BlackStone Group Says The Stock Market Is The Most Treacherous They Have Seen

Stock-Markets / Stock Markets 2016 Sep 29, 2016 - 12:41 PM GMTBy: Jeff_Berwick

There has rarely ever been another time like this.

There has rarely ever been another time like this.

Not since 1999 and not since 1929 before that, have so many billionaires, central banksters, financial elites and fund managers, warned that we are on the verge of a catastrophic bust.

And now, Joe Baratta, Blackstone Group LP’s top private equity deal maker, admits at a WSJ conference this week, “You have historically high multiples of cash flows, low yields. I’ve never seen it in my career. It’s the most treacherous moment.”

The most treacherous moment!

Rarely before have we seen the US stock market at near record highs with so many people warning it is about to burst…and the last two ended with catastrophic busts. And now we have another multi-billion dollar fund manager calling now the “most treacherous moment”.

In a recent Bloomberg interview where Blackwater’s president Tony James made a point to express his support for Hillary Clinton, he also mentioned that the firm is currently offloading more than it’s buying. He said, “We are net sellers on most things right now — prices are high,” he continued, “Interest rates are so low and there’s so much capital sloshing around the world.”

Now, as we near the end of the Jubilee Year, we have had a flood of big name money people coming out and warning that we are in, “unchartered territory”, as Jacob Rothschild said. Or, on the verge of a crash of “biblical proportions” as Jim Rogers said this summer.

Normally, when you see so many people expecting something, we run the other way. But, that’s just how crazy this entire financial and monetary system has gotten, that almost everybody can see it is just plain, unsustainable and so far outside of the bounds of normalcy, that many people like Blackstone, don’t even know what to do.

Yet, the US stock markets continue to sit near record highs as nearly everyone is frozen like a deer in headlights.

The economy is in dreadful shape and the Federal Reserve still can’t bring itself to raise rates even 0.25% for fear it will collapse the entire worldwide financial system. Or, they are waiting until just the right time to do so, is our guess.

Many are looking scaredly out of their Wall Street high-rise windows, wondering what is going to be this crash’s Lehman Brothers that sets it all off.

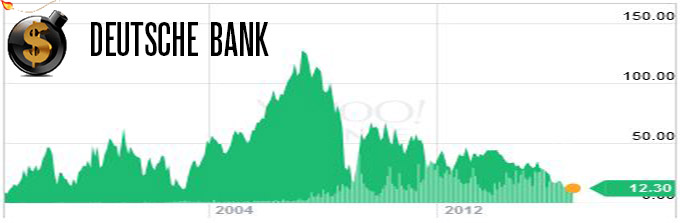

We said a year ago that Deutsche Bank should sit near the top of the giant list of black swans.

And it looks like we were right again with many now calling it the next Lehman Brothers. Angela Merkel has even said that if the bank were to fail, “there could be no government bailout”.

Merkel and the financial elites know full well that neglecting to bail out a giant like Deutsche will likely lead to a chain reaction of bank failures – something they want to see happen.

The Jubilee is a time of washing away and it’s a prerequisite for global governance. Commercial banks, and regional/national central banks need to fail to some degree in order for them to be pointed to as the problem. Once the blame is pinned to them, a solution involving a single world bank that issues a single world currency will be suggested as an alternative. This problem, reaction, solution, methodology, is used over and over by the globalists, it’s called the Hegelian Dialectic.

John Maynard Keynes was one of the first to suggest such a one world currency which he called the “bancor”. Keynes was also a member of a secret society called the Fabians who championed a wolf in sheep’s clothing as their “mascot” – something that further proves the malevolence associated with this agenda.

Many people have trouble following all of this market manipulation, especially because everything being done is so erratic. But the elite’s actions are purposely chaotic because their sole intent is to destabilize.

At the Dollar Vigilante we watch and follow the elite’s every move like hawks. It’s this kind of discipline that has allowed our senior analyst Ed Bugos to make phenomenal portfolio recommendations, some of which have earned over 4500%! Collectively, our overall holdings are up around 200% in the last year thanks to his expertise.

It’s not too late to capitalize on this chaos though! In fact, we believe it’s just getting started.

Subscribe to TDV to get up to date investment and geopolitical insights regularly.

When you become a member, you’ll gain access to exclusive stock picks as well as a swath of invaluable information to help you and your family survive and prosper through these treacherous financial times.

Our next issue is coming out this weekend and will be the last issue before the end of the Jubilee Year. And, it will only get more chaotic from there.

Make sure you have access to some of the best analysis in the world from TDV, the fastest growing financial newsletter in the world.

Don’t be a victim, be a profiteer.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.