US Economy Contracting as Paulson Seeks to Rescue Collapsing Banks

Economics / Credit Crisis 2008 Jul 27, 2008 - 11:09 AM GMT

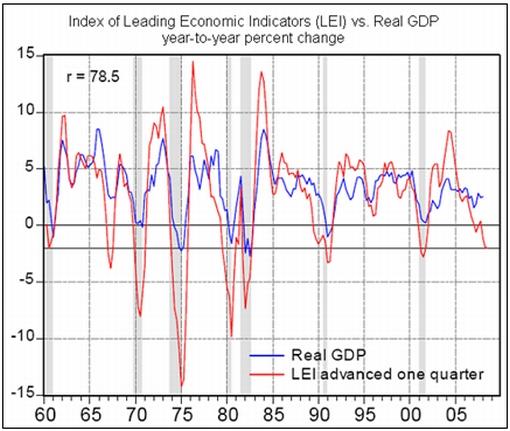

“The Index of Leading Economic Indicators (LEI) fell 0.1% in June, following a revised 0.2% drop in May (previously estimated as a 0.1% increase). The quarterly average of LEI is down 2.0% from a year ago, the largest decline in the current business cycle. Historically, such large year-to-year declines of the quarterly average of the index are associated with recessions, with the exception of 1967.

“The Index of Leading Economic Indicators (LEI) fell 0.1% in June, following a revised 0.2% drop in May (previously estimated as a 0.1% increase). The quarterly average of LEI is down 2.0% from a year ago, the largest decline in the current business cycle. Historically, such large year-to-year declines of the quarterly average of the index are associated with recessions, with the exception of 1967.

“The National Bureau of Economic Research announces the dates of peaks and troughs of business cycles long after they occur because they need to wait for revisions of economic data. The main message from today's LEI data is that it confirms the severely weak status of the economy in the near term. LEI data have been sending warning signals for several months but they have been largely ignored.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 21, 2008.

Asha Bangalore (Northern Trust): New homes – hints of market recovery are visible

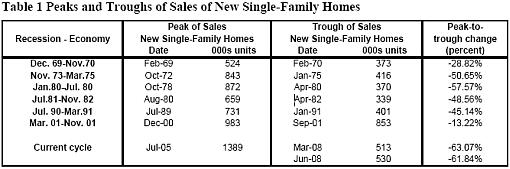

“Putting the latest sales data of new homes in a historical perspective, sales of new single-family homes are down 61.8% from the peak in July 2005 (1.389 million units). The bottom appears to have occurred in March 2008 when sales were down 63.1% from the peak. The median decline in sales of new-single family homes from the peak to the trough is 46.9% during 1969-2001.

“The median price of a new single-family home rose to $230,900 versus $227,700 in May. Home prices appear to have bottomed in May 2008, putting the peak-to-trough decline at 13.3%. The median decline in prices of new single-family homes from the peak to the trough is 8.6% during 1969-2001. In sum, the market of new homes is mending gradually.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 25, 2008.

Asha Bangalore (Northern Trust): Existing homes – weak conditions remain intact

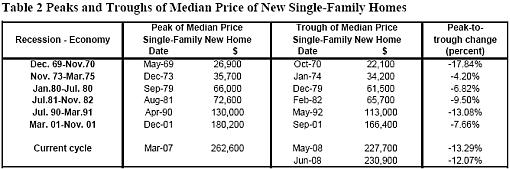

“Sales of existing homes declined 2.6% to an annual rate of 4.86 million units in June. Purchases of single family homes declined 3.2% to an annual rate of 4.27 million units, the lowest sales pace since January 1998. Sales of existing single-family homes are now down nearly 33% from their peak in September 2005.

“Overall, the inventory of existing homes rose to an 11.1 month supply, up from a 10.8 month supply in May. The median price of an existing single-family home ($213,800) in June fell 6.7% from a year ago. Given the number of unsold homes in the market, home prices would have to fall further to clear the inventory.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 24, 2008.

