Italy’s Banking Crisis Is Nearly Upon Us

Economics / Financial Crisis 2016 Dec 13, 2016 - 05:03 PM GMTBy: John_Mauldin

There is a high degree of probability (approaching 90%, I’d say) that Italy will experience a severe banking crisis in the next few quarters. Perhaps they can stave off the problem for a year, but something will have to be done about the banks.

There is a high degree of probability (approaching 90%, I’d say) that Italy will experience a severe banking crisis in the next few quarters. Perhaps they can stave off the problem for a year, but something will have to be done about the banks.

Italian GDP per person lagging the rest of Europe

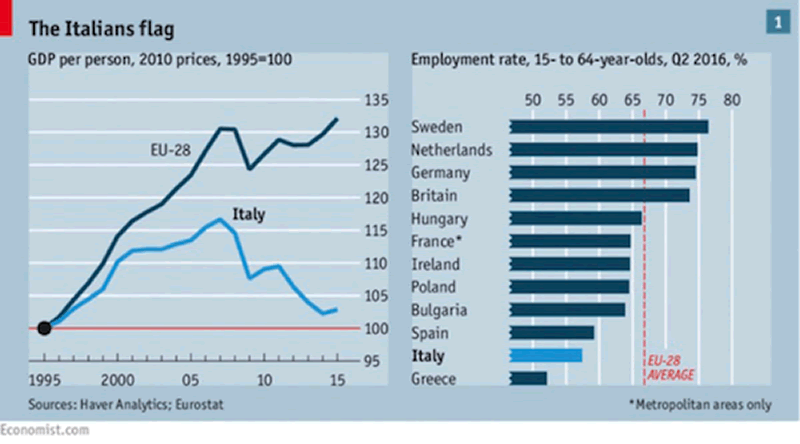

Italian citizens haven’t had much fun the past decade, judging from their GDP. You can see on the left side of the chart below that GDP per person has lagged the EU since 1995. Worse, it kept falling after 2009, even as Italy’s neighbors recovered.

This performance stands in stark contrast to Italy’s pre-euro experience. Even though Italy constantly revalued the lira, that revaluation process allowed Italy to grow its GDP in real terms as fast as Germany did for decades. Notice in the graph above that the real drop off in Italian economic performance began shortly after the introduction of the euro in 1999.

Italy was one of the economic miracles of the 1960s and 1970s. The northern part of Italy was a production powerhouse. The region was strong in the design and manufacturing of all manner of products across a whole host of industries. Even banking was strong.

You need to know that Italy is the eighth-largest economy in the world and has issued the third-largest amount of sovereign bonds. And that mountain of sovereign bonds is really the avalanche-in-waiting that an Italian banking crisis will send tumbling down on the rest of the world, because a large percentage of those bonds are outside of Italy—sitting on the books of banks and central banks.

The bar chart on the right above shows the employment rate for people ages 15–64 in various European countries. Italy is second worst on the list, with only Greece having fewer working-age jobholders.

