Don’t Buy The SPX Hope Stock Market Rally!

/ Stock Markets 2016 Jul 27, 2016 - 11:38 AM GMTBy: Chris_Vermeulen

All bubbles burst; the question is when? Quantitative Easing (QE) is much like an addiction. One needs more and more to get the initial effect, however, this becomes an asymptotic result, whereas, eventually, one needs an infinite amount that will no longer give a positive effect! So, now that QE has failed, I believe there will now be the introduction of “Helicopter Money”.

All bubbles burst; the question is when? Quantitative Easing (QE) is much like an addiction. One needs more and more to get the initial effect, however, this becomes an asymptotic result, whereas, eventually, one needs an infinite amount that will no longer give a positive effect! So, now that QE has failed, I believe there will now be the introduction of “Helicopter Money”.

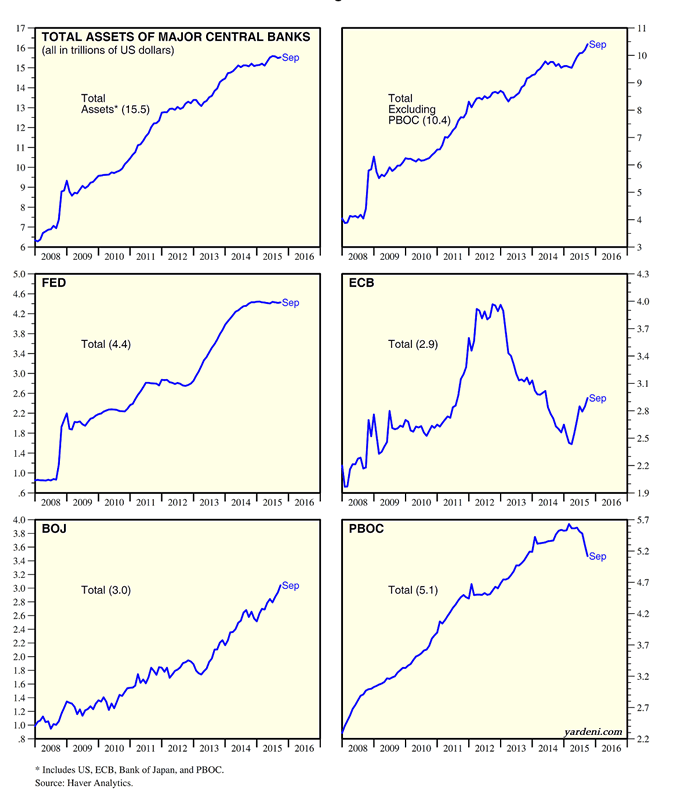

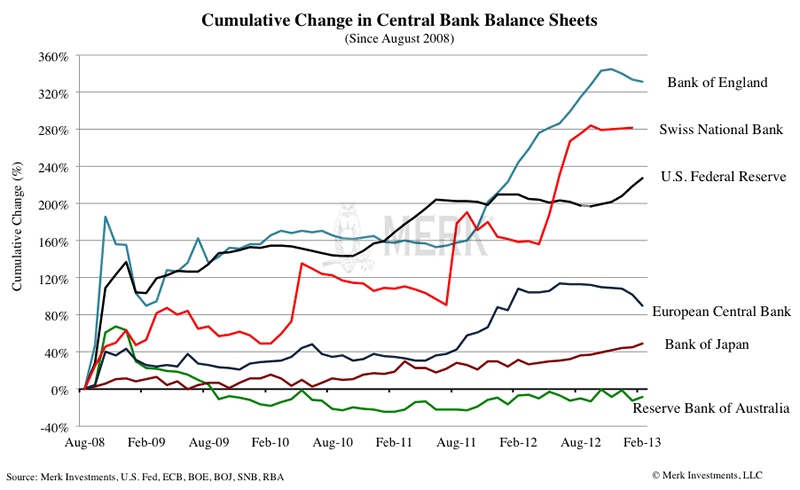

Global central bankers constantly continue to spend their way out of their contracting economies, which are now resulting in large budget deficits. The deficits that these policies have produced are unsustainableand have now created a new fiscal crisis within their countries. A second response has been to expand the central banks’ balance sheets as a way of providing liquidity to the private sector. These policies have also sent interest rates into unprecedented historical lows. European countries and Japan have sent their rates into negative territory, thereby reducing returns to fixed-income investors. Low interest rates have encouraged corporations to borrow more money but, in turn, harm the investors savings for their future.

