Why Nervous Pensioners Are Running for the Exit

Personal_Finance / Pensions & Retirement Oct 01, 2016 - 01:02 PM GMTBy: EWI

The Dallas pension system embraces risk with alternative assets

The Dallas pension system embraces risk with alternative assets

[Editor's Note: The text version of the story is below.]

The alarm over U.S. public pension shortfalls grows louder, which brings to mind this prescient comment from Robert Prechter's 2002 book, Conquer the Crash:

If you have a pension, you are almost surely dependent upon [securitized loans]. ... In a major economic downturn, this credit structure will implode.

And that's exactly what happened during the 2007-2009 "mortgage-meltdown." Large banks had taken out home loans made by retail banks and mortgage brokers and resold them to others. As we know, too many of those loans were bad, and the result was the worst financial crisis since the Great Depression.

Many public pension funds have yet to recover, even after a prolonged stock market uptrend.

Our July Elliott Wave Financial Forecast said:

Many pension fund assets are far more precariously positioned today than they were before the 2007-2009 bear market. Losses are already mounting.

The publication mentions that the funding gap for public pensions in 2012 was $1.83 trillion. Today, it's an astounding $3.4 trillion, almost twice as large.

A big part of the public pension problem is low yields.

The September Financial Forecast elaborates on how one pension system has ramped up risk to compensate:

The Dallas pension system now has more than half of its assets in alternate investments such as homes in Hawaii, a Napa Valley vineyard, an apartment tower in Dallas and a stake in the American Idol production company. In 2010, Money Management Letter cited the Dallas plan as "one of the best-diversified funds in the U.S." Six years later, Idol is off the air and the Dallas pension system is the prime exemplar of the danger of diversification in search of higher returns.

Less than a month after the September Financial Forecast published, we learn that financial fear is running rampant among Dallas pensioners.

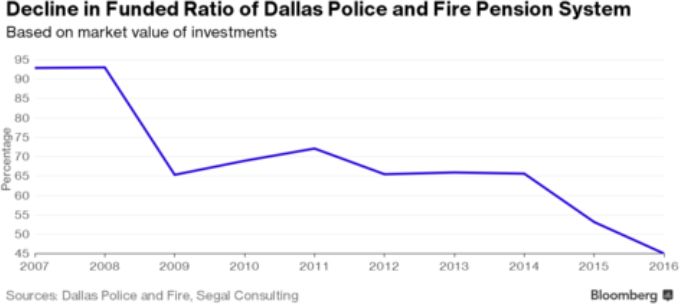

On Sept. 27, Bloomberg showed this chart and said:

Dallas's police and firefighters are quitting in droves, wagering that financial-market losses are about to render their promised pensions too good to be true.

With the city considering benefit cuts to help close a retirement-fund shortfall that grew by $1.2 billion last year, more than 200 workers have decided to retire or leave, about double the normal rate. ...

The public-safety system has just 45 percent of the assets it needs to cover benefits, down from 64 percent at the end of 2014 and half what it was a decade ago.

Other public pension funds are also in trouble, including the nation's largest.

The California Public Employees' Retirement System (Calpers) returned only 0.6% on its investments through the year ended June 30. It was the worst performance since the bear market ended in 2009. This is far below the 7½% that Calpers needs to meet its existing obligations.

One can only imagine the pension fund scenario when financial markets go into another full retreat.

This valuable free resource includes 8 lessons on topics critical to your financial survival, from Bob Prechter's New York Times best-selling book. You'll learn what to do with your pension plan, what to do if you run a business, how to handle calling in loans, paying off debt and so much more. Learn more and get your free 8 lessons here.

|

Get Your 8-Lesson "Conquer the Crash" Collection Now This valuable free resource includes 8 lessons on topics critical to your financial survival, from Bob Prechter's New York Times best-selling book. You'll learn what to do with your pension plan, what to do if you run a business, how to handle calling in loans, paying off debt and so much more. |

This article was syndicated by Elliott Wave International and was originally published under the headline Why Nervous Pensioners Are Running for the Exit. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.