What's Next for Crude Oil; Higher Prices or Crash

Commodities / Crude Oil Oct 28, 2016 - 04:51 PM GMTBy: Sol_Palha

"If the doors of perception were cleansed everything would appear to man as it is, infinite. For man has closed himself up, till he sees all things thru chinks of his cavern." ~ William Blake

2016 started with all the Drs of Gloom stating that oil was heading lower and many even predicted that it would trade down to $10.00. It was kind of interesting to watch this circus as there is a saying the cure for low prices is usually low prices. It would have made sense to take a firm stance against oil when it was trading above $100, but not when it was trading in the $30.00 ranges. These same experts were busy proclaiming higher prices when oil was trading north of $100.00. Only when oil was close to putting in a bottom, did they muster the courage to issue even lower prices; they would have been well served by simply keeping quiet. Experts were all trying to outdo each other; each one is releasing lower prices and a gloomier scenario. Here are some examples of the stories being put out at the time:

Get Ready for $10 Oil: Bloomberg on Feb 2016

Oil could crash to $10 a barrel, warn investment bank bears: telegraph.co.uk on Jan 2016

Oil Seen Heading to $20 by Morgan Stanley on Dollar Strength: Bloomberg on Jan 2016

Goldman Sees Risk of Oil Below $20: Bloomberg Feb 2016

At that point, we knew that a bottom was close at hand and on the 20th of January, 2016 we penned the first of many articles on oil. This is what we said back in Jan:

As it has closed below the psychological level of $30 on a weekly basis, it is likely it will experience one more downward wave before a tradable bottom is in place. A move to the $23-$25 ranges is now a strong possibility, and as long as oil does not close below $23.00 on a weekly basis, oil will start putting in a slow bottoming formation. Once a bottom is in, do not expect miracles from oil, trading will probably be limited to a tight range of $24.00-$36.00 for some time. Only a monthly close above $40 will signal that the trading range is going to shift to a slightly higher zone of $36.00-$58.00 with a possible overshoot to $65.00. Full Story

It is remarkable how these so-called experts always start to clamour and make the most noise when a market is either going to top or bottom. It would be fine if the advice they offered were of value, but they seem to tell you to buy when it is time to sell and sell when it is time to buy. In other words, their advice is usually on par with rubbish.

Marketwatch.com jumped the gun when they penned the following article

Why oil prices will head back toward $20 next winter: Market watch May 2016

Now that oil is trending upwards; we won't be surprised if articles calling for oil $100 start to surface again.

Oil traded as low as 26.14 and then reversed course and started to trend higher. It came within $1 of the top of our suggested targets. We also stated that oil needed to trade above $40.00 on a monthly basis which it has done. It's now on course for a test of the $55.00-$58.00 ranges, with a possible overshoot to the $60.00 ranges. Fulfilling what we stated in an article titled Mass Psychology predicted crude oil bottom 2016 that was published in March of 2016; an excerpt of this article is listed below:

Notice that the $30.00 price point level has held on a monthly basis. Oil has not closed below this important level on a monthly basis for two months in a row, and this has to be viewed a very bullish development. Our overall view is for crude oil to trend higher with the possibility of trading past the $55.00 ranges. In the face of extreme negativity, oil is reversing, just as it collapsed in the face of Euphoria. A weekly close above 35.00 will set the foundation for oil to trade past the main downtrend line and in doing so send the first signal for a move to the $50 plus ranges.

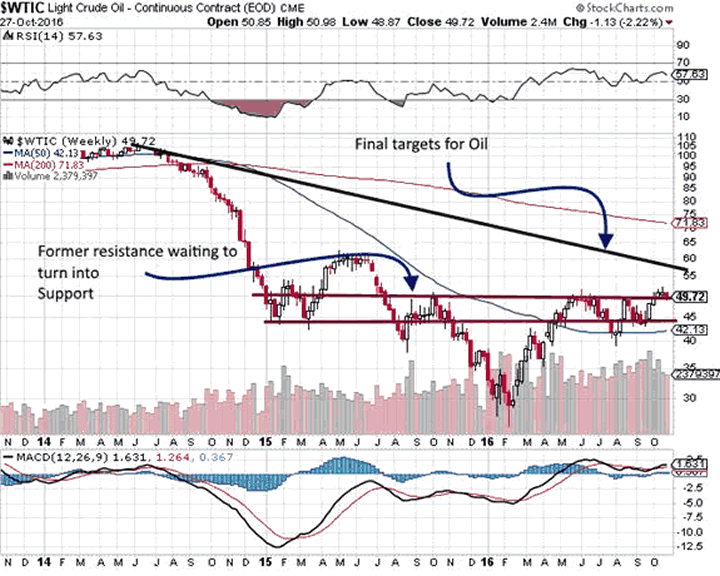

Now that oil has traded as high as $52.22, what does the future hold for oil? Is it going to reverse and crash due to a stronger dollar as was the case with Gold or is it going to continue trending higher. Let's take a look at the charts.

We would like to start off by stating that the trend is still up, so all pullbacks have to be viewed through a bullish lens. We did not feel the same way about Gold, and we stated that early in the year that we did not expect much from Gold. That has panned out so far; as oil has buried gold regarding gains on a percentage basis.

Oil is now sitting on a zone of former resistance, and while the market is somewhat overbought, oil could still trend to our higher targets ($55.00-$58.00) without pulling back. For this to occur, oil cannot close below $49.00 on a weekly basis. A close below $49.00 on a weekly basis will result in a minor pullback to the $45.00 ranges. Long story short, oil either trades to the $55.00-$58.00 ranges from here with a possible overshoot to the $60.00 ranges or it pulls back to the $45.00 ranges before trading to the above-suggested targets. After oil trades to the $58.00 ranges, we do not expect much from it. After topping out we expect it to test the $45.00-$48.00 ranges.

Conclusion

The trend is still bullish, and until the higher end targets of $55.00-58.00 are hit, or the trend turns negative, all sharp pullbacks should be viewed through an optimistic lens. The trend is showing no signs of weakness so it would take a rather significant development for it change. As oil has traded as high as $52.00 the bulk of the upward move we projected earlier in the year is completed; all that is left is for the upper-end targets to be hit; after that oil is expected to trend lower slowly. We are not expecting a crash but a consolidation; we will examine the longer term outlook after crude oil tops out.

"Only in quiet waters things mirror themselves undistorted. Only in a quiet mind is adequate perception of the world." ~ Hans Margolius

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.