The Twists and Turns of the Greenback

Currencies / US Dollar Oct 27, 2016 - 05:41 PM GMTBy: Steve_H_Hanke

At a monetary conference in Vienna back in 2014, the distinguished Frenchman, friend, and occasional collaborator Jacques de Larosière proclaimed that the current world monetary order should be termed an “anti-system.” He has a point – an important point. Among other things, such an anti-system invites an enormous amount of instability, as well as uninformed loose talk that influences public opinion and policy.

At a monetary conference in Vienna back in 2014, the distinguished Frenchman, friend, and occasional collaborator Jacques de Larosière proclaimed that the current world monetary order should be termed an “anti-system.” He has a point – an important point. Among other things, such an anti-system invites an enormous amount of instability, as well as uninformed loose talk that influences public opinion and policy.

The Chinese yuan has been at the center of much of the recent misinformation and disinformation about currencies. During the first presidential debate between Donald Trump and Hillary Clinton, Trump fingered China as the world’s best practitioner of currency devaluations – devaluations that Trump claims power China’s exports. Clinton didn’t object to Trump’s thesis. Indeed, she boarded the same train.

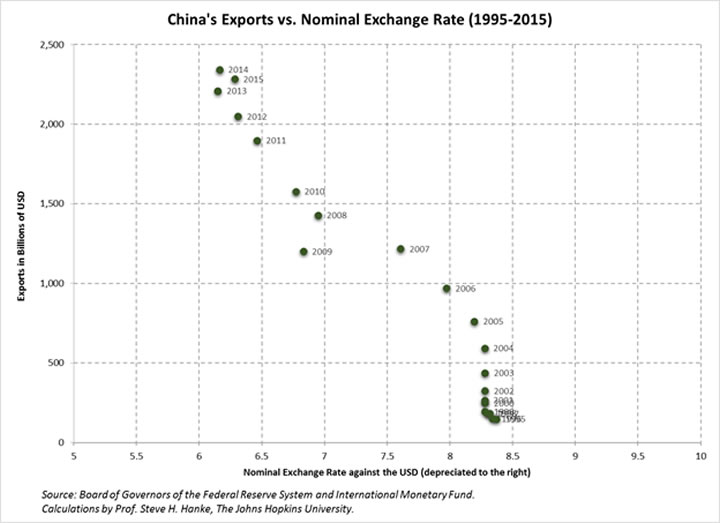

The facts are that Chinese exports have steadily risen since 1995, but they have not been powered by a depreciating yuan. In fact, the yuan has slightly appreciated in both nominal and real terms. The accompanying chart tells that story.

So, what was said about the yuan during the debate is untrue. But, that yuan story is not a debate slip. It is disinformation spread by unions, mercantilist of all stripes, and politicians: Republicans and Democrats alike.

Shortly after the first presidential debate, the yuan entered the International Monetary Fund’s Special Drawing Right (SDR) basket of top-tier currencies. With that, the Chinese boasted that the yuan was now in the same league as the other SDR currencies: USD, euro, Japanese yen, and the British pound. As part of China’s yuan promotion campaign, it declared that the yuan would be a serious challenger to the greenback as the world’s premier currency. While the yuan’s international use has grown rapidly, it started with a base of zero.

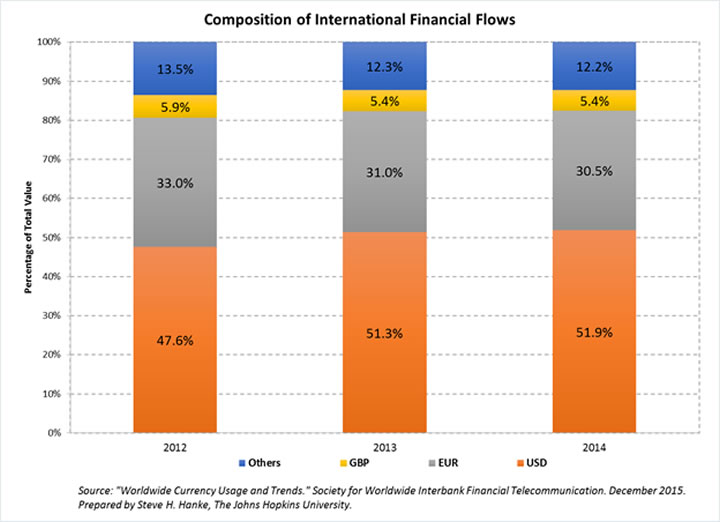

The dollar is King, and when it comes to currencies, Kings are difficult to dethrone. Even after the introduction of the euro in 1999, the USD has maintained its top spot as the currency held as official reserves, accounting for 63 percent of the total. When it comes to foreign exchange trading, the dollar is even more dominant, accounting for almost 88 percent of the turnover. Dollar notes are widely used internationally, too, with as much as two-thirds of all the greenbacks in circulation circulating overseas. In terms of the transactions handled by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the outfit that moves “money” among banks, the U.S. dollar has increased its dominance over the past few years, accounting for almost 52 percent of the total transactions (see the accompanying chart).

As with the introduction of the euro, claims that the yuan will dethrone the King are off the mark. For the past three millennia, there has always been a dominant world currency, and it’s very hard to challenge the King. This is evidenced by the longevity of dominant currencies. On average, they’ve reigned for 300 years. This would suggest that the U.S. dollar, unless the U.S. government makes a big mistake or a new disruption technology enters the stage, is probably going to be on the throne a while longer. Why?