Implementation of these monetary policies temporarily assisted the economy so as to reduce the impact of a new economic and financial crisis back in 2008. However, it was not the prudent policy to continue after everything became stabilized. The real solution was for an implementation of a new round of fiscal policies. This would have restructured the debt and allowed the global financial system to reset itself. Unfortunately, we are currently sitting on a ticking time bomb in all of the global financial markets.

True GDP growth comes from increasing productivity and real employment and allocating resources for proper economic activity. Global Central Banks have been applying monetary policies for so long, now, that they have become reckless and never created an exit plan. They never created any real required economic growth. The global central banks’ intervention, over eight years ago now, was to be the initial response in preventing a financial meltdown, however, monetary policy did not generate changes in productivity nor in the amount of economic resources that are required for any economy to expand. It is only the private sector that can generate the economic growth necessary to increase corporate profits and equity prices. As the size of the private sector shrinks, it becomes more difficult to generate growth within that economy.

Earnings Management

“Earnings Management” is the practice of attempting to intentionally bias financial statements in order for them to appear better looking than they actually are! Managers, in fact, make their earnings appear better, as well as their incentives for manipulating earnings, which is calculated and misleading to the shareholders. There are red flags for two different forms of revenue manipulation. One is manipulating earnings through aggressive revenue recognition practices, which is the most common reason that companies get in trouble with government regulators for their accounting practices. The other red flag for manipulating earnings is through aggressive expense recognition practices, which is the second most common reason that companies get in trouble for their accounting practices.

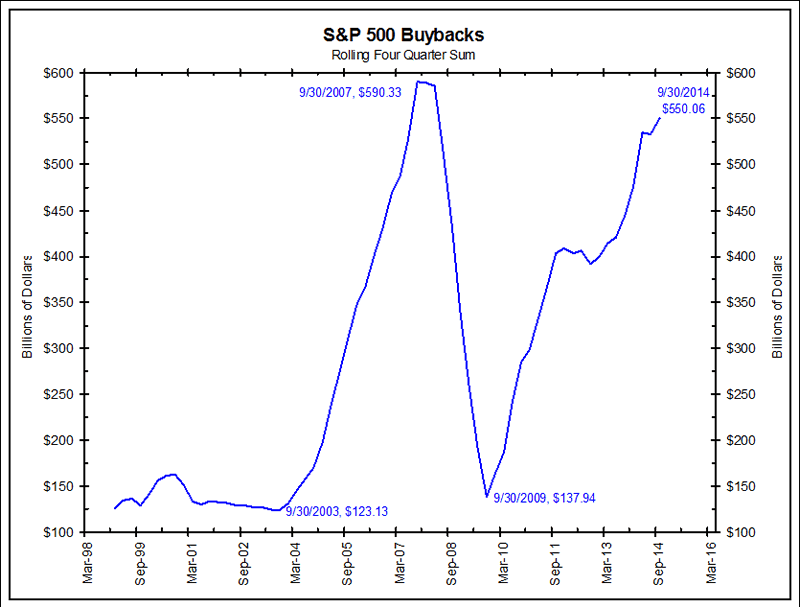

Share buybacks allow companies to repurchase their own shares on the market. Why do those companies want to do this? The number of shares held by the public will be reduced, which will increase the earnings per share, even if the total earnings are the same. The value of shares being traded will increase. It is valuable for a firm’s manager to buy back shares when it believes that the firm’s stock is currently trading below its intrinsic value. Executive compensation is often tied to executives’ ability to meet earnings-per-share targets. When it is difficult to meet the targets, the executives may repurchase shares in order to receive their executive or managerial bonuses.

Buybacks are not all created equal. The skills of the management in capital allocation and the culture of the company can make a difference in the outcome of the buybacks. Although buybacks are viewed as positive for stock prices, a lot of them happen at exactly the wrong time and destroy value for shareholders. I did talk with HoweStreet radio about how these high stock prices are deceiving.

