Post-election Debt Mathematics

Interest-Rates / US Debt Nov 23, 2016 - 07:10 AM GMTBy: DeviantInvestor

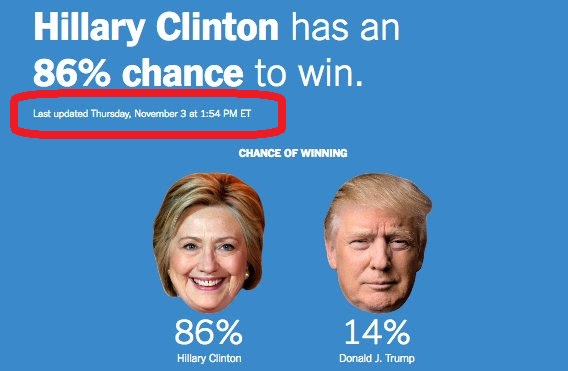

The U.S. Presidential election is over. One candidate won, one lost, but the mathematics did not change.

The U.S. Presidential election is over. One candidate won, one lost, but the mathematics did not change.

Mathematics of What?

- US government debt has grown far more rapidly than GDP for decades. This is unsustainable.

- US government revenues increase about 4% per year while the official debt has grown at 9% per year, on average, since 1913. Official debt doubles in eight years regardless of which borrow and spend party and politicians are supposedly running the country and that is unsustainable.

- Official debt is currently about $20 trillion. Does $40 trillion in official debt sound plausible in the year 2024?

- How about $80 trillion in the year 2032?

- Worse, the debt goes astronomical if the financial and political elite choose hyperinflation.

You see the problems:

- Congress and the administration will spend and spend for discretionary expenses and wars.

- Huge expenses are already mandated under existing Medicare, Medicaid, Social Security, and Retirement laws.

- The war machine is expensive and must be fed and maintained.

- Debt, interest expenses, Medicare expenses, Social Security and war expenses are clearly going to increase, regardless of which “party” and which President is in office.

- Revenues are slowly rising while expenses are rising rapidly.

- Accountability is … lacking.

- But … people and corporations wish to pay less in taxes, not more.

THE OBVIOUS SOLUTIONS CREATE TRAUMA:

Any solution regarding the mathematical inevitability of the above will create massive trauma. Consider the outrage concerning: Reduce federal employees by 5% every year for a decade. Eliminate the Federal Reserve. Cut military retirements. Eliminate half the budget for the Department of Defense. Reduce Social Security benefits by 50%. Dismantle the Medicare system. Return to a gold standard. Eliminate the Departments of Education and Energy. Raise taxes for everyone. Eliminate SNAP – food stamps. Cut corporate welfare, foreign aid, and more.

We might as well suggest we cut our own throats… The obvious solutions are dead on arrival given the political process.

WHAT ELSE IS POSSIBLE?

- Reset! Implement many cost savings programs, crash the economy, default on $20 trillion in debt, and create a depression that makes the 1930s feel like a sunny parade day at Disneyland.

or …

- Reset! Call forth the inflation monster to allow government to delay difficult decisions and thereby delay mathematical inevitability. Print dollars … lots of dollars. Create perpetual bonds that fund “helicopter money” for government expenses and payments to all Americans. Monetize debt… Think $10 for a cup of coffee or a gallon of gasoline with even higher prices on the horizon.

Given the nature of the political animals that inhabit congress, the administration, government departments, the “Deep State,” the Pentagon, and the Eccles Building, I think that mathematics, politics, and human nature clearly indicate that inflation will the answer chosen by the government, the “Deep State” and the Fed.

Mish offered his astute comments:

“Hillary was an agent of the status quo. Trump provides a chance at much needed change. The US can no longer afford to be the world’s policeman.

Non-Solutions

- Central bank sponsored inflation is not the solution, it is the problem.

- Regulation is not the solution, it is the problem.

- Public unions are not the solution, they are the problem.

- Competitive currency debasement is not the solution it is the problem.

- More debt is not the solution, it is the problem.

- Warmongering is not the solution, it is the problem.

- Tariffs are not the solution, they are the problem.

- Minimum wage hikes are not the solution, they are the problem.

- More military spending is not the solution, it is the problem.

- The status quo is not the solution, it is the problem.”

“Solutions

- End fractional reserve lending.

- Return to a gold standard.”

Repeat: End fractional reserve lending and return to a gold standard.

Don’t depend upon the mainstream media or Wall Street for accuracy and critical analysis. Think about what will preserve your purchasing power given a rip-roaring inflation that might engulf the United States during the next four years.

Given the inevitability of the mathematics, never mind the payoffs to politicians, what could go wrong?”

Protect your assets, purchasing power, and life-style before the value has been “wrung out” of them. Gold and silver come to mind.

Watch this video regarding silver. Skip to the 32 minute mark.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.