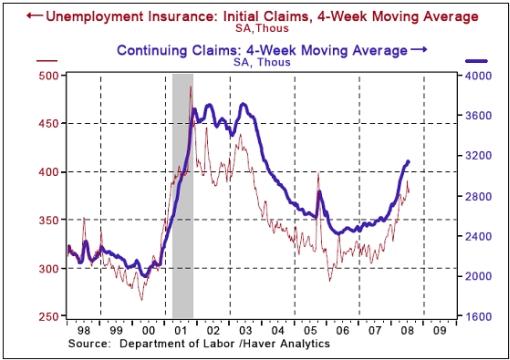

Asha Bangalore (Northern Trust): Jobless Claims – weakness in hiring prevails

“Initial jobless claims rose to 406,000 during the week ended July 19 from 372,000 in the prior week. The sharp increase is partly due to auto industry related shutdowns in the summer. Continuing claims, which lag initial jobless claims, stood at 3.107 million, down slightly from 3.116 million in the prior week. The four-week moving averages of both initial and continuing jobless claims continue to send a message of significant weakness in hiring.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 24, 2008.

Reuters: US banks primary borrowings from Fed biggest ever

“US banks' direct primary credit borrowing from the Federal Reserve rose to the highest level ever in the latest week, reflecting the growing need of the banking sector to rely on the central bank for cheap funding, analysts said.

“Banks primary credit borrowings averaged $16.38 billion per day in the latest week, a record high and up from $13.92 billion the previous week, Federal Reserve data showed on Thursday.

“On the day of July 23, banks' primary credit borrowings rose to $17.68 billion, the highest borrowing since September 12, 2001 when banks borrowed $45.5 billion in a single day.”

Source: John Parry, Reuters , July 24, 2008.

Bill King (The King Report): Home equity loans weighing on banks

“ Mr. Mortgage : Our nation's largest banks are being weighed down by second mortgage liens (home equity lines/loans). You have heard this in many of their earnings calls recently. The home equity market is thought to be as large as $1.3 trillion.

“For many banks this is their largest residential mortgage exposure. For example, Wells Fargo still carries $84 billion and Bank of America and Chase about $100 billion a piece. The banks were very touchy in their recent earnings reports on this topic. Wells Fargo actually changed the definition of ‘default' from 120 days to 180 days to push out defaults further and hide losses … Now, it looks as though the tax payers will shoulder the risks for the bank's irresponsible home equity lending as well. They added this last minute to the Fannie/Freddie, Wall St, Foreign Gov't, Washington DC, bank and investment bank bailout.

Source: Bill King, The King Report , July 24, 2008.

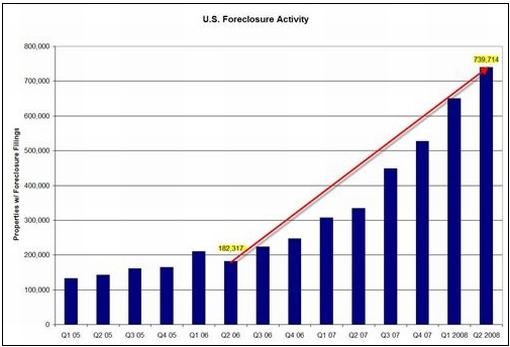

Bloomberg: US foreclosures double as house prices decline

“US foreclosure filings more than doubled in the second quarter from a year earlier as falling home prices left borrowers owing more on mortgages than their properties were worth.

“One in every 171 households was foreclosed on, received a default notice or was warned of a pending auction. That was an increase of 121% from a year earlier and 14% from the first quarter, RealtyTrac Inc. said today in a statement. Almost 740,000 properties were in some stage of foreclosure, the most since the Irvine, California-based data company began reporting in January 2005.

“‘Rising foreclosures are putting downward pressure on prices, increasing the possibility that homeowners will go upside-down on their mortgages,' said Sheryl King, chief US economist at Merrill Lynch & Co. in New York. ‘That will cause more losses in mortgage portfolios and less willingness from investors to securitize mortgages and therefore fewer mortgages.'

“About 25 million US homeowners risk owing more than the value of their homes, according to Bill Gross, manager of the world's biggest bond fund at Pimco. That would make it impossible for them to negotiate better loan terms or sell their property without contributing cash to the transaction.”

Sources: Bob Ivry, Bloomberg and ForeclosurePulse , July 25, 2008.