Italian banks have horrendous amounts of bad debt

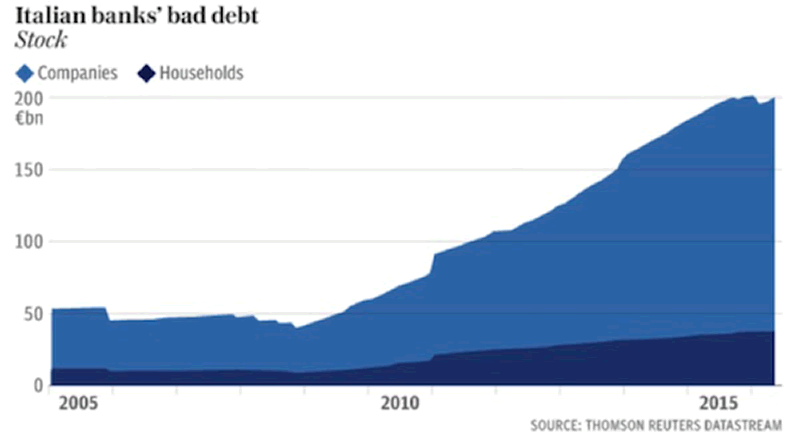

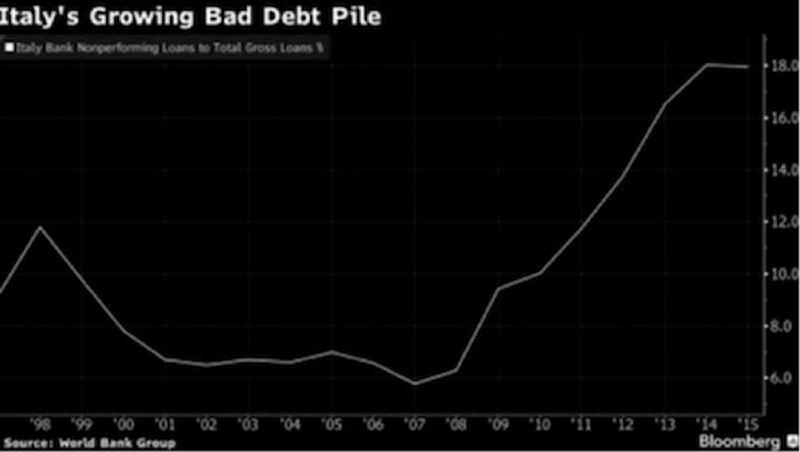

Eighteen percent of the total loans made by Italian banks are now considered to be nonperforming. Nonperforming loans occur everywhere of course, but not to this level. On an aggregated basis, the Italian banking system has less than 50% of the capital it would require to cover the bad debts. Estimates are that Italian banks may need €40 billion just to remain solvent. The banking situation gets even worse, as we will see.

Italy is problematic for many of the same reasons that Greece, Spain, and Portugal are. Bank customers in these southern eurozone states borrowed to buy goods from the wealthier north, mainly from Germany; and then the economic growth they anticipated failed to occur. The purchased goods have mostly been consumed, so there is no collateral to recover. Many loans look like near-total losses.

Let’s play “extend and pretend”

To adapt an old saying: If you owe the bank a million dollars, the bank owns you. If you owe the bank $100 million, you own the bank. Writing off a massive loan as a loss will render the bank insolvent. So, instead it goes into “extend and pretend” mode, allowing endless payment delays on the flimsiest premises, hoping against hope that you will win the lottery and resume paying your loan.

That’s what is happening in Italy and indeed throughout Europe. It happened in the US during our housing crisis. The chart below shows Italy’s pile of nonperforming loans in terms of its percentage of GDP. To put the bad debt in context for US readers, our banks would have to have nonperforming loans of $3.8 trillion to be this badly off. That total would dwarf any problems from the 2008 subprime crisis.

Italian banks need fresh capital

Eventually, even the bank has to admit that its delinquent borrowers aren’t going to mend their ways and become creditworthy. Where do you find the needed bank capital? You go looking for a bailout. That is the current situation in Italy. The country’s largest banks need fresh capital.

Banca Monte dei Paschi di Siena, the world’s oldest bank, one of Italy’s largest, and possibly its most troubled, is trying to raise €5 billion in new capital with a three-part plan: convert subordinated bonds to equity, sell new equity via private placement to institutions, and promote a new public equity offering. None of the three is going well.

You know a bank is in trouble when its stock drops 84% in less than a year and still no one sees a bargain.

Unicredit, which is even larger than Monte dei Paschi, intends to raise €13 billion early next year. Prospects for success range from slim to none. Time is running out too as depositors pull out their money and decline to deposit more. And we haven’t even talked about the multiple lawsuits facing these banks, for which they have set aside only a fraction of the potential judgments.

Some of those judgments will arise from an unsavory practice engaged in by certain banks that have sold bank-issued bonds to customers who thought they were depositing money into a bank account.

Now the bonds have lost value and may lose even more—potentially 100%—if EU rules prevail and Italy has to bail in bondholders before using public funds for a bailout.

Loyal bank customers will be the big losers

This is not just a problem with Monte dei Paschi. There is roughly €240 billion of this type of bank debt scattered around Italy. Bank customers looking for yield were told that this was a safe way to get it. You trusted your local bank, right?

Except now these loyal customers are first in line to lose all of their investment if their bank hits the wall. And that’s just what most of them are in danger of doing.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.