The Blockchain - Cold, Hard Cash Will Soon Be A Distant Memory

Currencies / War on Cash Aug 05, 2016 - 03:40 PM GMTBy: Chris_Vermeulen

The ‘blockchain’ technology, the very basis on which the bitcoins were created, is likely to become the backbone of the future digitization of money. The importance of the technology was asserted in the 16th Annual International Conference on Policy Challenges for the Financial Sector; a three-day convention which was held on June 1st through June 3rd in Washington, D.C.

The ‘blockchain’ technology, the very basis on which the bitcoins were created, is likely to become the backbone of the future digitization of money. The importance of the technology was asserted in the 16th Annual International Conference on Policy Challenges for the Financial Sector; a three-day convention which was held on June 1st through June 3rd in Washington, D.C.

The conference was held under the tutelage of the FED, the World Bank, and the International Monetary Fund.

It was attended by representatives of the major Central Banks, across the world. The subject for this year was ‘fintech’ and the first day was dedicated to studying the ‘blockchain’ technology which is the framework on which the popular digital currency bitcoin has been built.

FED Chairwoman Janet Yellen was the introductory speaker and she said that, “central bankers don’t normally like the word “disruption, but it’s not something to fear.

Technology has played a role in solving problems in the financial system in the past, and she encouraged her fellow bankers to learn everything they can about this new technology”, reports the Wall Street Journal, from comments relayed by Perianne Boring, the president of the Chamber of Digital Commerce.

“This truly shows the technology has reached the highest levels of society and government,” Ms. Boring said.

What is ‘blockchain’?

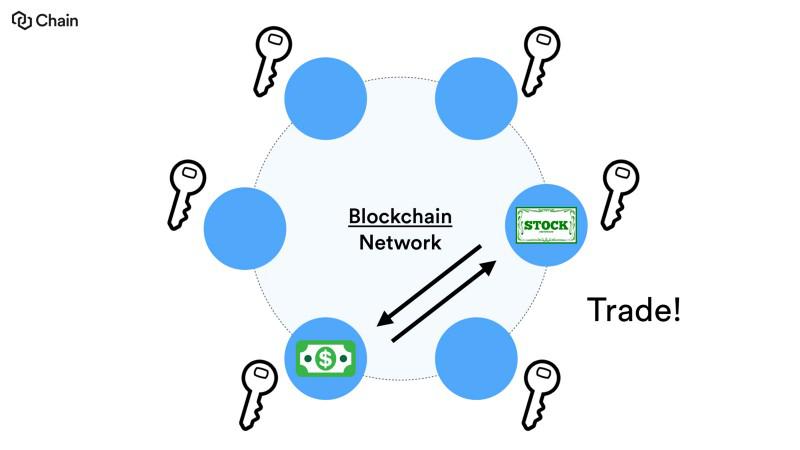

Simply put, a blockchain is a digital ledger of transactions that have been executed. New data continues to be added in a linear, chronological order through the completed blocks of data which are shared among the computers on the network.

Participants on the network use cryptography to edit the ledger online without the involvement of a central clearing authority. This ledger contains all the data of transactions from the start of the first block to the latest block.

Advantages of the ‘blockchain’:

As there is no necessity of a centralized authority to oversee the transactions, it creates a transparent, simple and fast transaction environment. As the data is available to all of the members, and any modification requires the permission of the majority of the members, it is better equipped to handle the onslaught of cybercrimes.

As no one can bypass the rules, the members can be assured that no single authority can deviate from the protocols. Due to direct transactions between two parties, transaction costs will be negligible.

The interbank transactions, which currently take days, can now be cleared in a matter of minutes, 24/7 and without the restrictions on working hours.

“Soon, the phrase ‘cross-border payment’ will make about as much sense as ‘cross-border email’,” said Mr. Adam Ludwin, co-founder and Chief Executive of the ‘blockchain’-focused startup Chain, during his keynote address.

Changes are needed to adapt it for the financial system:

The technology which is used in ‘bitcoins’ is unsuitable to be used directly in the various types of transactions like commercial papers, corporate bonds, U.S. Treasuries, etc., as these are issued for various business or policy purposes but there is already a new digital currency working with many of the top banks already which I mention later in this article.

Hence, a new more advanced and complicated system needs to be generated on the same ‘blockchain’ principle which can duplicate the ease of the use of current assets in a newly digitized model.

Challenges to adapting to ‘blockchain’ within the existing financial system:

It is unlikely that any government will be willing to part with their powers of which they control most of the monetary and fiscal decisions either directly or indirectly. Although the technology has enough security measures that are in place, the theft that occurred at Mt. Gox, which handled around 70% of all ‘bitcoin’ transactions, until 2013, reveals its’ vulnerability.

The ‘bitcoin’ is a small asset class with only a small quantity of bitcoins in circulation as compared to the trillions of transactions that take place daily, around the world. The computing power needed to handle such vast transactions is humongous. Such a setup requires billions of dollars, in investments, which may not be feasible to many.

Nonetheless, there are a number of entrepreneurs like Todd McDonald, co-founder and Head of Strategy at R3CEV LLC, a consortium of more than 40 financial institutions that are working towards the application of distributed ledger technologies to global financial markets.

“We can monitor compliance in real-time. We can answer questions about collateral ownership and hypothecation that were at root in the run on the system in 2007,” said Mr. Ludwin.

ARTICLE: The institutional investors are recognizing this outcome,

hence, they are the largest group of Bitcoin buyers.

Conclusion:

The days of cash are numbered and will soon be a mere memory! The revolution in ‘blockchain’ technology has reached the doors of the FED and it is now only a matter of time before the ‘greenback’ is phased out by the general public.

The reason I have started to cover bitcoin and digital currencies (Alt Coins) is because I believe they will become main stream much sooner than you think. In fact, there are already hundreds of new digital currencies available, though many are not and will not become key currencies.

I am watching, tracking and analysing many different digital currencies based on different metrics: how many online communities are focused on various alt coins, which ones have the most search engine searches, growth in market cap, have strong price charts, and which ones are focusing on working with large banks like the one call Ripple.

This new asset class is definitely disruptive, but I believe digital currencies add diversification not found anywhere else in the financial markets. They are a speculative play, safe haven during next financial crisis, and allows many people around the world to transfer money without being tracked and to possibly avoid taxes for those who want to side step government. Either way, more people and companies are accepting digital currencies and the demand and value they offer will eventually be priced into each each currency.

I have learning and slowly identifying some exciting opportunities in this new asset class which I feel everyone should some exposure to in their portfolios. Soon I will unveil some of my top currencies and where to buy and store them – Stay Tuned!

Chris Vermeulen – www.TheGoldAndOilGuy.com

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.