Financial Times: John Paulson looks at cash-strapped banks

“John Paulson, who recorded what was thought to be the single biggest profit in the history of the hedge fund industry last year by betting on a financial collapse, is planning a new fund to provide capital to cash-strapped banks.

“Mr Paulson's New York-based Paulson & Co plans to open a new hedge fund by the end of the year to buy into financial institutions raising cash, although the plans have not yet been finalised. Investors said they expected to see documentation for the new fund next month, assuming it went ahead.

“The move suggests Mr Paulson is preparing to call the bottom of the market for financials, a shift likely to be closely watched by other investors. Mr Paulson was the flag-carrier last year for a group of hedge funds that made enormous profits – estimated by investors at more than $12 billion for Paulson's funds – by shorting, or betting against, subprime mortgages.”

Source: James Mackintosh, Financial Times , July 23, 2008.

David Fuller (Fullermoney): Equities – is fundamental background deteriorating or improving?

“Is the fundamental background still deteriorating or is it now improving? People could debate this question all day, every day, without necessarily reaching agreement. Therefore, I will focus on four obvious concerns – the price of crude oil, the performance of bank shares which we have always regarded as lead indicators, central bank policy, and what I often refer to as the Wall Street leash effect.

“Crude oil has broken its medium-term uptrend, which is an improvement in terms of investor concerns, but it needs to fall considerably further to reverse its shock effect on stock markets and GDP growth.

“Western bank indices have bounced sharply after clear evidence of capitulation selling in the west, which is a recent improvement, but will need to demonstrate further evidence that the overall trend is reversing. Bank indices in other regions have often fared considerably better in recent months, not least in Japan.

“Central banks are still hawkish on inflation although there is some tentative evidence of a softening in this stance.

“The Wall Street leash effect had been very negative before providing some respite commencing last week, although it hit a speed bump today as the rally reached initial resistance from the January and March lows.

“Net it all out and we have some improvement. However to revive animal spirits among bulls, the technical rallies which commenced last week will have to be larger and more durable than what we saw following the January and March lows.”

Source: David Fuller, Fullermoney , July 24, 2008.

Jeffrey Saut (Raymond James): Attempting to catch a bottom

“If the decline in crude oil continues to play, it should be bullish for stocks. Indeed, just as in horseshoes and hand-grenades, all you have to be is ‘close' when attempting to ‘catch' a bottom in the stock market to make a lot of money if you adopt a scale-in buying approach, which is what we have attempted to do over the past few weeks! As stated two weeks ago, ‘What a great time to be an investor' for if you are a well prepared investor, volatility breeds opportunity.”

Source: Jeffrey Saut, Raymond James , July 21, 2008.

David Rosenberg (Merrill Lynch): EPS to see 35% correction

“The decline in domestic economic activity, steadily climbing input costs and diminished support from currency translation is likely to result in a sharp downturn in EPS, in our view. We see EPS operating earnings at 68.0 in 2008 (down 17.7% from 2007) and 63.0 in 2009 (down 7.2%). That translates into a 35% decline in EPS from the peak in 2006.

“We have been saying all along that the slowdown in the economy is not about the business sector. Balance sheets, outside the financial sector and the perennially restructuring auto sector are relatively healthy. However, the toxic combination of declining revenues and soaring costs mean that few sectors will escape this downturn with profit margins intact.”

Click here for the full report.

Source: David Rosenberg, Merrill Lynch , July 18, 2008.

John Authers (Financial Times): Why US financials have staged a recovery

Click here for the full article.

Source: John Authers, Financial Times , July 22, 2008.

Gareth Williams (ING): European profits under pressure

“The number of profit warnings from large-cap European companies this year looks set to hit the highest level since 2003, warns Gareth Williams, equity strategist at ING.

“He notes there were 25 warnings in the first half of 2008, the most for five years, and that there have been a further five so far in the second half.

“‘Since 1996, 48% of profit warnings have come in the first half and 52% in the second half. Using the average to project forward suggests 52 profits warnings for the year as a whole; in other words, there might be another 22 to come.'

“However, Mr Williams warns that it is far more likely that the second half will see profit warnings coming through at a faster rate than in the first six months of the year.

