Ignore Yellen and Buy the Dip in Precious Metals

Commodities / Gold and Silver 2016 Aug 27, 2016 - 04:23 PM GMTBy: Jason_Hamlin

Investors worldwide have been on pins and needles in eager anticipation of a speech from our economic overlords. Friday morning FED chair Yellen finally opened her mouth and said a whole lot of nothing.

Investors worldwide have been on pins and needles in eager anticipation of a speech from our economic overlords. Friday morning FED chair Yellen finally opened her mouth and said a whole lot of nothing.

Markets didn’t know exactly how to react to her nothingness. Stocks were up and then down. Gold was down and then up. The USD index plunged and then rallied nearly 1%. Will the FED raise rates in 2016 or not? The drama continues as Yellen of Oz pulls the levers behind the curtain.

But the central banker has no clothes. She is the woman behind the curtain, largely a mouthpiece for the real powerbrokers behind the scenes. And even they are just buying time with this unsustainable monetary experiment. It ends badly, but good luck guesssing when.

The key sentence from Yellen’s speech that got the most attention was probably this one:

“In light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.”

But the more telling sentence went largely unoticed by the financial media:

“future policymakers may wish to explore the possibility of purchasing a broader range of assets.”

They may indeed, if they wish to keep the entire market from collapsing on their watch. And that seems to be the goal for the time being… extend and pretend.

What Does It Mean for Gold Investors?

I think the best thing investors can do is to ignore Yellen and her ramblings. She is not going to be able to raise interest rates by more than 25 basis points in 2016, if at all. This isn’t enough to stop a new bull market cycle in precious metals. In fact, there isn’t much reason to believe that rising rates will be bearish for gold anyway. There is a fairly strong historical trend of gold prices rising along with interest rates, as we documented here.

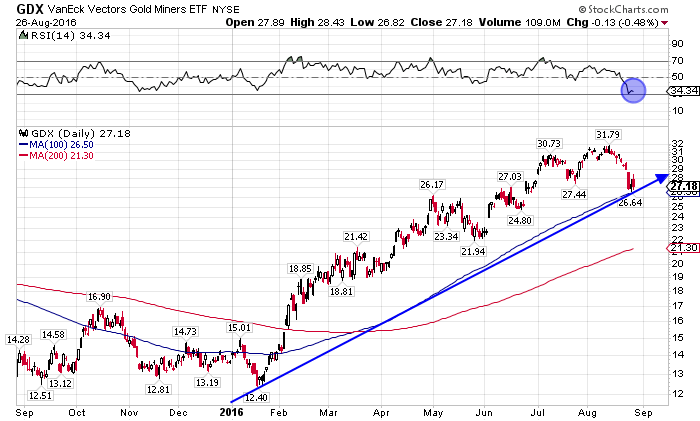

But you don’t have to go too far back in history to understand how gold might react to a hike in interest rates. The last time the FED made a move, in December of 2015, it was followed by one of the strongest rallies the precious metals market has ever experienced. Mining stocks in particular enjoyed a huge run, with the Gold Miners ETF (GDX) doubling in roughly 3 months. Several mining stocks that we have highlighted went up 1,000% or more in a very short time period.

After a few very minor dips, gold and silver have finally experienced a more substantial correction over the past few weeks. The Gold Miners ETF is down roughly 15%, but still up 98% year to date.

