Silver Will Be A Top Performing Asset In The Next Financial Crisis

Commodities / Gold and Silver 2016 Sep 13, 2016 - 02:43 AM GMTBy: Chris_Vermeulen

The much awaited Jackson Hole speech by the Fed Chair Janet Yellen – and the subsequent nonfarm payrolls data failed to ignite the prospects of a rate hike this September of 2016. The market now forecasts only a 21% probability of a rate hike in this month, according to the CME FedWatch Tool. The probability of a rate hike in December of 2016 stands at just above 50%.

The much awaited Jackson Hole speech by the Fed Chair Janet Yellen – and the subsequent nonfarm payrolls data failed to ignite the prospects of a rate hike this September of 2016. The market now forecasts only a 21% probability of a rate hike in this month, according to the CME FedWatch Tool. The probability of a rate hike in December of 2016 stands at just above 50%.

Time and again, I have explained why the Fed cannot hike rates in 2016. Contrary many market experts, my view has stood the test of time and has come to fruition. According to my research, the chances of a rate hike in December of 2016 are also very bleak. Nonetheless, the Fed speakers will continue to “jawbone” the dollar, the way they have been doing for the whole year.

The coming week has a number of Central Banks competing with each other to unleash their monetary easing plan as if that is the only solution to all the economic problems plaguing the world. Even the failure of the past seven years has not deterred them from printing more money from thin air.

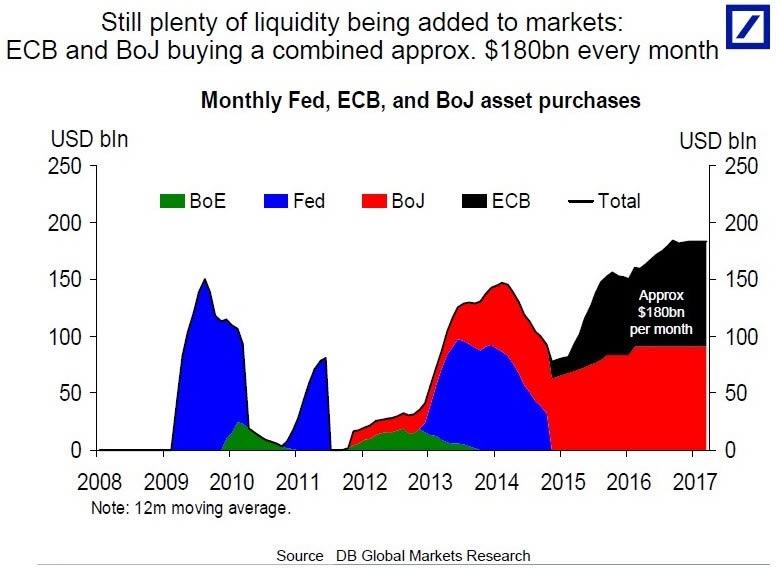

$180 Billion Of Bond Buying – Even Larger Than 2009

The European Central Bank and the Bank of Japan combined are purchasing a whopping $180 billion of bonds monthly, as shown in the chart below. Add to it, the new bond buying program announced by the Bank of England, and the number rises even higher. All three are expected to recommend either adding to their existing bond purchases or extend their duration in their next policy meetings.

This has led the Bond King Bill Gross to warn investors of the dangerous consequences. In a letter to clients, he wrote: “Investors should know that they are treading on thin ice”.

“This watch is ticking because of high global debt and out-of-date monetary/fiscal policies that hurt rather than heal real economies. Sooner rather than later, Yellen’s smooth shot from the fairway will find the deep rough,” reports CNBC.

Silver Is On The Cusp Of A Massive Rally

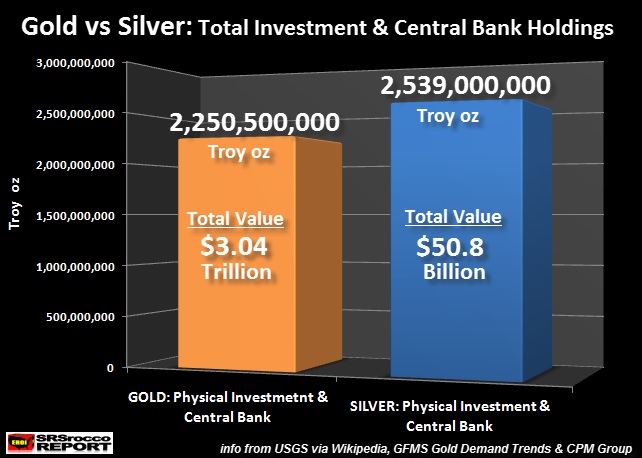

When investors realize that they are holding worthless currencies, the big money will rush into the precious metals. Consider this: The total world’s investment holdings in silver are a paltry $50.8 billion, compared to $3.04 trillion in gold, as shown in the chart below.

Did you know that the hedge funds alone manage around $2.7 trillion, according to Barclay Hedge data? Even if a small portion of the trillions sloshing around out there decides to enter into silver, the white metal will shoot through the roof.

Traders Are Finally Recognizing The Importance Of Silver

Following the poor jobs report last Friday, traders jumped into silver, thus driving it higher, as shown in the chart below.

As explained in our earlier articles, investors should not only look to buy into the “white metal”, they should also explore options of investing in the silver miners.

What Are The Silver’s Technicals Suggesting?

Silver had a massive run from the lows of $15.83 to $21.22. No markets rise vertically, a 50% Fibonacci correction is a healthy and accepted norm. As seen in the charts below, silver too has corrected 50% of the recent rise.

The weaker hands are out of silver, whereas, the stronger hands have bought the white metal at lower levels. Silver is currently trading above both the 20 – day and the 50-day exponential moving average. This is a sign that it has resumed its uptrend, and is set to rally higher.

Once silver crosses above the highs of $21/oz, it should reach its target of $25/oz.

Conclusion

As Bill Gross says, the world markets are being manipulated by the Central Banks. Consequently, investing is becoming a difficult proposition. You need the help and support of an expert with an edge to invest at the right time and to be positioned propertly for when high volatility strikes.

Until volatility picks up we can only focus on short-term extreme oversol/overbought markets for opportunities. Keep watching this space and subscribe our services to get the maximum benefit of timely advice to buy and sell silver and various other asset classes.

If you want to follow my lead as I swing trade and invest long-term using ETFs join me at www.TheGoldAndOilGuy.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.