Stock Market Higher into Next Week Then...

Stock-Markets / Stock Markets 2016 Nov 11, 2016 - 02:47 PM GMTBy: Brad_Gudgeon

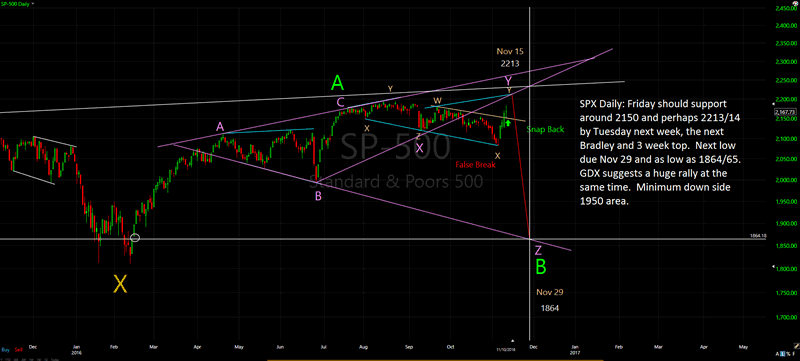

Last week, I mentioned that it was possible that Y of B could make a new high into next week then we go down hard. I had 2214 (or so) on the SPX as a maximum upward target and that could be the case by Tuesday next week.

Last week, I mentioned that it was possible that Y of B could make a new high into next week then we go down hard. I had 2214 (or so) on the SPX as a maximum upward target and that could be the case by Tuesday next week.

On Tuesday, at the close, we went short expecting a Trump victory and a plunge. Wow! The futures plummeted down about 100 and then came back with a vengeance! It sure caught us by surprise (the strong comeback, not the plunge).

There are some worrisome astro aspects ahead, especially around November 18th going into around November 29th. Firstly, we have a super moon on Monday near the 3 week cycle top next week in Taurus in the second house of money. This should represent a topping area. It is also a Bradley turn.

Secondly, as we approach OPEX (11/18), Mercury squares Neptune (dishonesty,chaos, New World Order [is this a conspiracy?]), then Neptune turns Stationary Direct on the 19th, which implies reversals of any attempt to rally. Mercury conjuncts Saturn on the November 23rd (fear). On the 24th of November (Thanksgiving), Jupiter squares Pluto (extremes, trouble, violence), then on the 25th Venus conjuncts Pluto (despair, destruction).

The Mercury (communicating) trine Uranus aspect (rebellion) of November 26th, looks like an exhaustion of sorts, so we may open down hard on the 28th. Venus squares Uranus (love of money), this may be the bottom or close. It is also a Bradley turn. The moon moves into Capricorn and out of Sagittarius on December 1, so any selling should be gone by the second of December at the latest.

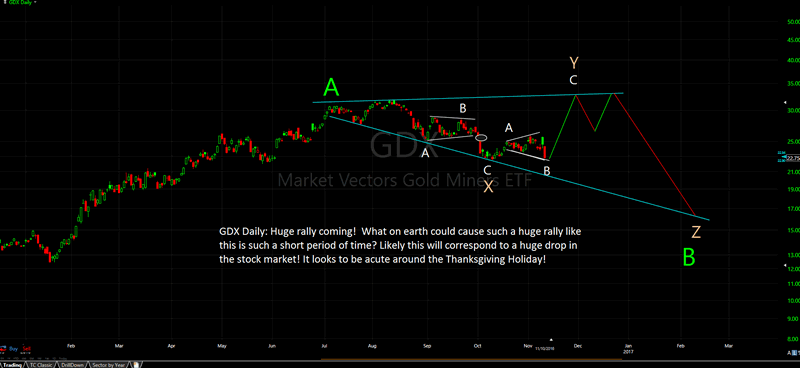

The charts of both the S&P 500 and GDX below show that we may see a huge plunge in the stock market and a huge rally in gold and the miners into the last week of November. Geocentric Mercury moves into Sagittarius on November 12 and ends on the 2nd of December. This implies huge moves in the gold complex. My read says BIG up from the November 11 into the end of November.

SPX Daily Chart

GDX Daily Chart

Could this be New World Order revenge coming? Has anyone noticed the Dow Industrial up over 200 today, with the SPX up only 4 and the NASDAQ 100 down almost 2%? This is a market headed for trouble, at least in the short term. Sounds like a test on the way.

Please do not trade my forecasts without a subscription. Remember, the forecast may change as information changes. That is why it is incumbent upon you to stay informed to those changes by having a subscription.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com.

Copyright 2016, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.