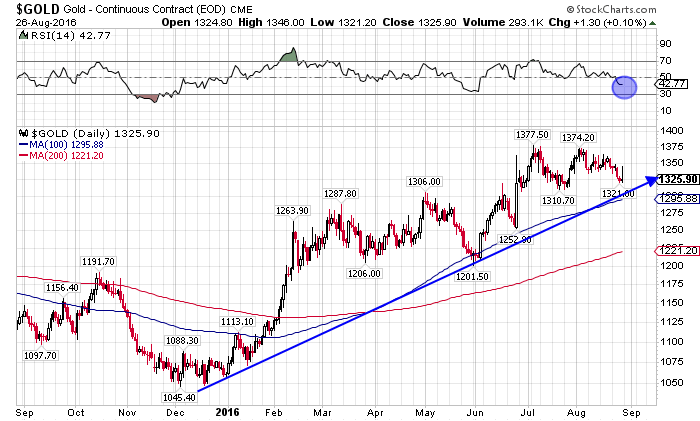

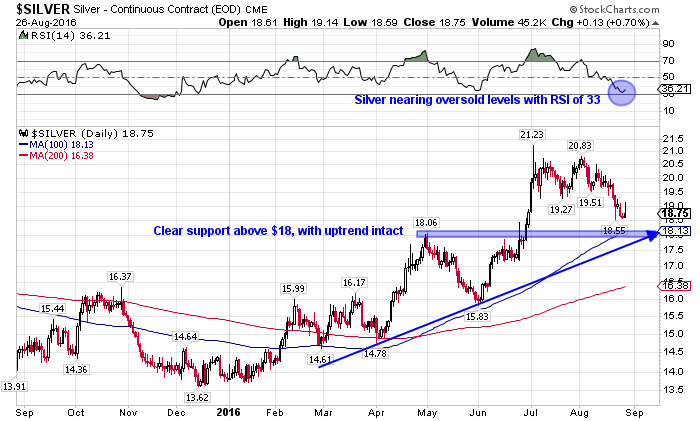

Picking the bottoms of these corrections is largely guesswork, but let’s see what the charts suggest.

The gold chart shows a pullback of roughly $50 from around $1,375 to a low of $1,321. This is still well above techincal resistance at $1,305 and the 100-day moving average at $1,295. The RSI is still not oversold, so there could be a bit more downside ahead.

The silver chart shows a drop of around 13% from $21.23 to $18.50. As with gold, silver is also above key technical support on the chart and the uptrend remains intact. The RSI dipped towards oversold levels just above 30, the lowest reading since late 2015. A bit more downside is possible, but it seems that the correction in silver has largely run its course.

The Gold Miners ETF (GDX) chart also signals what could be the end of this multi-week correction. The share price of GDX has dipped towards the 100-day moving average and the RSI bounced off oversold levels. I believe mining stocks are likely to come roaring back in September, so this appears to be a good buying opportunity. I don’t think it makes sense to go “all in” quite yet, but I am slowly edging into new positions.

Summary

The media loves to mock gold investors and parade ‘expert’ gold bears on television with every minor pullback. They come up with all sorts of reasons why the advance is over and gold will fall back below $1,000 now. Even Harry Dent has found his voice again.

Of course, nobody knows for sure what happens next. But we added a new junior silver miner to the Gold Stock Bull portfolio on Friday and I utilize these opportunities to buy quality mining stocks at a discount.

Misguided investors panic sell when they are convinced that the FED will start raising rates aggressively. But this broken record keeps on spinning. Fool me once, shame on you. Fool me twice…

Even assuming the FED decides to raise rates, which is not likely before the election, the gold bears have their logic all wrong. Interest rates climbing from zero to just above zero will have a muted impact on gold and silver. It is mostly anticipation of the hike and fear of uncertainty, not the actual rate increase that causes gold prices to decline. And as long as we remain above prior resistance and it turns into suppport, there is no invalidation of the uptrend.

So go ahead and hike, or don’t, either way I expect much higher gold and silver prices over the next few years. If you missed your opportunity to buy the first time around, you might want to consider using this dip to your advantage. If you want my ramblings on a more frequent basis, plus intant access to our model portfolio of 15 stocks, trade alerts whenever we buy/sell and our top-rated contrarian newsletter, click here to become a Gold Stock Bull Premium Member.

We all know how this story ends and those sure look like gold bars to me.

In a 1964 article, educator and historian Henry Littlefield outlined an allegory in the book of the late 19th-century debate regarding monetary policy. According to this view, for instance, the “Yellow Brick Road” represents the gold standard, and the silver slippers (ruby in the 1939 film version) represent the Silverite sixteen to one silver ratio (dancing down the road).

Moreover, following the road of gold leads eventually only to the Emerald City, which may symbolize the fraudulent world of greenback paper money that only pretends to have value. It is ruled by a scheming politician/central banker (the Wizard/FED Chair) who uses publicity devices and tricks to fool the people (and even the Good Investors) into believing she is benevolent, wise, and powerful when really she is a selfish, evil humbug.

We work hard at uncovering undervalued silver stocks with the potential to generate huge returns for investors. Below is a picture of me touring a silver mine in Mexico that I ended up recommending to subscribers after meeting with management. You can benefit from our hard work and research, simply by subscribing here for less than $1 per day.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2016 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.