Gold Price is Not Topping

Commodities / Gold and Silver 2016 Aug 14, 2016 - 12:19 PM GMTBy: Gary_Savage

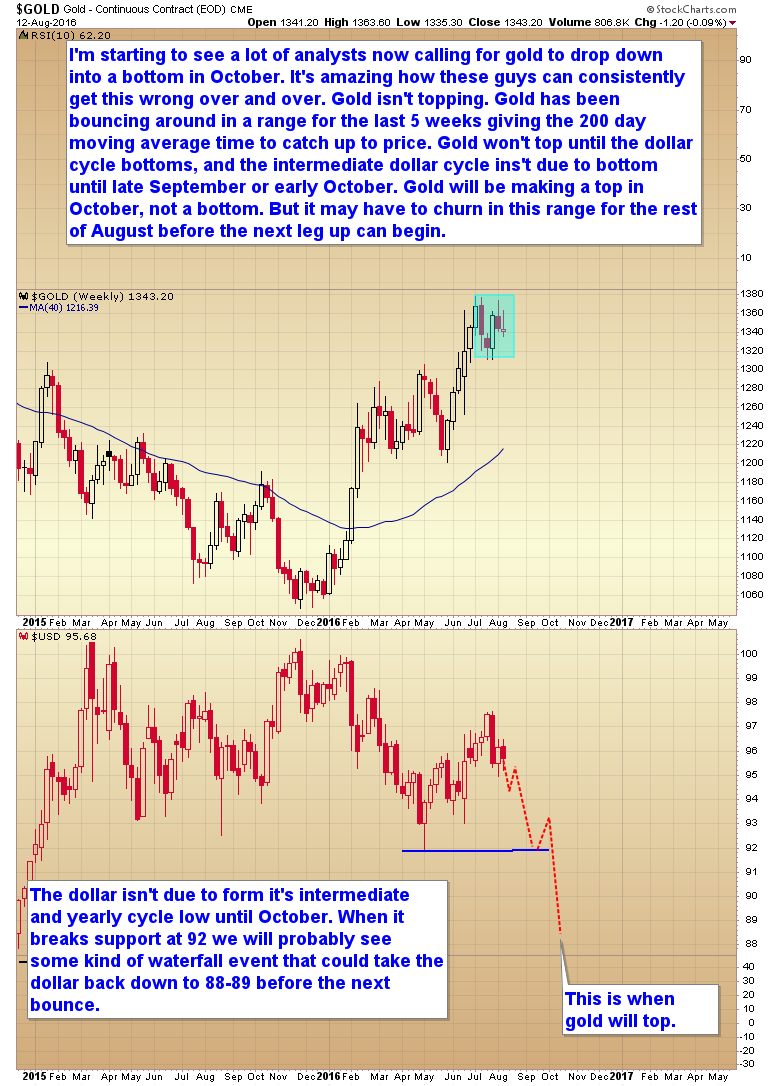

I’m starting to see a lot of analysts now calling for gold to drop down into a bottom in October. It’s amazing how these guys can consistently get this wrong over and over again. Gold isn’t topping. Gold has been bouncing around in a range for the last 5 weeks giving the 200 day moving average time to catch up to price. Gold won’t top until the dollar cycle bottoms, and that intermediate cycle isn’t due to bottom until late September or early October.

Gold will be making a top in October, not a bottom. But it may have to churn in this range for the rest of August before the next leg up can begin.

The dollar isn’t due to form it’s intermediate and yearly cycle low until October. When it breaks support at 92 we will probably see some kind of waterfall event that could take the dollar back down to 88-89 before the next bounce.

Like our new Facebook page to stay current on all things Smart Money Tracker

Gary Savage

The Smart Money Tracker

Gary Savage authors the Smart Money Tracker and daily financial newsletter tracking the stock & commodity markets with special emphasis on the precious metals market.

© 2016 Copyright Gary Savage - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.