“‘Bottom-up forecasts remain dangerously optimistic and our top-down models suggest that euro strength, high oil prices and consumer fragility will start to hit home in the coming quarters,' he says.

“Mr Williams says that, unsurprisingly, the banking, retail and technology sectors have dominated the list of warnings so far this year. ‘Our top-down work on margins and earnings suggests that technology, industrials, autos and food & beverages may be the sectors that deliver unwelcome surprises in the second half.'”

Source: Gareth Williams, ING (via Financial Times ), July 22, 2008.

Lex (Financial Times): Cyclical stocks collapse in UK

Since the middle of May – roughly marking the top of the last rally – the FTSE 100 index has been hit hardest by a collapse in cyclical stocks. Investors have not just given up on the UK. It seems that belief in the resilience of the global economy is draining away as well.

“Over the past two months the transportation, retail, property and media sectors have all fallen further than bank stocks. If some now think the economy is following the US into oblivion, the very institutions charged with trying to avoid this fate have hardly reassured. Last week, speeches from the chancellor of the exchequer and the governor of the Bank of England only just stopped short of telling people to pack their bags and move to France.

“But more worrying is the slump in resources stocks, which reflects the health of the global, rather than the domestic, economy. The share prices of mega-miners BHP Billiton and Rio Tinto have lost more than a quarter of their value in the past two months, underperforming the broader market by 15%. In that period both companies have announced a near doubling of their iron ore contract prices and other metals are trading near record highs. Nor was either stock screamingly expensive.

“The mining sell-off suggests the global growth story is over. Fears of a slowdown across the developed world are being realised. But now the robustness of some developing economies is being questioned. The rate of growth in China is slowing, as last week's second-quarter numbers – albeit still an impressive 10% – showed. UK investors may soon look back fondly to a time when they just had to worry about banks.”

Source: Lex, Financial Times , July 21, 2008.

Bloomberg: Mobius sees “good bargains” in China and India

“Stocks in China and India offer ‘good bargains' after benchmark indexes in the nations declined more than any other major market this year, Templeton Asset Management's Mark Mobius said.

“‘We've been rearranging the portfolio based on valuations, which have come down pretty dramatically in places like India and China,' Mobius, who oversees about $47 billion of emerging-market equities, said in an interview from Toronto. ‘There've been big declines.'

“Mobius joins investor Jim Rogers in favoring Chinese stocks after they plunged 46% this year. China and India, the two most populous nations, are the worst performers among the world's 20 largest stock markets as soaring raw material prices and slowing economic growth weigh on profits. Last year, China's main index surged 162% and India's advanced 47%.

“China's CSI 300 Index is valued at 21 times reported earnings, near the lowest in more than two years, and down from a peak of 53 times in October 2007. In India, the Sensex Index is trading at 14 times reported earnings, down from a high of 31 earlier this year. That compares to a multiple of about 22 times for the S&P 500 Index in the US.

“Rogers, who said he hasn't sold any of the Chinese equities he started buying 1999, told investors on June 28 not to ‘give up' on the nation's stock markets.

“Marc Faber, publisher of the Gloom, Boom & Doom Report, disagrees. The investor … said on July 4 that investors betting on a rebound in China's tumbling stocks are setting themselves up for more losses.

“Mobius added that he favors shares in Brazil and Russia because the two markets can still benefit from the demand for energy and other raw materials. ‘Russia and Brazil are pretty much in the same position,' Mobius said. ‘Both of those areas are swimming in excess liquidity, which will drive consumer prices as well.'”

Source: Catherine Yang and Chen Shiyin, Bloomberg , July 22, 2008.