To answer that question, we borrow from the work of Nobelist Robert Mundell. In Mundell’s study of the world’s dominant currencies over the past three millennia, he found that there was always one currency that dominated, and that the following five characteristics were associated with each dominant currency:

- The transactions domain was large. On this score, the U.S. clearly qualifies. Until recently, it has been the world’s largest economy measured on a purchasing power parity basis. Today, its GDP accounts for 16.1 percent of the world’s total. China has recently surpassed the U.S. on that measure, with 16.9 percent of the total, and the Eurozone has 11.9 percent. So, in terms of their transaction zones, both the yuan and the euro could challenge the greenback.

- Monetary policy inspired confidence. No currency ever survived as a top international currency with a high rate of inflation or with a recurring risk of debasement or devaluation. So, unless there are significant U.S. monetary policy mistakes, challengers will face a Sisyphean task.

- Exchange controls were absent. Exchange controls, such as those in China, are always a sign of weakness, not strength. Controls alone eliminate the Chinese yuan as a challenger to the greenback’s dominance. This explains why China is working to remove controls. It is worth stressing that one of the areas where the U.S. dollar is becoming increasingly vulnerable to a challenge is the area of sanctions (read: restrictions), which the U.S. government imposes on the use of the greenback. Financial sanctions – which have been inspired by an aggressive, interventionist, neoconservative philosophy – are used by the U.S. and are administered as weapons of war by the Office of Foreign Asset Control at the U.S. Treasury (OFAC). Paradoxically, the OFAC is waging war on the U.S. dollar. Gone are the days when George Washington, in the middle of the U.S. Revolutionary War, could draw on his account at the Bank of England.

Related to exchange controls are other types of restrictions that can be placed on how people can spend and transfer the money they own. One way to restrict the use of a modern currency is to abolish it. That is just what Harvard Professor Kenneth Rogoff has proposed in his new book The Curse of Cash, which was recently published by Princeton University Press. And Rogoff is not alone. Another Harvard Professor, former U.S. Treasury Secretary Larry Summers, and Prof. Narayana Kocherlakota, who was formerly the president of the Federal Reserve Bank of Minneapolis, have also advocated moving away from greenback cash. Such a move would open the gates for a challenge to King dollar.

- Strong international currencies have always been linked to strong states. States that can defend themselves against external and internal enemies. This is a security-stability factor.

- Until the world entered the age of complete fiat currencies, all the dominant currencies had a fallback factor. They were all convertible into gold or silver. So, today’s currencies, being fiat currencies, have no fallback factor, and all are vulnerable to a challenge. Perhaps a new disruptive technology will allow for the production and efficient use of a private currency with a fallback factor. Such a currency, if deemed to be legal, could mount a challenge to the King.

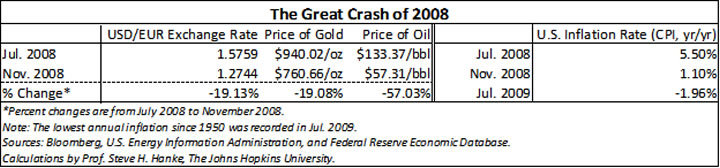

When viewing the twists and turns of the greenback in Jacque de Larosière’s anti-system, there is no better place to start than the Great Crash of 2008. The accompanying chart shows that the USD/€ exchange rate – the world’s most important price – fell a stunning 19.13 percent over a brief four month period. Linked to the soaring dollar, two other important prices, gold and oil, collapsed by 19.08 and 57.03 percent, respectively. Not surprisingly, the annual inflation rate in the U.S. moved from an alarming rate of 5.5 percent in July to an outright deflation of -1.96 percent a year later. Contrary to the Federal Reserve’s claims, the dance of the dollar and related changes in commodity prices and the level of inflation indicated that monetary policy was way too tight in late 2008. This caused massive instability that we still haven’t fully recovered from.

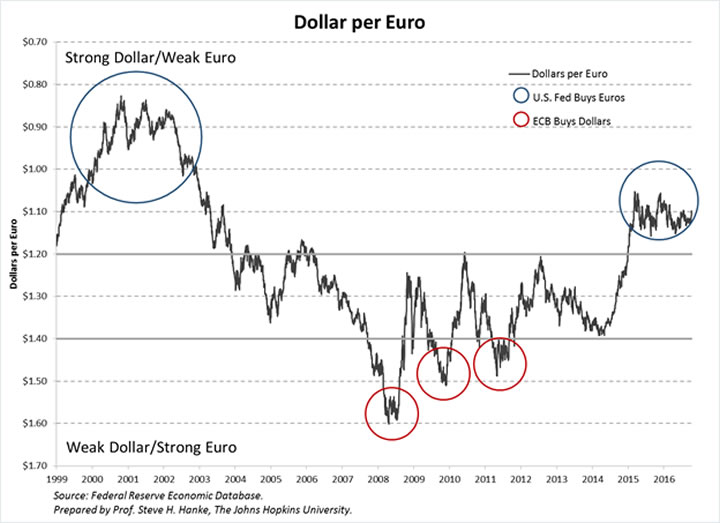

What can be done to reduce the instability in the current anti-system and mitigate the damage caused by the twists and turns of King dollar? The world’s two most important currencies – the dollar and the euro – should, via formal agreement, trade in a zone ($1.20 - $1.40 to the euro, for example). The European Central Bank would be obliged to maintain this zone of stability by defending a weak dollar via dollar purchases. Likewise, the Fed would be obliged to defend a weak euro by purchasing euros. Just what would have happened under such a system (counterfactually) since the introduction of the euro in 1999 is depicted in the accompanying chart.

Stability might not be everything, but everything is nothing without stability.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2016 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.