Euro Devaluation Accelerates – Millions Of Europeans Wishing They’d Bought Gold

Currencies / Euro Dec 08, 2016 - 05:04 PM GMTBy: John_Rubino

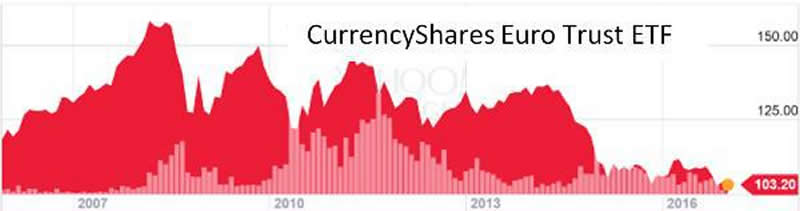

ECB Chairman Mario Draghi’s announcement of bigger and better QE this morning should have surprised no one. The fact is that the eurozone is coming apart at the seams and the only tool left to delay the inevitable is easier money. As the following chart illustrates, the euro has been declining since 2008, with the descent accelerating lately.

ECB Chairman Mario Draghi’s announcement of bigger and better QE this morning should have surprised no one. The fact is that the eurozone is coming apart at the seams and the only tool left to delay the inevitable is easier money. As the following chart illustrates, the euro has been declining since 2008, with the descent accelerating lately.

And more is coming. The only way for Italy, Greece and possibly France to keep it together is for their currency to plunge relative to those of their trading partners, thus making it easier to sell domestically-produced stuff abroad. So euro parity with the dollar will generate headlines when it happens but will just be a way-point on a journey to much lower numbers. That is, if the whole global financial system doesn’t blow up first.

What’s a European saver to do? Sitting on a euro-denominated bank account generated a 30% loss of real purchasing power during this “recovery,” which for the average European more than offset the trade benefits of a cheaper currency (hence the recent political turmoil). So going forward, cash is clearly not an attractive way to preserve capital.

Gold, on the other hand, is made for this kind of situation. In the past decade it has more-or-less tripled in euro terms. The difference between a 30% loss and a 200% gain is not lost on the people living through it, so expect European gold demand to rise going forward.

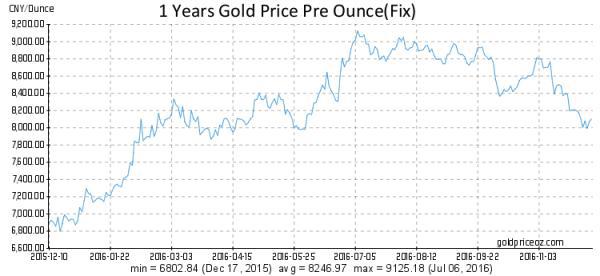

Meanwhile, the same thing is happening in China, where the yuan has been falling steadily and is now at a multi-year low to the USD.

The difference is that many Chinese seemed to have understood what was coming and have for the past decade been loading up on gold. The result: currency devaluation actually improves the finances of large numbers of gold-owning citizens.

For Americans there are two lessons here:

1) Because we’re making the same mistakes as Europe and China – borrowing more than we can ever hope to pay off and papering the growing mess over with artificially-low interest rates and aggressive currency creation – the dollar won’t last long as the only major currency that’s appreciating. We’ll eventually be forced to devalue, which will take the currency war to a new and vastly more dangerous stage.

2) When the above happens gold will soar in dollar terms just as it is now rising in euro and yuan terms. So today’s US savers have a choice of role models: Will we be impoverished Europeans with shrinking bank accounts or enriched Chinese with ever-more-valuable stacks of gold?

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.