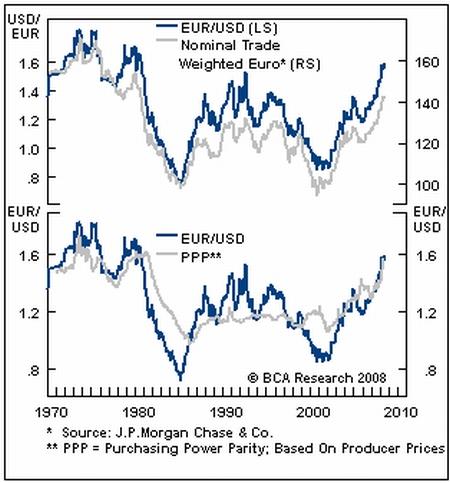

BCA Research: Euro – a tense anniversary

“Since its lows in late 2000, the euro has risen over 83% against the US dollar and 51% in trade-weighted terms. While we do not rule out one last spike in the currency, the climb has left the euro extremely overvalued and vulnerable to a correction. We suspect the latter will begin in 2009, as the domestic economy slows sharply and the US begins to recover.

“Another precondition would be a further setback or consolidation in crude prices, given that the ECB is more sensitive to headline inflation than the Fed.

“However, we are not expecting a collapse in the euro. The currency will continue to enjoy a positive interest rate differential with the US and the PIGS (Portugal, Italy, Greece and Spain) will not withdraw from the euro zone. Technically, there is strong resistance in the $1.38 to $1.41 range, established when the synthetic rate twice tested those levels in the early 1990s. Should it break these floors, the next support would be around $1.30.”

Source: BCA Research , July 21, 2008.

Financial Times: Renminbi fall fuels talk of policy shift

“The Chinese renminbi fell for the third consecutive day on Monday, sparking speculation that its continued appreciation might not be a foregone conclusion.

“The renminbi has risen more than 6% against the dollar this year as the Chinese authorities have used the currency as a tool to dampen inflationary pressures in the country's overheating economy.

“By midday in New York, the renminbi dropped 0.2% to Rmb6.8290 against the dollar after the People's Bank of China fixed the currency's daily mid-point lower for a third successive day.

“Gabriel Stein, of Lombard Street Research, said that, while the move could just be put down to ‘normal daily fluctuations', the Chinese ministry of commerce had called for a slower pace of renminbi appreciation.

“Wen Jiabao, the Chinese premier, has talked about helping China's exporters.

“‘It could be the beginning of a policy shift,' said Mr Stein. ‘It could also be an attempt to stave off speculative capital inflows by showing that renminbi appreciation is not a one-way bet.'”

Source: Peter Garnham, Financial Times , July 21, 2008.

David Fuller (Fullermoney): Oil prices by far the biggest global problem

“I have previously said that this year's spike in crude oil prices had become by far the biggest global problem. Spikes in the price of oil have proved to be much more damaging economically than slow, steady rises. … spikes certainly contributed to recessions in 1990-1991 and 2001-2002. I also recall the oil shock recessions of 1973-1975 and 1980-1982, as will many veteran subscribers.

“Today, I feel increasingly confident that crude oil established an important medium-term peak last week. However it remains to be seen whether or not oil continues to fall back even more quickly than it rose, as it could, or ranges in a phase of top extension before declining to what I suspect will be at least $100. The difference in timing is important because it will be a crucial factor for central banks, which continue to express more concern over inflation than slowing economic growth. It will also influence the level of speculative activity in other commodities.

“Meanwhile, I think Mark Mobius is right to be interested in China and India at these levels, and given the size of the funds that Templeton manages, he cannot really afford to hold out for historically low valuations. Circumstances may not produce them and they probably would not stay there very long in any event.

“The main reservation most strategists have about China, India or any other promising market today, is inflation. That is why oil really is everything. At $100 a barrel, investors would obviously be a lot less concerned about inflation, and able to refocus on all the attractive aspects of emerging (progressing) markets. If we see $100 oil later this year, which I think is a real possibility, I suspect most stock market indices will be higher than they are today, led by those with the best combinations of sound governance and economic growth.

“To those who might ask: would we not then see oil move back up and renew its uptrend, my answer is not immediately. Lower demand for oil in the USA, due to more efficient usage, could easily offset rising demand in China for a while. Also, it is only a matter of time before Iraq's oil production increases dramatically.”

Source: David Fuller, Fullermoney , July 22, 2008.

Financial Times: Arctic has 90 billion barrels of crude oil

“The Arctic holds as much as 90 billion barrels of undiscovered oil and has as much undiscovered gas as all the reserves known to exist in Russia, US government scientists have said in the first governmental assessment of the region's resources.

