You Didn’t See This Bubble Burst Coming

Commodities / Agricultural Commodities Sep 13, 2016 - 01:50 PM GMTBy: Harry_Dent

I keep saying that in the next great crash, everything will get swept up in the onslaught – with virtually no exceptions.

I keep saying that in the next great crash, everything will get swept up in the onslaught – with virtually no exceptions.

And that goes too for what we eat!

The 30-Year Commodity Cycle peaked in mid-2008 and has been the first major bubble to crash and burn.

The CRB (Commodity) Index has been down as low as 67%, with the potential for 74% or lower in the next few years.

Among individual commodities, oil has been down as much as 82% in early 2016. It looks set to revisit its late 2011 low – $18, or down 88%. And meanwhile, iron ore and steel have been down 76% with a potential for 88%.

That all goes without saying. When my Commodity Cycle turns down, these are all likely to follow. And the commodity bubble proves that when bubbles burst, they don’t just correct in a gentlemanly manner – they crash and burn so that the downside is more like 80%, not 50% as in more normal, long-term corrections.

That said… I would have thought the last thing people would do in tough times is eat less!

The biggest surprise in the commodity crash to me has been that even agricultural commodities like corn have crashed. It’s down 62% with a potential for 70%-plus.

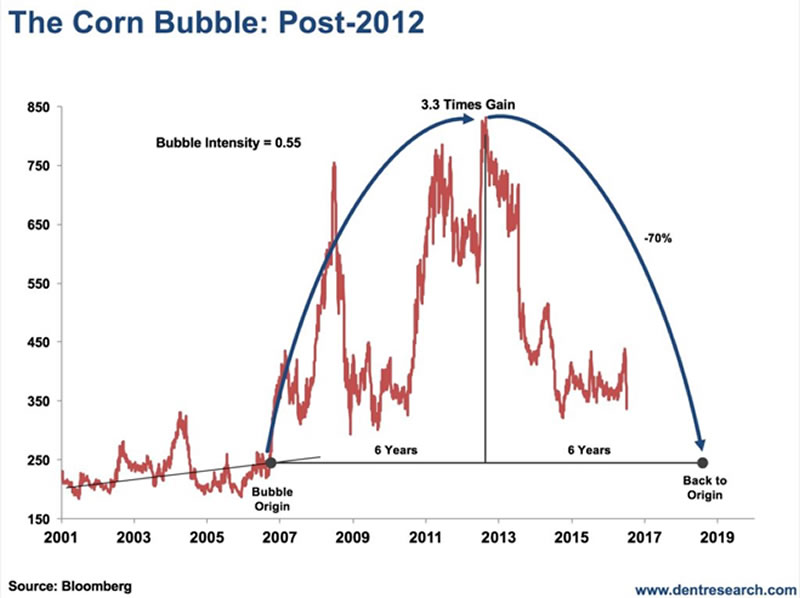

Look at the chart on corn:

It’s dropped from a high of $832 in late 2012 to $318 recently!

Corn is literally everywhere. It goes in animal feed. It’s in our processed food. Cornstarch, corn syrup, ethanol… it’s everywhere. And it’s down across the board. Wheat has also fallen 61% and soybeans are down 52%.

But here’s the kicker…

You’d think with all these grains down so badly that the land they’re made on would be down as well.

But the thing is, they’re not…

Yet.

Farmland is still near its highs in many areas. In states like Indiana, Illinois and Ohio, farmland prices are still strong due to the upward pressure of suburban sprawl.

But the one state that has little suburban sprawl is Iowa, and corn is its biggest crop by far. I would know – I’ve been there several times. It seems to have more corn than people and produces more of it than most countries!

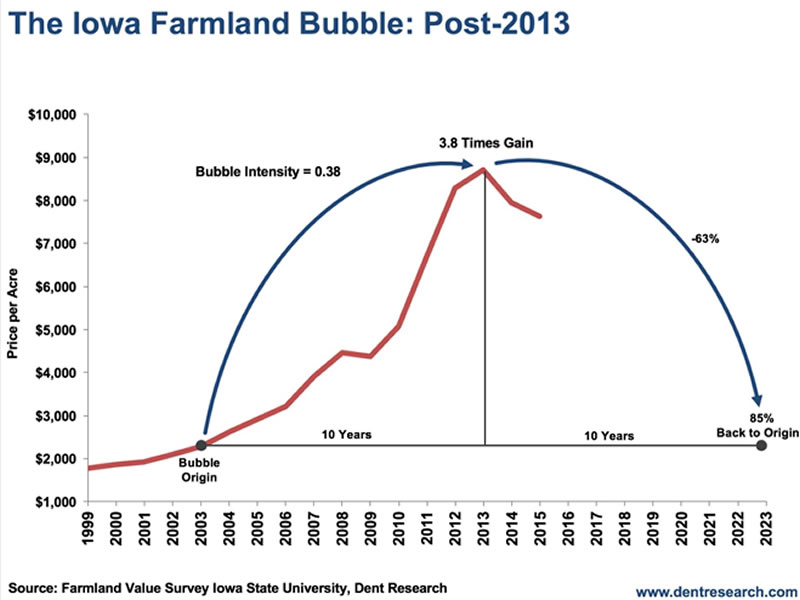

For that reason, it’s the purest state to get a feel for the farmland bubble. And the forecast isn’t pretty:

Farmland there has only fallen about 12% so far. It peaked shortly after corn in early 2013 at $8,716 per acre.

But before all’s said and done, I could see Iowa farmland crashing 63% when it bottoms out around early 2023. In general, real estate tends to fall back 85% towards its Bubble Origin as opposed to 100% in stocks and commodities.

And believe me – farmland will catch up to corn and continually lower agriculture prices in general. Whereas stocks typically crash in half the time it took for the bubble to build, commodities and real estate tend to take just as long to crash as they do to build. But the coming second and broader real estate crash will likely be what drives it over the ledge.

It’s what I’ve been saying for years: given enough time, bubbles always burst. Still, when I warn that major bubbles will crash some 63% – or more like 80% in most cases – people act like it just isn’t possible.

It’s simply because most people don’t understand bubbles! And that’s why I’ve written a new book on them.

This new book – The Sale of a Lifetime – is dedicated to documenting and explaining bubbles so there’s no excuse for being blindsided by them when they burst.

And bubbles. Always. Burst.

In the case of farmland, the chart above shows that there was indeed a bubble that took 10 years to build from early 2013. It wasn’t as steep as most residential bubbles around the world and only had a bubble intensity of 0.38 – more average for a real estate bubble.

But still high enough to trigger a 63% crash.

Again, this particular bubble peaked in early 2013. Since it took 10 years to build, it’ll take another 10 or so to burst – meaning we’ve still got about six or seven years to go with this one!

And you heard it here first!

The whole point of my new book is that bubbles are not black swan events. They are, in fact, highly predictable. Farmland may hold up a bit better than commercial and residential real estate, but it’s going down with everything else.

Once it does, farmers and investors should look for “the sale of a lifetime” in farmland around early 2023, and possibly earlier.

My book will be released next Thursday. You’ll find it on Amazon. Be sure to grab your copy.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.