Gold’s Second Waterfall Drop this Week

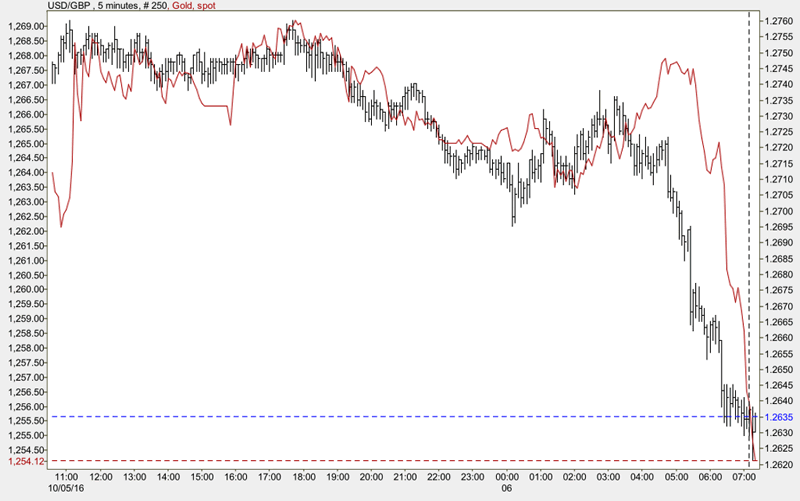

Commodities / Gold and Silver 2016 Oct 06, 2016 - 06:38 PM GMTWe do not often find ourselves jogging the same track as the redoubtable Dennis Gartman who commands untold premiums for his advice, but now, it seems, he is verifying our suspicion of two days ago (Please see “Gold’s waterfall drop might be associated with the big drop in British sterling”) that something is amiss in London gold trading circles. Here is today’s chart – a second waterfall move in the gold market coincident with a second swan dive for the pound and Gartman’s take (snipped from ZeroHedge).

My first instinct was that the paper gold liquidations in London “could be part of a scramble for liquidity among big banks.” Gartman blames it on one “massive” hedge fund. . . .Don’t know if he has an inside track on that or an educated guess, but for now we will stick with “the banks” – more precisely the trading banks who were long the metal on paper up until now.

Says Gartman:

“As for gold and the other precious metals they remain rather obviously weak and as we move away from Tuesday’s collapse it appears more and more that this was a forced liquidation on the part of a large… actually a massive… hedge fund out of London. The sheer panic that swept through the gold market then really hadn’t the look of a sell off predicated upon a rumoured push by the ECB to curtail its purchases of sovereign debt securities, nor had it the look of a rush on the part of hedgers in the gold mining industry to hedge forward production. Rather it had the look of forced margin-clerk liquidation. It looked like panic on the part of someone, somewhere who had lost control of the situation.”

Another waterfall later, it looks like the Gartman’s culprit should be pluralized, unless the single fund’s positions are so deep that it will need more than one trading session to get liquid. But that doesn’t make a lot of sense, nor does it speak highly of the fund’s chief trader, if it is indeed one big fund doing the damage. Why set yourself up for lower prices on your second foray when the trade could have been implemented in one fell swoop? We may find out the details at some point down the road, but it is doubtful. Stuff hidden in the bushes in London tends to stay in the bushes unless something forces it out.

The key point is that, if these waterfalls represent forced liquidations to meet obligations elsewhere, the selling will be limited to the positions on the books of whatever entities need the capital. In short, they are likely to come to an abrupt end.

Meanwhile, as the World Gold Council reports this morning, China is out of the game for the week on holiday so gold’s standing buyer won’t be back in the game until next week. When they get back, it they sense opportunity, they will use this downside and put a call on the market for more physical metal. If that happens, we could get a quick reversal. As we have reported here copiously there still isn’t enogh physical metal available to meet a big surge in physical demand and the buy orders won’t be met if the price is not high enough.

We go along with the World Gold Council and others who have deemed the current situation a buying opportunity, particularly for physical buyers who can weather any further downside. In the past snapback rallies under similar conditions have been sharp and robust. We can report strong volumes at USAGOLD in both gold and silver over the past few days – not at the best-of-the-year levels reported by some of our British counterparts, but notable nevertheless. Americans are not as directly affected, but they know attractive pricing when they see it. MK

If this type of gold-based analysis interests you, you might want to take a look at the October issue of News & Views – Forecasts, Commentary & Analysis on the Economy and Precious Metals, we invite to subscribe at our registration page. There is no charge for the service and your participation is welcome.

In this edition, we cover Deutsche Bank’s troubles and their potential effects on the gold market, Russia’s important policy of gold accumulation for its national treasury, the surprising strength in the silver ETFs, an interesting piece on the long term evolution of the gold market and some background on what a prominent member of the Council on Foreign Relations thinks about gold (Titled “An enlightened minority”). We think you will also gain from this issue’s Chart of the Month on gold under varying longer-term interest rate circumstances.

We invite your interest. . . . . . . . .

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.