Copper - When the Pendulum Swings

Commodities / Copper Nov 18, 2016 - 04:09 AM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger equates the position of the financial markets to that of a protagonist in a classic horror story and reflects on recent moves in the copper market.

Precious metals expert Michael Ballanger equates the position of the financial markets to that of a protagonist in a classic horror story and reflects on recent moves in the copper market.

One of the greatest pastimes I enjoyed as a youth was reading books, and until adolescence, when I began to focus on history, my favorite reading genre was horror. Mary Shelley's "Frankenstein," Bram Stoker's "Dracula,” and "The Mummy" by Anne Rice were all books that resided in the bookshelf in our family room.

However, the author whose work always entranced me by the second or third chapter was Edgar Allen Poe, whose sense of the macabre was beyond any of the aforementioned authors. Tales and poems such as "The Fall of the House of Usher" and "The Raven" and "The Murders in the Rue Morgue" all went on to become magnificently campy Vincent Price venues, but the one book that used to captivate my morbid sense of obsession was "The Pit and the Pendulum," with particular fascination with Poe's description of the slowly descending path of the razor-sharp pendulum as it gradually approaches the captive's throat.

In my opinion, the world of global finance is similar in scope, danger and outcome to that of the poor religious dissenter who found himself at the bottom of that convex pit in Poe's masterpiece. The horrific levels of debt egregiously piled upon itself over and over and over again, whether to bail out the banking systems or to ensure an incumbent's reelection or to reverse flawed fiscal policies, has the fragility of the world lying prone in the pit with the pendulum of insolvency slowly descending.

The irony is that the eventual meeting of pendulum to throat—aka sovereign insolvency—can only be postponed by hyperinflation, otherwise known as currency debasement. With all of the post-election analysis spinning a "Dow 20,000!" narrative, infrastructure build-out designed to juice the number of jobs and increase the Labor Participation Rate can only be achieved by more credit creation, which is the counterfeiting of the national currency.

To lift the poor captive out of the pit and away from the pendulum will require negotiation, legislation and accommodation on all fronts, notwithstanding the fact that Mr. Trump has to get INAUGURATED first. And while we all await a wondrous and magical elixir to fix American unemployment, structural deficit and social division, the likes of which have not been seen since the mid-1800s, the pendulum slowly and deliberately descends. All of the financial commentators at CNBC and CNN are working at a feverish pace pitching the Trump KoolAid so they can make their benchmarks by year-end, and if it wasn't so tragic, it would be laughable.

Bond prices have been annihilated since the election, as the USD has screamed to par and beyond; mortgage rates in Canada and the U.S. have spiked; and the 10-year (U.S.) Treasury just traded north of 2.23%. The cost of borrowing is critical to the housing and construction industries. With the amount of overlevered homes in big cities around the planet (and particularly Canada), rising bond prices are NOT necessarily good for the banking business if the existing mortgage portfolio suddenly becomes default-ridden.

Speaking of banks, they have been charging since the election, and the excuse is that "they will capture the spread," meaning they will have a wider profit margin on their loan books. Well, excuse me for pointing this out, but even if we get three rate hikes in 2017 and the mortgage rate goes from 2% to 3%, that is still MINISCULE as compared to even ten years ago. What the banks have been doing is borrowing from the Fed at 0% to reinvest at 0.25%, so they effectively capture 0.25% of free money ("counterfeit fiat") paid back to them from the pockets of the American taxpayer.

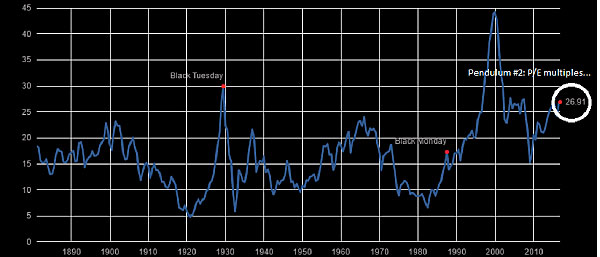

Interestingly, what this latest, interventionalist-induced stock market "Trump Rally" has done is move the Shiller P/E to the highest level since the dot.com bust in 2000, and to the same level it was at in the 2008 financial crisis. Stocks, my friends, no matter what your advisor tells you, no matter whether "infrastructure-related" or "trade war friendly" or "bankster-spread captures," are NOT cheap. There is only one reason P/Es are reaching escape velocity, and that would be because people are jettisoning cash (and they are). Every time there is a print above 25 in the Shiller P/E, Edgar Allen rolls over in his grave and the pendulum descends a little further.

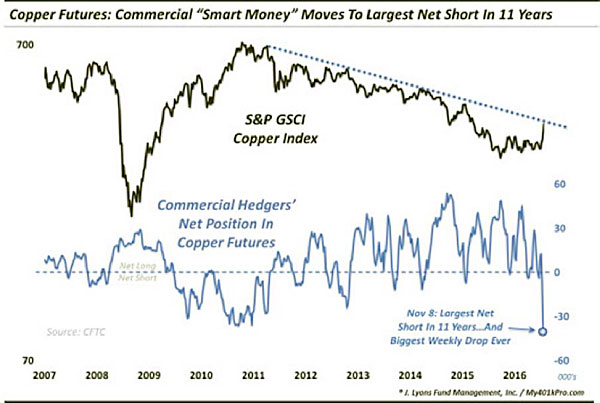

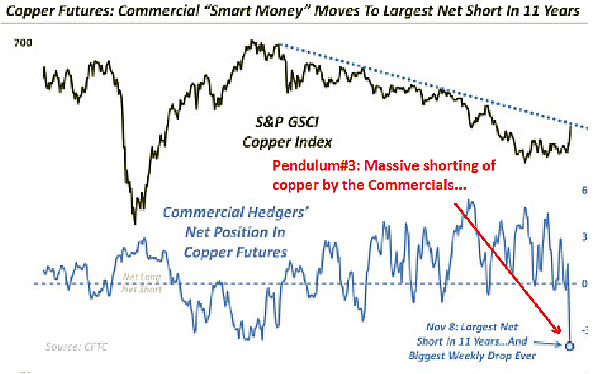

So, finally we see copper being "massaged" up to the big downtrend line, and cries from the rooftop of "Infrastructure!" resonate throughout the trading desks in London, New York, and of course, in Beijing, where massive speculative buying juiced the December futures to the long-term downtrend line, where it did a complete $.28/lb. reversal, putting in a massive engulfing candle, and has not seen daylight above $2.55/lb. since.

What really hit me was the COT for copper issued earlier in the week, where we just saw the single largest net increase over a reporting period EVER, at 31,000 contracts. The aggregate short position in copper is now 38,000, the largest since 2005. To put this into perspective, each copper contract is 25,000 lbs, so the increase into the spike to $2.78/lb was 775,000,000 lbs, or 351,000 metric tonnes.

From my reporting of the COT for gold, you know the track record for the banks that hedge production. Whoever increased those hedges certainly did not expect HIGHER prices, and this all occurred BEFORE the U.S. election. We shall see whether Dr. Copper earns his moniker. . .

As we move into the second full week of trading with the financial blogosphere crammed with Trump-nostications of all sorts and ilks, I simply await the moment in time that market participants wake up to the reality that the world is drowning in debt, sitting at the bottom of the pit staring up into the mortality of the descending pendulum. And by the way, in the book, the victim actually escapes from the pit only to be confronted with molten-hot walls converging inwardly, black-robed demons staring outwardly, faces afire. . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts and images courtesy of Michael Ballanger.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.