Take a look at the chart below. This is a real eye opener for most, as it clearly shows how aggressively publicly-traded company executives are buying back shares to keep the earnings-per-share number high and cover up their lack of sales and growth. Eventually, this will come to an end, as does everything.

Currently, buybacks are at the same level reached before the last stock market top. I expect buybacks will end sooner than later, but the cover-ups will continue as long as executives have capital to spend.

You should know how to spot and recognize earnings management and get a more accurate picture of earnings so you will be able to spot the bad person(s) in finance reporting!

A variety of assumptions and accounting estimates are used in arriving at the final earnings figures. In assessing the health of a company, both lenders and investors alike almost always look at the quality of it’s earnings first. However, it is nearly impossible for a company to consistently report stellar periodical earnings over a lengthy period of time. This is because a company’s business activities are affected by changes in economic cycles, seasonal changes, new legislation, and other extraordinary events that occur.

In order to normalize the continuous succession of ebbs and flows in financial results that are characteristic of any typical business, company managers, more often than not, resort to a practice known as earnings management. Earnings management occurs when managers use judgment in financial reporting and in structuring transactions in order to alter financial reports so as to either mislead some stakeholders in regards to the underlying economic performance of a company or to influence contractual outcomes that depend on reported accounting numbers. In other words, earnings numbers are deliberately manipulated by management for the purpose of meeting their company’s objectives, whatever they might be!

The Death of Investing!

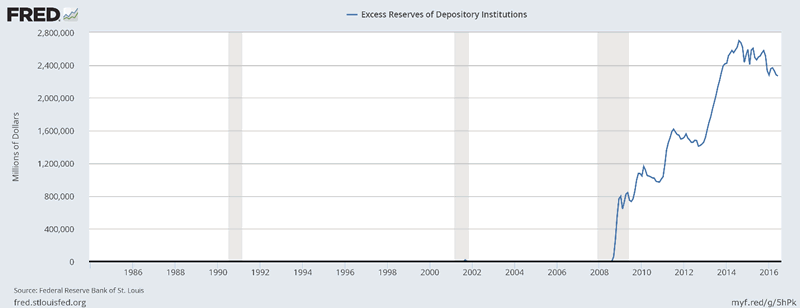

Why is it that banks are holding so many excess reserves? What does the data tell us about current economic conditions and about bank lending behavior and practices? Some observers claim that the large increase in excess reserves implies that many of the policies introduced by the Federal Reserve in response to the financial crisis have been ineffective. Rather than promoting the flow of credit to firms and households, the data, as shown in the chart below, indicates that the money lent to banks and other intermediaries by the Federal Reserve since September of 2008 is simply sitting idle in banks’ reserve accounts. The FED has been intentionally discouraging banks from lending to Main Street, which has increased unemployment and stalled out the economy.

There is a new crisis just around the corner known as The Long Wave Winter Of Discontent.

Global governments have built up large debts that far exceed their GDP. They have even larger future liabilities in terms of pension and health care for retired workers. So how is it that investors can anticipate an increase in profits, which is necessary to generate and maintain higher stock prices?

It is quite evident to me that it is because of these conditions that expectations of future corporate profitability will fall and that equities will experience a substantial decline very shortly. This also means that unless the conditions, as cited above, change, equity prices could be the same as they were in the early 1980’s or lower.

Bill Gross, noted bond investor of Janus Capital Group Inc., stated that “investors should worry, for now, about the return of one’s money, not the return on it. Our credit-based financial system is sputtering, and risk assets are reflecting that reality even if most players (including central banks) have little clue as to how the game is played.” Global central banks have gone way too far!

Recently I have share some insight on a new and fast-growing type of money or asset class, which removes the central banks from the entire equation. It’s just a matter of time before these assets explode in value and the FED/central banks are scrambling to gain control again.

Concluding Thoughts

In short, I have been talking/warning about the US stock market topping out for about a year now. This lengthy process is taking a long time to play out, as most major market tops do, but each month we move closer to another life-changing financial event for the global economy.

While I am not yet short the US stock market so that I can profit from falling prices, subscribers and myself have been long bonds and precious metals for a while and enjoying the ride up.

Various markets are starting to become VERY interesting, and huge opportunities are just around the corner!

Follow My Analysis & ETF Trades at: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.