Why Gold Is Oddly Looking Bullish

Commodities / Gold and Silver 2017 Jan 24, 2017 - 10:10 AM GMTBy: Nicholas_Kitonyi

The price of gold appears to be on yet another homerun after eight weeks of decline. The price of the yellow metal has been on an upward trending movement since December 23, 2016 amid the growing uncertainty on the potential impact of President Donald Trump’s policies on the stock market.

The price of gold appears to be on yet another homerun after eight weeks of decline. The price of the yellow metal has been on an upward trending movement since December 23, 2016 amid the growing uncertainty on the potential impact of President Donald Trump’s policies on the stock market.

Since the turn of the year, the US stock market has exhibited mixed reactions to Trump’s pre-and-post inauguration period, with America’s 45th president’s activity swinging the market up and down on a weekly basis.

Now, when there is uncertainty in the stock market, investors tend to leverage the level of risk exposure by putting some of their investments in gold products, including physical gold, gold ETFs, and gold stocks.

The price of gold has been rallying despite the notable improvement in global inflation with the EU, Japan and the US posting some significant increments in the key economic indicator. Illustratively, the EU inflation rate has increased tremendously over the last eight months rising from -0.1 in May last year to 1.1 in December, whereas the Japanese inflation level is now at 0.5% after a period of six successive months (April to September) in the negative territory.

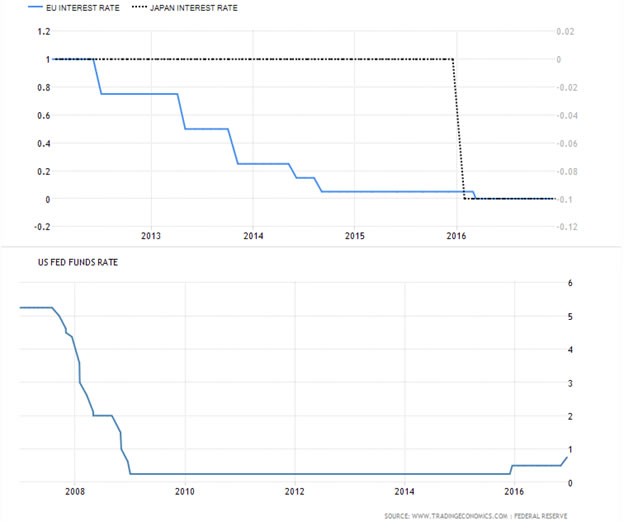

Under normal circumstances, this should signal a bullish outlook for the stock markets across the world, which in turn would push the price of gold lower. However, both the EU and Japan do not seem to be ready yet, to introduce tapering in their monetary and fiscal policies as they continue with their respective quantitative easing schemes.

This is one reason why the price of gold could continue to trend higher in the first half of 2017.

On the other hand, the US inflation rate continues to rise to new levels and judging by the current progress, it seems to have met the Federal Reserve’s expectations for it to announce a series of rate hikes in the coming quarters.

However, even given the last two interest rate hikes, the US interest rates are still very low historically, which means that the level of return in fixed income investments might well be unable to match what an investor buying gold could get in the short-term horizon.

The US Federal Reserve Funds rate is now pegged at 1.75% after the second hike in two years, but still looks well below the levels reached in the pre-global financial crises of 2008/2009.

It is also clear that gold should continue to thrive in the next few months as both the EU and Japan’s interest rate levels remain in the negative territory at -0.1%.

Unlike the case of the US, Japan and the EU have been lowering their base interest rates over the last few months, and this shows that their economies are not yet off the hook.

Therefore, despite the recent improvement in inflation levels, fundamentals still point to a potential rally in the price of gold which makes gold investment an ideal option for consideration early in the year.

From a technical perspective, it looks as though we are having a Déjà vu following the recent US interest rate hike.

Last year, the price of the yellow metal rallied early on in January through April following the first Federal Reserve interest rate hike since the pre-global financial crises in the late 2000s. And looking at the chart below, the same trend seems to be taking shape after rebounding in late December, again, shortly after the rate hike.

This shows that traders are literally using past pricing statistics to trade gold, which implies that they could continue to rally the price of the yellow metal at least through the first half of 2016.

As such, gold traders and investors will be setting their sights on a potential bullish run for the next few months, and this could create several targets depending on their trading timeframes.

As demonstrated in the chart below, the spot gold price currently stands at about $1,214 an ounce.

From here, the next immediate target is at about $1,230 an ounce, but the main target remains at $1,300.

And for those aiming at even higher potential zones of taking profits, $1,380 is still a realistic mark.

The price of gold appears to be well set for another leg up after two months of decline following the uncertainties that surrounded the US elections and the interest rate hike.

After both events passed smoothly, the uncertainties now hover over the potential impact of President Trump’s policies on the stock market. The Federal Reserve also predicted three rate hikes in 2017, but given the change of power at The White House, investors are already becoming skeptical of another rate hike this year.

Conclusion

In summary, it clearly does seem to be a good time to buy gold both from the technical and fundamental perspectives.

Globally, the markets are still very much unpredictable while in the US, even the recent increase in inflation cannot guarantee better returns in the credit market.

The yellow metal might, however, be an interesting option to look at this year.

By Nicholas Kitonyi

Copyright © 2017 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.