Bitcoin in Asymmetric Position

Currencies / Bitcoin Jul 20, 2016 - 12:34 PM GMTBy: Paul_Rejczak

In short: no speculative positions.

In short: no speculative positions.

The recent halving of Bitcoin rewards has proved to be a sort of no-volatility event. In an article on CoinDesk, we read:

One of the primary expectations leading up to halving was that the price would drop due to an expected rumor-and-event cycle, whereby traders would accumulate the asset, riding the excitement up until the actual halving took place, at which point they would exit positions.

Petar Zivkovski, the director of operations at WhaleClub, for example, predicted that the smart money – institutions, professional traders, and other knowledgeable bitcoin traders – would sell their bitcoin holdings at the event.

The day before halving, the price of bitcoin dropped by close to 10%, from $674 to $618, according to CoinDesk’s USD Bitcoin Price Index (BPI). While slightly premature to the actual event, this could have been a sign of that event-based selling.

Yet, since the halving, the price has been in a tight trading pattern between $637 and $673 per bitcoin, or 5% fluctuations.

One possible explanation is that the smart money believes the price of bitcoin is going to go even higher, and that the new supply to the market is being bought, offsetting any sales by the smart money.

We have already written about the relative lack of volatility around the halving date but this interpretation is actually pretty interesting. It might be the case that Bitcoin didn’t decline when it “should have” because of the fact that there is strength in the market and possibly more buying power than selling. This is pure speculation, but it could be the case that the lack of action in Bitcoin following the halving is fueled by buyers or potential buyers. At the same time, Bitcoin doesn’t really need much to be back to bearish in technical terms.

For now, let’s focus on the charts.

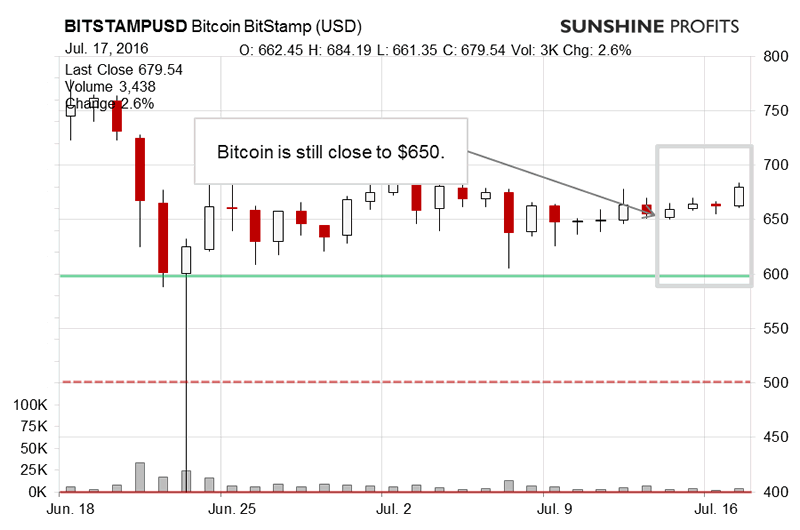

On BitStamp, we have recently seen only one day of more price action. This was yesterday with a jump to around $675. The volume was up from the day before but not very significant by any means. What can we infer from this kind of action? First, recall our recent comments:

(…) the market has put some time between the current price and the recent high without moving higher. This seems a bearish indication as Bitcoin hasn’t continued its march to the upside. On the other hand, the stagnation period is one with decreased volume. This might actually overturn the bearish conclusion. The picture is quite cloudy at the moment.

With the following swing to the upside being not particularly strong, we have a bearish hint. Additionally, Bitcoin failed to close far from its open on Saturday and moved down yesterday. This, too, are bearish hints.

The recent move to the upside weakens the previous bearish hints. On the other hand, the depreciation yesterday is a bearish event and the volume on which the move took place was higher than the volume during the upswing. All of this means that we are back to a cloudy picture.

