EUR-USD pattern still on track

Currencies / Euro Aug 26, 2016 - 09:26 PM GMTBy: Ken_Ticehurst

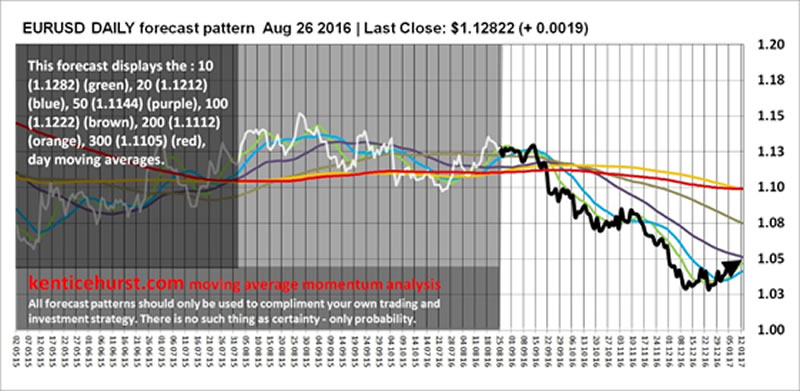

The Euro has spent the last year consolidating against the US Dollar, however it appears as though this long consolidation was just a breather in a longer term down trend. Our updated daily forecast pattern below, shows how we think this consolidation will end during the next few months.

Currently the 50 is below the 100 day moving average and they are all bunched quite tightly as is often the case before a decisive move, we expect the 50 and 100 day moving averages to converge and the begin to drop together and the 100 day is turning down. Our forecast shows the 100 falling below the 200 and 300 day moving averages, by the time that happens this weakness in the Euro should be well underway,

Whilst everyone loves to hate the Dollar, the simple fact is that the Dollar is the cleanest shirt in the laundry basket, sure it's not great but that's not the point. With a near 60% weighting for the Euro, to hate the Dollar is to love the Euro and quite simply that is not something that seems even remotely sensible at this stage.

The Euro zone is a continuing train wreck, nothing has been solved, the divide between the North and South continues to grow, the ECB seems set on a path of destroying the Mediterranean economies through continued bailouts, which serve only to alleviate the large German and French banks.

The third bailout in May of this year has done little if anything to alleviate the long term structural problems Greece faces, their debt to GDP ratio rather than declining is increasing, this is simply not the way to solve a debt crisis. This recent bailout has merely removed Greece from the critical list, like a patient being resuscitated and assuming that this will fix a chronic long term illness.

Conveniently this bailout allowed the can to be kicked down the road until after the German federal elections in 2017 and here is the biggest problem the Eurozone faces, its economy is simply not being run for the benefit of its citizens. It is an ideological and political enterprise that simply pushes ahead with a grand plan regardless of the consequences for many of its citizens. The Eurozone is run for the benefit of its political institutions.

Our forecast shows what we think will happen to the EURUSD over the coming months, our analysis of large structural patterns indicates that the last year was nothing more than a bear market consolidation and now we are about to enter the continuation phase where investors realise the same old problems will continue to re-emerge as long as politics trumps sensible economics.

Our forecast shows the pattern structure of how the Euro may well decline over the next year, it comes from a larger pattern that has been in play for over a year now and should finally herald another Euro crisis as investors continue to punish the currency for the structural mess the technocrats have failed to address.

No market rises or falls in a straight line and the Euro is no exception, sentiment is a key factor in the determination of how investors price assets. Regardless of the long term outlook for the Euro it cannot fall to its true intrinsic value against the Dollar in one go.

As price falls or rises away from perceived value (generally the value at which at which traders and investors were previously comfortable with) momentum starts to decay and price begins to consolidate just as the EURUSD has done for some time now.

Then provided the fundamentals haven't changed which with the Euro being driven by ideology rather than pragmatism is a given, the next wave down can begin.

It is our assertion that both the fundamental and technical picture both point to the next leg down in the Euro and consequently the next leg up in the Dollar Index are about to begin in earnest. Again we note this is not about how good the Dollar is, it is all about how bad the Euro is, it is after all like most markets relative.

You can follow our free forecasts on our web site, we post regularly on our twitter account which is embedded on our home page. Our forecasts use our moving average momentum analysis technique which coupled with our proprietary software, analyses each market we cover looking for probable patterns.

Because we now publish the underlying patterns our subscribers get unrivalled access to some of the most unique forecast charts available, and get a trading and investment edge over their competitors.

Our forecasts are fractal patterns that last for months and years, we monitor the development of these probable patterns continually to ensure we are on track. Our methodology is to create a most probable long term fractal pattern and then continually test it and model it over multiple time frames to ensure the pattern remains a probable event.

Ken Ticehurst

You can read more about our unique foresting system and moving average momentum analysis at our website: http://www.kenticehurst.com

Copyright 2016, Ken Ticehurst. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.