“The report is likely to add impetus to the race among polar nations, such as Russia, the US, Denmark, Norway and Canada, for control of the region.

“The US Geological Survey (USGS) believes the Arctic holds 13% of the world's undiscovered oil, while 1,669,000 billion cubic feet of natural gas is equivalent to 30% of the world's undiscovered gas reserves.

“‘The extensive Arctic continental shelves may constitute the geographically largest unexplored prospective area for petroleum remaining on earth,' the USGS said.”

Source: Carola Hoyos, Financial Times , July 23, 2008.

Eoin Treacy (Fullermoney): Gold is likely to outperform oil

“The overlay chart of oil and gold shows that both commodities have been in impressive uptrends for much of the decade to date. However within this secular uptrend, there have been periods when one has outperformed the other. We have just gone through a significant phase where oil outperformed not only gold but a host of other commodities and asset classes. Gold has also performed well, but the question remains how well it will perform on its own if oil enters a medium-term correction.

“From the beginning of the year, oil has outperformed in spectacular fashion and has rallied to less than 7 times the price of gold in relative terms. This area marks the lower side of a more than five-year range and last week's bounce probably indicates that this period of outperformance is over for the medium-term. In this environment gold is likely to be the better investment.”

Source: Eoin Treacy, Fullermoney , July 21, 2008.

Bloomberg: Hong Kong approves first gold exchange-traded fund

“The Hong Kong Securities and Futures Commission approved the city's first gold exchange-traded fund to meet investors' demand after bullion prices climbed.

“Hong Kong wants to bolster its position as an Asian financial center as rivals Tokyo and Singapore offer commodities trading. Gold for immediate delivery has jumped 39% in the past 12 months as investors seek an inflation hedge and alternative assets as global equities declined.

“‘Gold-related investment products are expected to be well received when inflation remains high as investors are seeking ways to preserve their wealth,' Kenny Tang, associate director at Tung Tai Securities, said in Hong Kong. ‘An ETF makes investment in gold easier and more accessible for public investors. What they need is only a stock-trading account.'

“A gold exchange-traded fund typically allows investors to trade the commodity without taking physical delivery of it. Each share in the fund represents a quantity of the commodity.

“The listing in Hong Kong comes after a similar fund started trading in Japan this year and in Singapore in 2006. Hong Kong is also planning to start a commodities exchange in the first quarter of 2009 and will offer dollar-denominated fuel oil contracts for delivery into China.”

Source: Theresa Tang, Bloomberg , July 23, 2008.

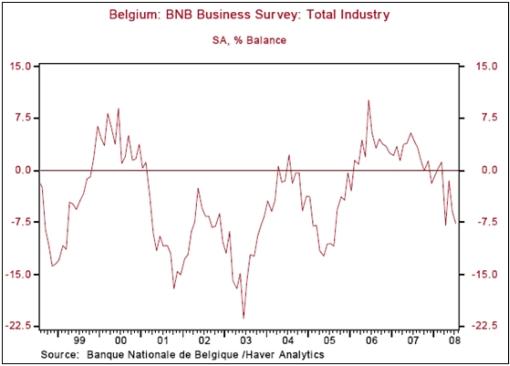

Asha Bangalore (Northern Trust): Deteriorating outlook for the Eurozone

“The slew of weak data from across the Eurozone this morning all but guarantees that the European Central Bank (ECB) won't be making any more rate hikes in the second half of this year. The RBS/Markit flash composite PMI dropped from 49.3 in June to 47.8 in July, the lowest since November 2001 and clearly indicating a contracting economy. Most of the decline was concentrated in the manufacturing index, which slid from 49.2 to 47.5, while the services PMI slipped from 49.2 to 48.3.

“Today also saw the release of our favorite Eurozone leading indicator, the Belgian National Bank's (BNB) business confidence indicator. As we've noted before, thanks to Belgium's strong trade ties with its neighbors (about 80% of Belgium's manufacturing output is sold abroad, mostly to fellow EU members), the BNB's business confidence index is a reliable leading indicator – about six months out – for GDP growth in the Eurozone as a whole. Again, the news is not good. The composite index dropped to -7.6 in July from -5.9 in June, driven by a sharp fall in the retail sales sub-component, which plunged to -12.5 (-6.8 in June).

