Trump’s Agenda Stacks the Odds in Gold’s Favor

Commodities / Gold and Silver 2016 Nov 18, 2016 - 04:51 PM GMTBy: John_Mauldin

"It's the economy, stupid."

"It's the economy, stupid."

This was the catch-phrase Bill Clinton’s campaign used in 1992 to help defeat George H.W. Bush. In this year’s presidential race, the slogan “Make America Great Again” branded the Trump campaign as a referendum against the economic policies of the current administration.

No matter the race—be it in local or national politics—the economy plays a crucial role in determining whether the incumbent party will retain office or relinquish it to another group.

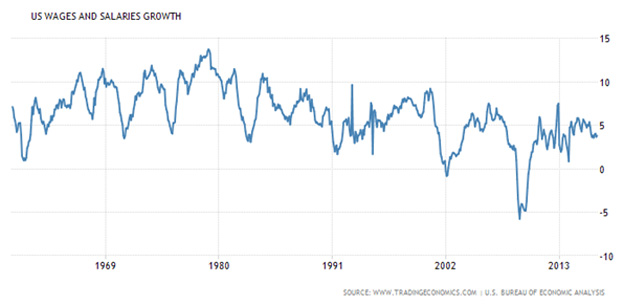

On Election Day, America voted for change amid years of tepid economic growth and declining wage growth.

Whether Donald Trump can ignite faster economic growth and bring more well-paying jobs to American soil is the $64,000 question.

What does seem certain is his anticipated route to make it happen: more debt and deficit spending.

Based on financial market reactions in the days following the election, this may be easier said than done—especially since US government debt has increased by 150% since 2006 to over $20 trillion dollars.

Promise of increased spending already affecting markets

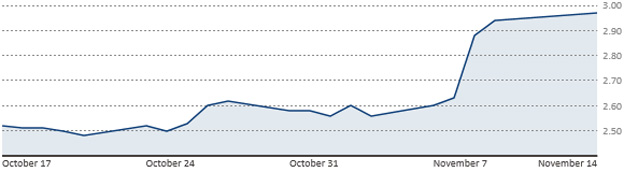

Given its duration, the 30-year bond is one of the best predictors of changes in inflation expectations and the direction of overall interest rate structure.

Since the election, the potential for greater spending and accelerating inflation has spiked 30-year Treasury bond yields 15%.

US 30-year Treasury Bond Yield

While inflation at the consumer level has been relatively non-existent since the financial crisis of 2008/2009, extremely accommodative Fed policy has hugely benefitted other assets.

Specially, values of US stocks are at record levels and real estate has reached or exceeded levels not seen since the mid-2000s in many parts of the country.

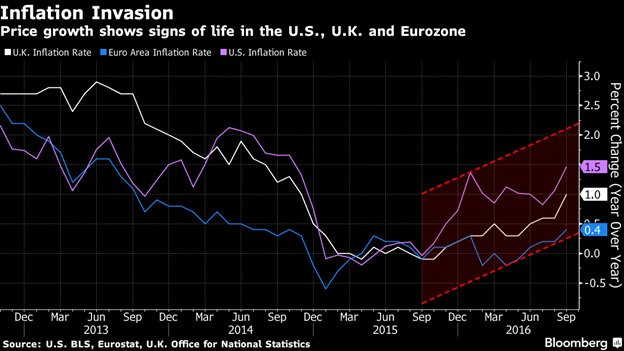

But as seen below, inflation has started to tick up in the US and other major economies. This is occurring at the same time economic growth is stalling.

It’s a precarious combination—even more so considering the Federal Reserve’s plan to increase the interest rate next month, and again in 2017.

The re-emergence of stagflation

The Trump administration’s ambitious agenda in the current economic climate has the distinct possibility of triggering inflationary forces, ultimately resulting in stagflation.

Stagflation is a combination of low economic growth in the presence of rising prices and under employment. Necessities like food, fuel, and electricity will increase in cost and assets like real estate and stocks will decline.

While the employment picture has improved since the financial crisis, the quality and types of jobs being added are questionable—as indicated by wage data and labor force participation rate.

Jobs, specifically manufacturing jobs, were a big pillar of Trump’s campaign and will undoubtedly be one of his major initiatives after taking office.

Even if he’s successful in creating jobs, it will take a significant amount of time before the effects have an impact on economic growth and government revenue. And to make this and many of his other plans come to fruition—building a wall on the Mexican border, increasing immigration efforts, and improving infrastructure such as airports and bridges—it will require debt and most likely, higher borrowing costs.

As you can see in the chart above, the US dollar is still viewed as the strongest global currency, and this has become even more pronounced recently. But its strength could prove to be a double-edged sword as exports become more expensive and additional debt service by foreign holders will be difficult as their currencies depreciate.

Recent history shows stagflation buoys gold

During the 1970s period of stagflation, gold experienced a significant rally. In fact, it tripled in price from 1972 to 1974. It tripled again at the end of the decade.

The cause of the coming stagflation may be different this time around, but the result could very well be the same. Gold’s recent correction is an opportunity to get positioned with an initial allocation or make an additional investment—before prices really begin to soar.

Gold is poised to be a major beneficiary of this administration’s agenda and its potentially inflationary agenda.

To put this in perspective, the last period of significant stagflation coincided with gold’s move to $850/oz. in January 1980. Adjusted for inflation, this would equate to $2,500/oz. in current dollars.

With massive uncertainty and abrupt fiscal policy changes likely, now is the time get positioned into physical precious metals.

Free Ebook: Investing in Precious Metals 101: How to buy and store physical gold and silver

Download Investing in Precious Metals 101 for everything you need to know before buying gold and silver. Learn how to make asset correlation work for you, how to buy metal (plus how much you need), and which type of gold makes for the safest investment. You’ll also get tips for finding a dealer you can trust and discover what professional storage offers that the banking system can’t. It’s the definitive guide for investors new to the precious metals market. Get it now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.