Sell those Euros. Sell'em

Currencies / Euro Jan 07, 2017 - 12:07 PM GMTBy: EWI

How do you know a real FX opportunity from a fake one?

How do you know a real FX opportunity from a fake one?

Late last Thursday night (Dec. 29), I got an insistent email from a colleague.

Jim Martens, long-time editor of our forex-focused Currency Pro Service sent me this message with only a subject line:

-------- Original message --------

From: Jim Martens

Date: 12/29/16 9:16 PM (GMT-05:00)

To: Vadim Pokhlebkin

Subject: Sell those euros. Sell'em

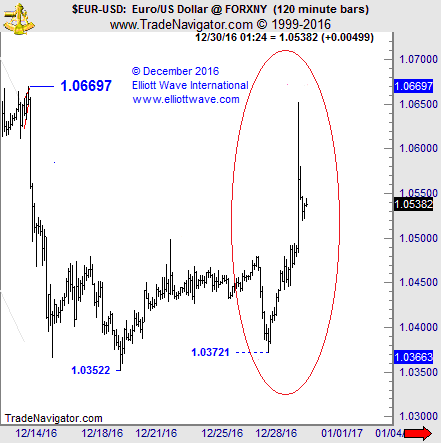

It was around 9:30 PM when I read Jim's email, glanced at a EURUSD chart and saw that it had spiked about 300 pips higher in after-hours trading:

At the time, news stories included some head-scratching. As our next-day Short Term Update put it,

"The [Euro] surged to 1.0654 in overnight trading. Several financial stories were at a loss for the sharp rise. "No 'particular' news seems to be driving the euro's jump," says the head of forex sales at an Asian bank. Bloomberg called the jump a "Mystery Move."

Even if the reasons behind it weren't clear, without a doubt many forex traders saw the 300-pip jump as the start of a bigger rally. But to our Currency Pro Service team it was clear it wasn't the start of anything.

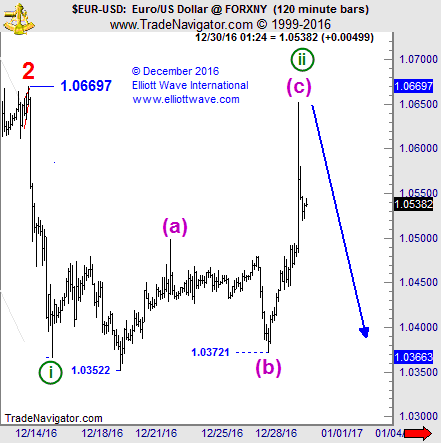

Here's the same chart with Elliott wave labels shown:

"Sell those euros," as the subject line said. You can see why: We saw the rally as the last gasp of a wave 2 correction.

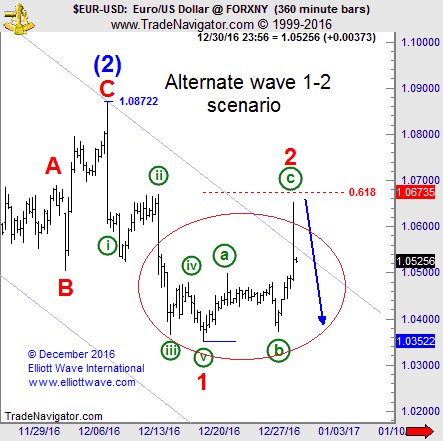

In fact, for days leading towards that spike EURUSD's wave patterns called for the decline to resume:

When last Thursday's "mystery" rally came up to within pips of a .618 Fibonacci resistance area, it warned us that the bottom was ready to fall out.

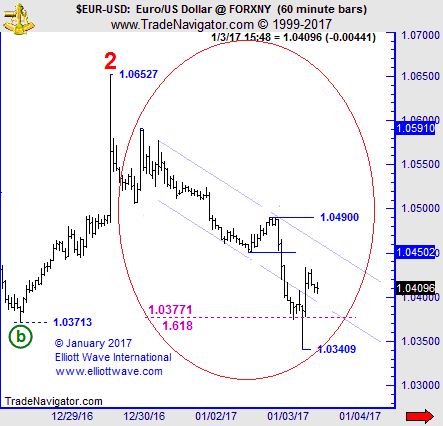

Which it did. On Tuesday (Jan. 3), the U.S. dollar index hit a fresh 14-year high against the euro and other competitor currencies. This Currency Pro Service chart shows you the extent of EURUSD's decline:

In a Tuesday morning intraday update, Jim Martens wrote:

EURUSD

[Posted On:] January 03, 2017 09:38 AM

(Last Price 1.0393): Good morning and welcome to our intraday coverage of the first New York session of 2017. We ended 2016 suggesting the euro might experience a rough start to the new year. It's down 1.10% since Friday.

Also on Tuesday, a Reuters headline said: "Dollar hits 14-year highs after strong U.S. manufacturing data." If only the news could really explain everything.

Trading Forex: How the Elliott Wave Principle Can Boost Your Forex SuccessLearn how to put the power of the Wave Principle to work in your forex trading with this free, 14-page eBook. EWI Senior Currency Strategist Jim Martens shares actionable trading lessons and tips to help you find the best opportunities in the FX markets you trade. |

This article was syndicated by Elliott Wave International and was originally published under the headline "Sell those euros. Sell'em.". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.