The cloudiness remains (…), however, a little bit less so than was the case previously. Namely, Bitcoin has declined today and the currency is below $650 (...). This is a bearish development but is it bearish enough to go short, in our opinion? Not necessarily.

The general idea hasn’t changed much. Bitcoin is still at $650, which might be an important level (more on that later). One possibly significant bullish hint is that Bitcoin didn’t decline following the announcement of the halving of mining rewards. This might be a show of strength. The recent volume, however, has on the downside, which suggests that Bitcoin is yet to move a significant move in either direction from $650.

The fact that Bitcoin moved to $675 doesn’t really change much as the volume was not significant and the currency didn’t really take out any significant resistance level along the way. If Bitcoin breaks above $700, we might see even more upside potential but the really important level is the June top around $780. We’re not quite there yet.

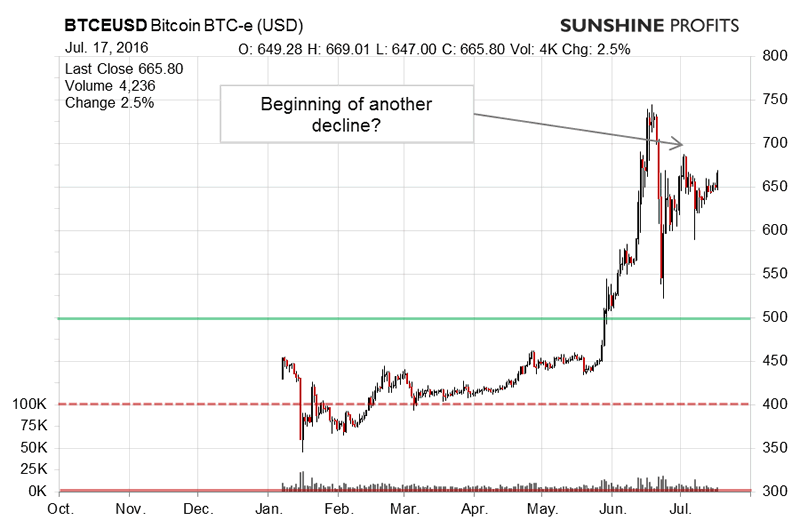

On the long-term BTC-e chart we see an uptick above $650. This doesn’t seem to be anything to call home about. Our previous comments:

There’s still room for decline and we are still leaning toward the opinion that the next strong move will be to the downside. The action we see now is similar to what we saw back in 2013 and 2014 – a strong rally, sharp decline and a bounce up. Back then the action was followed by a lengthy period of depreciation. This doesn’t have to be the case now, but it might be a bearish hint. At present, we would prefer to see some more depreciation. Possibly even one day could do, depending on the magnitude of the move. Stay tuned.

A day of depreciation has materialized today, at least so far. Is it enough to go back on the short side of the market? We don’t think this is the case just yet. Bitcoin is now very close to the 38.2% Fibonacci retracement but still above this level. This means that we might be very close to getting a confirmation of a swing to the downside but are not there just yet. Again, stay tuned as the situation might change quite quickly now.

There hasn’t been much change since we wrote these words and the $650 level on BitStamp and the $630 level on BTC-e are still ones to observe as they coincide with the 38.2% Fibonacci retracement for the recent rally. The situation remains tense in the market and the next move might establish at least a short-term trend.

The 38.2% Fibonacci retracement level is still very much in play. We haven’t seen a move below this level just yet. At the same time, we haven’t seen a move above the $700 level which might be the next important level on the upside. As such, the situation still has a bearish tilt in our opinion, but it’s not enough to go short just now.

A lot of what we wrote previously remains the case today. The situation is slightly less bearish than a couple of days ago but not really bullish. Right now, we are waiting for a break below the 38.2% Fibonacci retracement level. Bitcoin might actually move up to $750 without generally changing the outlook. At the same time, not that much depreciation can make the picture a lot more bearish than it is now. Stay tuned.

Summing up, in our opinion no speculative short positions are favorable at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.