“Hitherto, we have seen plenty of negative data from Spain, the ‘zone's fourth-largest economy, thanks to its housing market slump. Ireland has also been weakening rapidly. Now, the combination of high prices, a strong currency, and tight credit conditions is weighing on the likes of France and Germany. While one month of poor data does not a recession make, the trend clearly is downward – and that should be enough to stay the ECB's hand, even if consumer price inflation has not yet peaked.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , July 24, 2008.

Victoria Marklew (Northern Trust): Easing credit growth in Eurozone

“Today's ECB data on credit and money supply showed that the pace of loan growth to the private sector is easing, coming in at 9.8% on the year in June, versus 10.5% in May. In addition, the headline rate of growth in M3 money supply fell to an annual 9.5% in June from 10.0% the month before. While the pace of credit and monetary expansion is still high for a slowing economy, the fact that they are easing all but guarantees that the European Central Bank (ECB) won't be making any more rate hikes in the second half of this year.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , July 25, 2008.

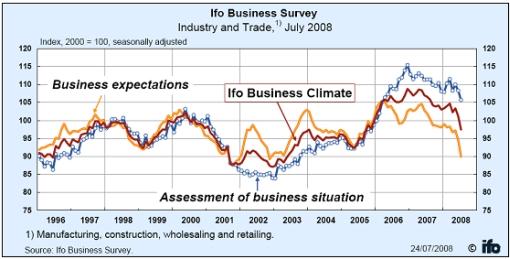

Ifo: German Business Climate Index falls

“The Ifo Business Climate Index for industry and trade in Germany has fallen again significantly in July following a clear worsening in the previous month. The firms are much more dissatisfied with their current business situation and they are clearly more reserved regarding the six-month outlook. These results suggest that the economic upswing is coming to an end.

“In manufacturing the business climate index has fallen noticeably. Satisfaction with the current business situation has declined among the survey participants. They also anticipate weaker business in the coming six months. Export business will no longer expand so rapidly, in the estimation of the manufacturers. Their willingness to take on additional staff has weakened somewhat.

“In the other three survey sectors – construction, retailing and wholesaling – the business climate index is clearly trending downwards. In both trade sectors, wholesaling and retailing, the business climate index has fallen significantly. The trading firms have assessed both their current business situation as well as the six-month outlook clearly more pessimistically than in June. In construction the business climate has clouded somewhat. The current business situation has been assessed more unfavourably and the business expectations are more cautious than in the previous month.”

Click here for the full report.

Source: Ifo , July 2008.

Times Online: Fears of recession grow as Britons stop spending and sales slump

“High street sales suffered a record slump last month, stoking fears that a vicious downturn in consumer spending will tip Britain into recession.

“The quantity of goods sold in shops across the country plummeted by 3.9% during June, the biggest monthly drop since 1986, official retail figures showed.

“The data, the first official confirmation that a severe downturn in consumer spending is taking hold, sparked further worries of a headlong retreat from the high street, undercutting the spending that has fuelled the economy for more than a decade.

“Sales of food were particularly hard hit, as shoppers balked at paying sharply higher prices for their weekly supermarket shop or lunchtime snack. Clothes and shoes purchases also dropped markedly.”

Source: Gary Duncan, Times Online , July 25, 2008.

Victoria Marklew (Northern Trust): Hawkish Bank of England even as economy slows

“The relentless stream of negative economic news out of the UK has the headline writers dredging up the old specter of stagflation – a ‘stagnant' economy with rising inflation. While the UK isn't at the point of recession yet, and there is reason to suppose that the headline inflation rate will start to ease come year's end, the outlook is certainly deteriorating.

“All told, it was no surprise when the Bank of England's (BoE) nine-member Monetary Policy Committee (MPC) left the repo rate unchanged at 5.0% on July 10. However, this morning's release of the minutes of that meeting did contain a bit of a surprise: while seven of the members opted to leave rates on hold and one argued for a cut, the ninth member had argued in favor of a rate hike. Not only was this three-way split unusual (the first in two years), the tone of the meeting was surprisingly hawkish, with the members debating the need to raise rates to defend their reputation as guardians of price stability.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , July 23, 2008.

