Gold Buying ‘Opportunity’ After Surprise 3.4% Drop

Commodities / Gold and Silver 2016 Oct 05, 2016 - 03:46 PM GMTBy: GoldCore

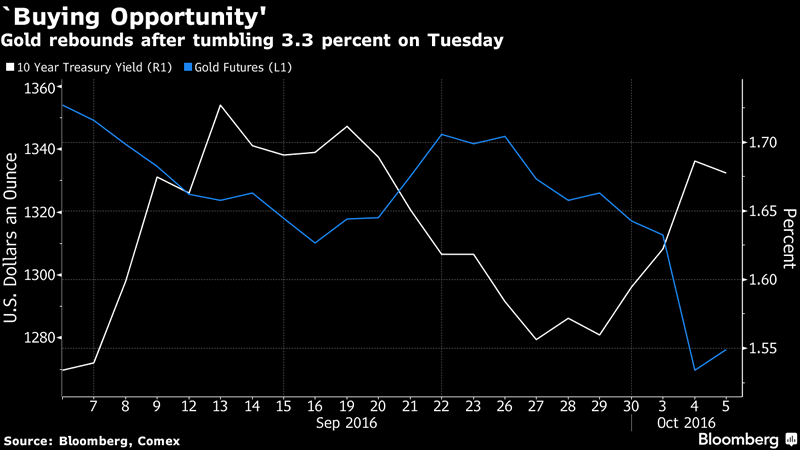

“Gold rebounded after the biggest drop in more than a year as investors reminded themselves of a world that’s beset by risk, from the prospect of further currency weakness to the final stretch of the U.S. presidential election,” according to Bloomberg today.

“Gold rebounded after the biggest drop in more than a year as investors reminded themselves of a world that’s beset by risk, from the prospect of further currency weakness to the final stretch of the U.S. presidential election,” according to Bloomberg today.

As Investors See World Beset by Risk, Gold Rebounds From Tumble (Bloomberg)

Gold fell by 3.4% to $1,268.70, while silver fell by even more and was down 5.1% to as low as $17.73/oz. Gold was also down by more than 3% versus the euro and sterling gold was also down 3% as the beleaguered pound had a temporary reprieve.

The sudden sell off was peculiar and it surprised analysts. It began at exactly 1200 British Standard Time (BST) just as U.S. markets opened and concerted and continuous ‘paper or electronic’ futures gold selling continued throughout U.S. trading hours, despite no data of importance, nor corresponding sharp moves in fx markets, energy and the oil market, nor indeed in stock markets. Indeed Asian and European indices were higher overnight. U.S. indices were higher at the start of the day too and then saw very gradual declines in the course of the day.

The sharp losses for gold and silver were attributed to a renewed “taper tantrum” and angst about central banks potentially rising interest rates and the indeed the ECB potentially tapering their massive QE programme. Indeed, these concerns are being blamed for European and emerging market stock indices falling today. However, the Bloomberg report which is being blamed for the falls, was not confirmed. It reported that the ECB will “probably” gradually wind down bond purchases before the possible conclusion of quantitative easing. The report was from anonymous “euro-zone central-bank officials”.

As ever, it is best to ignore Fed, ECB and other central bank “jaw boning.” It has been shown to be mere noise over the years. Rather it is important to focus on the fundamentals of the global economy which is poor and deteriorating. With obvious ramifications for increasingly casino like global financial markets and risk assets such as stocks and bonds. Conversely, the fundamentals of the gold market are positive, arguably increasingly so.

The price falls came despite strong technicals and fundamentals which have led to the 20% plus gains seen in gold this year. There are indeed new positive factors in the gold market that have materialised in recent weeks and months as gold and silver consolidated in Q3. These include

i) Brexit and the risks this posed to the EU economy and the EU itself

ii) European banks remaining extremely fragile. Not just Italian and periphery nation European banks but also core Germany’s bank Commerzbank and Deutsche Bank all of which heightens the risk of contagion in the EU. Credit Suisse in Switzerland is another systemic bank

iii) Finally, the political situation is the U.S. is as fractious and uncertain and there are two of the worst Presidential candidates in U.S. history whose economic policies and foreign policies are concerning

iv) Increasing and very robust investment demand globally – especially in western markets and especially from smart money high net worth and institutional buyers including the Rothchilds, Blackrock Inc and Munich Re.

“It’s a buying opportunity,” Bob Takai, chief executive officer and president of Sumitomo Corp. Global Research Co., said from Tokyo. Uncertainty about “the European currency, uncertainty about the sterling pound, all these things point to the direction that gold is going to be favored” he told Bloomberg.

Smart money traders, investors and value bullion buyers are buying gold and are using the price falls to accumulate on the dip. GoldCore has seen one of the busiest days trading on our online bullion platform since Brexit.

As we have covered in recent months, the smart and prudent retail, company, family office, HNW, pension, hedge fund and institutional money is aware of the real risks of a new global financial crisis and continues to diversify into gold.

Gold Prices (LBMA AM)

05Oct: USD 1,274.00, GBP 1,001.11 & EUR 1,134.37 per ounce

04Oct: USD 1,309.15, GBP 1,026.90 & EUR 1,172.21 per ounce

03Oct: USD 1,318.65, GBP 1,023.40 & EUR 1,173.99 per ounce

30Sep: USD 1,327.90, GBP 1,025.01 & EUR 1,187.67 per ounce

29Sep: USD 1,320.85, GBP 1,016.92 & EUR 1,177.14 per ounce

28Sep: USD 1,324.80, GBP 1,020.10 & EUR 1,181.06 per ounce

27Sep: USD 1,335.85, GBP 1,031.01 & EUR 1,187.84 per ounce

Silver Prices (LBMA)

05Oct: USD 17.80, GBP 13.99 & EUR 15.86 per ounce

04Oct: USD 18.74, GBP 14.68 & EUR 16.78 per ounce

03Oct: USD 19.18, GBP 14.89 & EUR 17.07 per ounce

30Sep: USD 19.35, GBP 14.92 & EUR 17.33 per ounce

29Sep: USD 19.01, GBP 14.61 & EUR 16.95 per ounce

28Sep: USD 19.12, GBP 14.69 & EUR 17.05 per ounce

27Sep: USD 19.42, GBP 14.99 & EUR 17.26 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.