US Conflicting Economic Data : Payrolls and Second Quarter GDP Growth

Economics / US Economy Jul 25, 2008 - 11:26 AM GMTBy: Joseph_Brusuelas

The upcoming week will be defined by two closely linked US macroeconomic data that will frame the debate about which direction the economy is poised to take during the latter half of 2008. Yet, these two data are likely to paint two very different portraits regarding the condition of the economy. On Thursday the market will observe the preliminary estimate of economic growth during the second quarter of the year, followed by the publication of the July non-farm payrolls the next morning.

The upcoming week will be defined by two closely linked US macroeconomic data that will frame the debate about which direction the economy is poised to take during the latter half of 2008. Yet, these two data are likely to paint two very different portraits regarding the condition of the economy. On Thursday the market will observe the preliminary estimate of economic growth during the second quarter of the year, followed by the publication of the July non-farm payrolls the next morning.

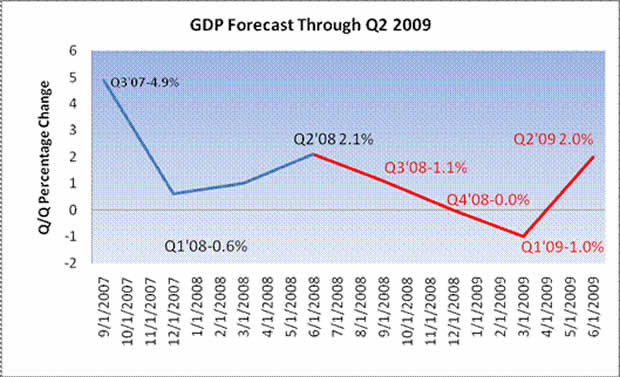

According to Bloomberg, the current market consensus anticipates a 1.8% rate of growth, fractionally below our forecast of a 2.1%. Given the bear market rally that we have observed over the past week, there is little doubt that the 08:30 AM EDT release on Thursday morning will provide a fairly solid case for equity bulls who are claiming that a bottom is in the process of forming in the market. Demand from the external sector could approach 2.0% and personal consumption should hold steady at a 1.0% rate of growth.

The contribution of government spending should remain quite solid, but our forecast implies that the combination of the decline in residential fixed investment and a reduction in inventories should combine to reduce overall growth by 1.1%. Due a strong rise in demand for net exports and the stimulus inspired rate of personal spending, the data does tend to suggest that the risk to the report is to the upside. We would not be surprised to observe an initial print as high as 2.6%, with subsequent revisions back to the downside during subsequent estimates towards our 2.1% forecast.

However, once the dust settles and the market begins to look at the source of growth and is able to evaluate its sustainability a different picture may emerge. What permitted personal consumption, which accounts for nearly 70% of overall growth, to obtain a rather anemic rate of growth, was not a resilient consumer, but the well-timed fiscal rebates. To be blunt, it was not a consumer hungry for a return to the malls, but government spending, which was behind a second straight quarter of weak growth in personal consumption. As the June retail sales data illustrated, the impact of the stimulus checks has begun to wane and there is very little going forward to support spending.

That very potent fact will be on vivid display the following morning when the July non-farm payrolls report is published. Unlike the previous days headline data, the data from the labor sector will not be construed as positive, but will be focused on the potential drag on future consumption. The current consensus forecast expects a net -70K jobs will be lost, which is little better than our forecast of -93K for the month. We think that the combination of downward revisions to recent payroll estimates and losses in goods producing, manufacturing and the service sector should push the headline towards the -100k mark for the first time since the downturn in the economic cycle began.

Our forecast for the US economic growth path for some time has been that output would resemble a “W.” We expect that Q2'08 represents the middle apex in what is shaping up to be a classic double dip economic downturn. Our growth forecast implies that the market should observe growth in the third quarter to check in at 1.1% and the final three months of the year to observe a 0% rate of growth, with an outsized risk of a negative print. Moreover, we do expect that the rate of unemployment will advance to 6.0% by the end of

the year and further job losses to add to the -438,000 jobs lost thus far in 2008. Thus, what on Thursday may be the source of much celebration among equity bulls, by Friday morning may not seem so compelling. In fact, by mid-day on Friday the recent bear market rally may fade into a classic bull trap. To our colleagues that are making the case that the economy is in recovery and now is the time to jump into the market and purchase equities we have one question; what will support consumption six months out once the stimulus power of the rebate checks evaporates?

By Joseph Brusuelas

Chief Economist, VP Global Strategy of the Merk Hard Currency Fund

Bridging academic rigor and communications, Joe Brusuelas provides the Merk team with significant experience in advanced research and analysis of macro-economic factors, as well as in identifying how economic trends impact investors. As Chief Economist and Global Strategist, he is responsible for heading Merk research and analysis and communicating the Merk Perspective to the markets.

Mr. Brusuelas holds an M.A and a B.A. in Political Science from San Diego State and is a PhD candidate at the University of Southern California, Los Angeles.

Before joining Merk, Mr. Brusuelas was the chief US Economist at IDEAglobal in New York. Before that he spent 8 years in academia as a researcher and lecturer covering themes spanning macro- and microeconomics, money, banking and financial markets. In addition, he has worked at Citibank/Salomon Smith Barney, First Fidelity Bank and Great Western Investment Management.

© 2008 Merk Investments® LLC

The Merk Hard Currency Fund is managed by Merk Investments, an investment advisory firm that invests with discipline and long-term focus while adapting to changing environments. Axel Merk, president of Merk Investments, makes all investment decisions for the Merk Hard Currency Fund. Mr. Merk founded Merk Investments AG in Switzerland in 1994; in 2001, he relocated the business to the US where all investment advisory activities are conducted by Merk Investments LLC, a SEC-registered investment adviser.

Merk Investments has since pursued a macro-economic approach to investing, with substantial gold and hard currency exposure.

Merk Investments is making the Merk Hard Currency Fund available to retail investors to allow them to diversify their portfolios and, through the fund, invest in a basket of hard currencies.

Joseph Brusuelas Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.