Bitcoin after Recent Decline

Currencies / Bitcoin Aug 10, 2016 - 11:37 AM GMTBy: Mike_McAra

In short: short speculative positions; stop-loss at $657; initial target at $527.

In short: short speculative positions; stop-loss at $657; initial target at $527.

The customers of the recently hacked Bitfinex exchange will most likely share the losses resulting from the theft, we read on the Wall Street Journal website:

Bitfinex, the digital-currency exchange that lost $65 million to hackers last week, plans to spread the losses among all its users, including those not directly affected by the hack.

The Hong Kong-based digital-currency exchange said in a statement Sunday that the losses from the theft would be shared, or “generalized across all accounts and assets” of its clients, with each taking a loss of around 36%.

“Upon logging into the platform, customers will see that they have experienced a generalized loss percentage of 36.067%,” it said, adding that the company would soon share a fuller accounting of its computation of the losses. “This is the closest approximation to what would happen in a liquidation context.”

(…)

Bitfinex said it would give all affected clients a “BFX” token crediting each of their discrete losses. The token could be redeemed in full by Bitfinex or possibly exchanged, upon the creditor’s request, for shares of iFinex Inc., the exchange’s parent company.

This is obviously bad news for the company’s customers as their assets got sliced but it might be the best of the bad scenarios as it partially cleans up the mess left from the hack. Also, the “BFX” token, even if it is a far cry from actually getting the funds back, is some kind of compensation for all the losses. As such, it might restore some confidence in the company and in Bitcoin.

For now, let’s focus on the charts.

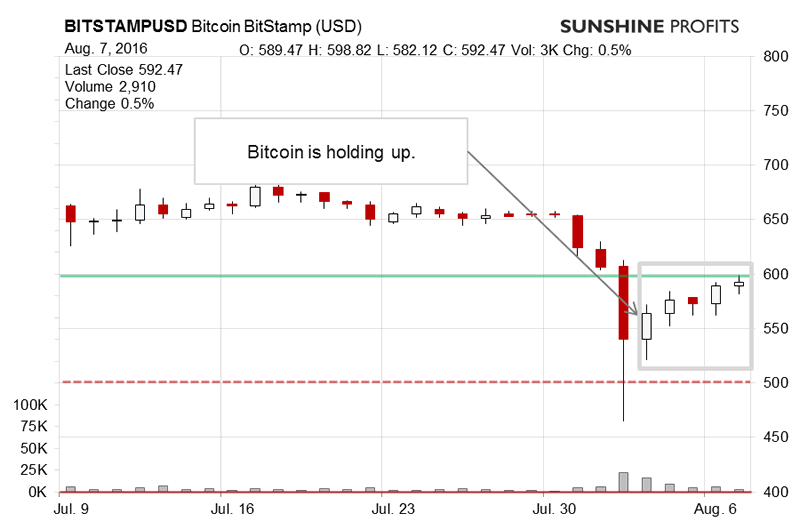

On BitStamp, we saw some movement to the upside. Is it enough to change the outlook? Recall our recent comments:

The situation actually became bearish before the announcement of the hack at Bitfinex. So, the plunge that perspired afterwards didn’t catch our subscribers off-guard. The following Bitfinex situation added fuel to flame and Bitcoin actually reached our initial target level the next day (Tuesday). Needless to say, the volume was explosive. The currency has recovered somewhat since then and is now around $570.

Bitcoin is now a little higher, at around $590. Is this enough to change the outlook to bullish? We don’t think so. The currency is now slightly above the 61.8% retracement level based on the previous top (July) and the recent bottom. This is a moderately bullish indication as we might see a third close above this level today. At the same time, the situation has not really improved in a meaningful way.

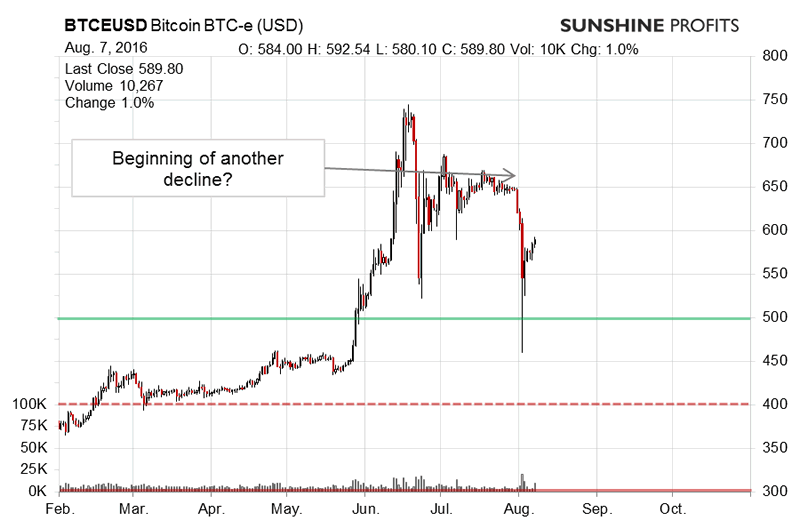

On the long-term BTC-e chart, we see the rebound. Our previous thoughts:

We have now seen a very powerful decline materialize. We’ve also experienced a rebound above the June low. This, however, doesn’t necessarily mean that the decline is over. First of all, yesterday’s rebound took place on relatively strong volume but today’s has been far more muted. Secondly, the RSI was below 30 for only one day and we might still see more depreciation. Finally, and perhaps a little surprisingly, the recent Fibonacci retracement levels are still in play, despite the volatility of the move. Bitcoin is at the 38.2% retracement level, actually slightly above this level. We haven’t really seen an invalidation of the decline and, consequently, the outlook remains bearish. If we see more upside potential, we might adjust the hypothetical position. This is not the case just now.

Bitcoin is now above the mentioned 38.2% level, at the 50% level. The rebound, however, hasn’t been particularly strong and the Bitfinex hack still looks like a potential turning point for the medium-term trend. The caveat here is that we could still see some upside volatility and this could make us change the hypothetical position.

Summing up, in our opinion short speculative positions might be favorable at the moment.

Trading position (short-term, our opinion): short positions; stop-loss at $657; initial target at $527.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.