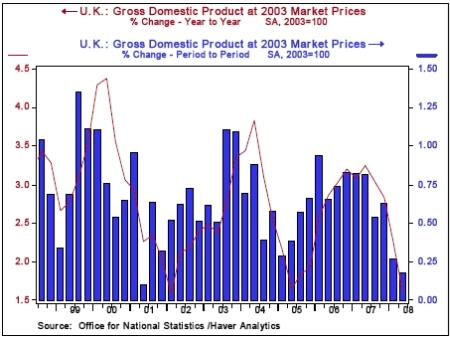

Victoria Marklew (Northern Trust): Preliminary UK Q2 GDP confirms slowing economy

“Today's preliminary Q2 GDP report from the UK showed real growth slowing to 0.2% on the quarter and 1.6% on the year, the weakest in three years and down from 0.3% and 2.3%, respectively, in Q1. A marked fall in construction output, the result of weakness in private house building, was largely to blame – down 0.7% on the quarter. However, the slowdown in the dominant service sector was also notable, with growth of just 0.4% on the quarter and 2.1% on the year, the weakest annual growth in 16 years.

“This report will add to expectations that the Bank of England's Monetary Policy Committee will leave interest rates on hold for the next few months.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , July 25, 2008.

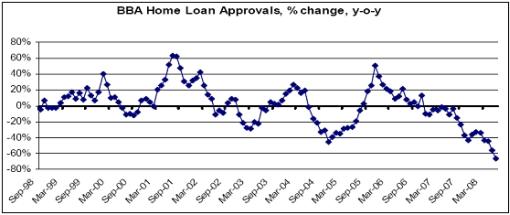

Victoria Marklew (Northern Trust): UK housing slowdown accelerates

“Finally, the housing sector slowdown continues to accelerate toward an outright slump. The British Bankers' Association today reported that mortgage approvals for house purchases – a leading indicator for the market as a whole – plummeted 67% on the year in June to just 21,118, the lowest number since the series began in September 1997.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , July 23, 2008.

Financial Times: Japan exports see first fall in 55 months

“Japanese exports shrank for the first time in nearly five years in June as the growth in shipments to emerging markets that had underpinned demand failed to offset the global impact of the US economic slowdown.

“The 1.7% year-on-year decline in shipments in June was the first in 55 months and increases the likelihood that Japan, the world's second largest economy, contracted in the second quarter.

“The data was a blow to advocates of the so-called ‘decoupling' theory, who have argued that a surge in demand in emerging markets such as Asia, the Middle East and Russia would make up for any US slowdown.

“‘The decoupling scenario is almost collapsing,' said Junko Nishioka, Japan economist at RBS.

“The decline in exports, coupled with an increase in the cost of imports largely because of a higher energy bill, pushed Japan's June trade surplus down nearly 90% to Y139bn ($1.3 billion) – much lower than expected.”

Source: David Pilling, Financial Times , July 24, 2008.

Financial Times: China's banks told to tighten mortgages

“Chinese officials and government economists have warned domestic banks to tighten their mortgage lending criteria after the US government's action to prop up Fannie Mae and Freddie Mac, the giant mortgage agencies.

“Liu Mingkang, China's top banking regulator, has in recent days urged the country's state-owned commercial banks to beware of risks in the real estate sector and ordered them to tighten loan approval processes.

“Others among China's policy community have also begun to express concerns about the health of the country's banks amid signs a once-booming property sector has begun to slow.

“Average house prices in China's 70 largest cities were up 10.2% from a year earlier by the end of June, according to official figures. But sales volumes in important cities, including Shanghai, Beijing and Shenzhen, have fallen precipitously in recent months. Some analysts fear steep price falls ahead.

“Lending standards at Chinese banks are often much looser than in developed countries, in part because China is still in the early stages of building a credit rating system.

“China's total stock of consumer debt remains far below of more developed economies. At the end of June, total mortgage lending in the Chinese banking sector amounted to Rmb3,350 billion or nearly 12% of gross domestic product.”

Source: Jamil Anderlini, Financial Times , July 23, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.