 12.5 ‘Bitcoins’ per block.

While the central banks have been on a printing spree, the ‘Bitcoin’ is on a tightening route which boosts its’ price, as is visible in its’ sharp rise, this year.

A few miners will find it difficult to continue mining at the halved rewards which is likely to slow down new mining as halving will continue, in the future.

“The block halving will dramatically decrease the bitcoin being added as we approach 75 percent of all bitcoin issued. People understand that in this world of ever expanding assets and printing of money, we have something that’s fixed and limited in issuance. It gives a decent alternative for people who want to hold assets that can have sustained purchasing power,” stated Bobby Lee, Chief Executive of BTCC which is one of the largest’ bitcoin’ exchanges, in the world, based in China reports CNBC.

I recently watch a fantastic TEDX talk on Bitcoin and digital currencies and how they are changing the world, financial systems, and lives in huge way, and this is only the tip of the iceberg. This TEDX Talk makes so much logical sense why bitcoin and other currencies are so important for us as individual’s – Watch Video

However, the ‘Bitcoins’ volatility has dropped dramatically over the past few years with the lowest linear level of volatility seen since is this asset class started. It has become easier to use for trading, purchasing and using for purchases. I am presently only highlighting that readers will do well to keep an eye on ‘Bitcoins’ and other crypto/digital currencies, along with gold and silver.

In fact, I have been researching the digital wallet solution where I can purchase many up and coming digital currencies within one location as a NEW ASSET class for my portfolio. Why? Because I firmly believe the masses will slowly migrate their money into various digital currencies a safe haven store of wealth and for ease of use. Payments can be made with your mobile phone to anyone, anywhere in the world and for any amount with ZERO fees/costs, and in many cases it cannot be traced.

Sir John Templeton, the legendary mutual fund manager and founder of Templeton Group, said:

“Invest in many different places – there is safety in numbers.”

So in short, I will share with you in future articles and as a subscriber to my trading and investing newsletter exactly which digital wallet, and digital currencies I will be buying and interested in learning more about as the world and financial systems evolve. When the time is right to invest my followers will know.

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.