Retailers Are Doomed as Most Americans Are Too Poor to Shop

Companies / Retail Sector Jul 25, 2016 - 03:24 PM GMTBy: John_Mauldin

BY TONY SAGAMI : We are entering the heart of earnings season. It may be a wild one as Wall Street’s outlook is quite poor.

BY TONY SAGAMI : We are entering the heart of earnings season. It may be a wild one as Wall Street’s outlook is quite poor.

The consensus Wall Street estimates for Q2 profits of the S&P 500 is a 5.6% fall (YOY). That would be the fifth quarter in a row of falling corporate profits.

The retail industry is particularly vulnerable. (I’ve written about that a lot in my free weekly column, Connecting the Dots, at Mauldin Economics.) Many retailers who’ve previously reported dismal results warn that the rest of the year will be even worse.

In May, retail sales shrunk by 3.9%, worsening from a 2.9% drop in April.

Moody's Investors Service lowered its estimates for 2016 retail sales. The tone of their overall outlook shifted from “positive” to “stable”:

We have scaled back our growth and outlook expectations for the US retail industry primarily due to weakness in four sub-sectors: apparel and footwear, discounters and warehouse clubs, department stores, and office supplies.

Bank of America—which knows a thing or two about credit card usage—said its debit and credit cards data showed particular weakness in four retail areas:

- Department stores: down 4.0%

- Teen/young adult stores: down 4.6%

- Home goods: down 3.6%

- Electronics: down 3.0%

Most Americans stopped shopping

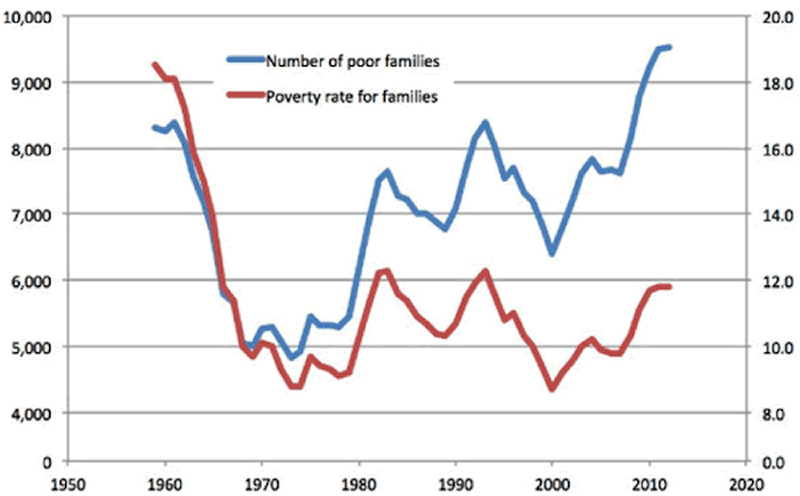

Discouraging retail results are the result of many developments. One of the more surprising culprits, however, is a growing number of Americans who just can’t afford it.

More than 20%, or 26 million Americans, are simply too poor to shop, according to America’s Research Group (ARG).

We all know about the 47% of Americans that get government benefits. Politicians, however, largely overlooked another 26 million Americans that are the working poor.

This class works an average two to three jobs and pulls in less than $30,000 of annual income.

Even those fortunate enough to make more than that are struggling. Nearly half of Americans have not seen an increase in salary over the last five years. Higher medical insurance deductions reduced take-home pay for another 28%.

As a result, “The poorest Americans have stopped shopping, except for necessities,” said Britt Beemer of America’s Research Group.

It gets worse. Even finding money to pay for necessities is a struggle. Two-thirds of Americans have essentially zero savings. 47% of Americans wouldn’t be able to gather $400 for a doctor visit without reaching out to friends.

Investment Implications

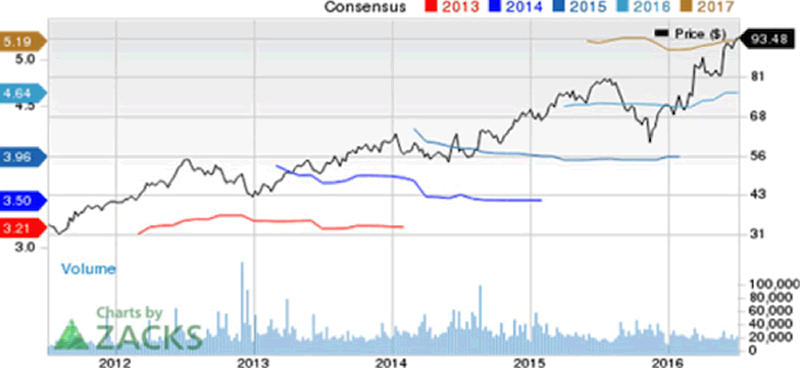

That gloomy news doesn’t mean you have to pass on all retailers. Cash-strapped American consumers are increasingly turning to discount retailers. And they are doing very well.

For example, Dollar General (NYSE:DG) has been on fire due to strong profit growth. In the last quarter, Dollar General beat the pants off Wall Street’s expectations of $0.94 of profit by delivering $1.03 per share.

That was 22% above last year’s first quarter and the fifth quarter in a row that Dollar General exceeded forecasts.

That tells me one thing: catering to cash-strapped Americans can make big profits.

Oh, and for you dividend lovers, Dollar General pays a $1.00 annual dividend.

Other discount retailers that enjoy strong business include: Dollar Tree (DLTR), Big Lots (BIG), TJX Companies (TJX), Wal-Mart (WMT), and Costco (COST).

That doesn’t mean you should rush out and buy any of these stocks tomorrow morning. As always, timing is everything. Discount retailers, however, are one of the few bright spots in the retail industry worth your consideration.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.