WTI Crude Oil Pattern Still on Target for Higher Prices

Commodities / Crude Oil Aug 22, 2016 - 04:28 PM GMTBy: Ken_Ticehurst

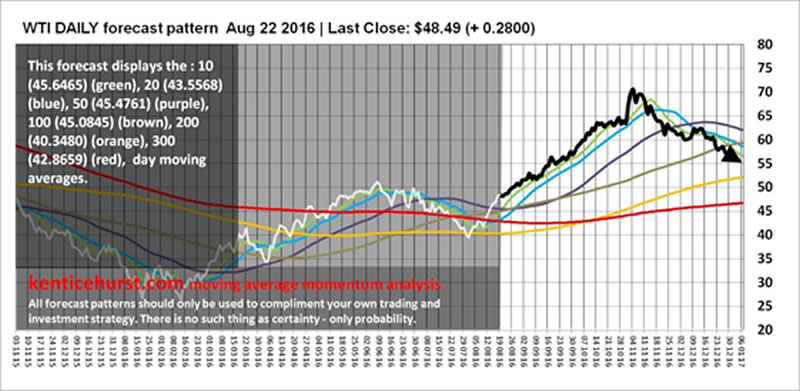

Since our last article WTI has behaved perfectly, clearing all our daily hurdles. Our longer term patterns show the strong possibility of a rise to $60+ during the second half of this year before a further decline in to 2017.

Our recent forecast suggested a bounce off the $40 support before a new leg up fuelled by the 50 and 100 day moving averages converging. This we forecast would be the catalyst for a move towards what we believe would be long term resistance in the $60+ range, we could even get to $70 per barrel.

We held the 200 day moving average and got back above the 300, 10 and 20 day moving averages., now this week we have got back above the 50 and 100 day moving averages that seem to be converging as forecast.

We believe that we are currently in the mid point of a dead cat bounce in crude oil with at least a possible retest of the recent lows in 2017, this forecast represents the most bullish case we can really find for WTI at present but also the most probable, however heavy resistance above at the 100 week moving average, could stall this move.

In our opinion this forecast remains valid providing price closes above the 10 ideally and definitely above the 20 day moving average on a daily basis, a daily close above the 100 week moving average would certainly be positive.

As with all our forecasts we offer a road map for the trade or investment idea, our subscribers also get to see our longer term weekly and monthly forecasts which adds even more detail.

You can follow our free forecasts on our web site, we post regularly on our twitter account which is embedded on our home page. Our forecasts use our moving average momentum analysis technique which coupled with our proprietary software, analyses each market we cover looking for probable patterns.

Because we now publish the underlying patterns our subscribers get unrivalled access to some of the most unique forecast charts available, and get a trading and investment edge over their competitors.

Our forecasts are fractal patterns that last for months and years, we monitor the development of these probable patterns continually to ensure we are on track. Our methodology is to create a most probable long term fractal pattern and then continually test it and model it over multiple time frames to ensure the pattern remains a probable event.

Ken Ticehurst

You can read more about our unique foresting system and moving average momentum analysis at our website: http://www.kenticehurst.com

Copyright 2016, Ken Ticehurst. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.