Bitcoin Price Above Resistance

Currencies / Bitcoin Jan 27, 2017 - 03:43 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

The recent drop in Bitcoin volatility is widely attributed to developments in China. On Bloomberg, we read:

Bitcoin's volatility has plunged since China banned leveraged trading and forced exchanges to charge fees.

Perhaps more meaningfully, trading volume has plunged 98 percent compared with the first days of 2017, according to data from bitcoinity.org. On Jan. 1, when bitcoin traded at $1,012.3, 4.8 million coins exchanged hands. On Wednesday, only 80,092 did. Sure, many Chinese investors, who still represent the lion's share of trading, are away from their desks because of the Lunar New Year. Still, the speed and pattern of the decline make it hard not to draw a line to the regulatory action.

A conspicuous change in the yuan's share of trading tells the story. On average, 97 percent of all bitcoin transactions between the end of July and Dec. 31 were performed in the Chinese currency. This week, that number dropped to 63 percent; Wednesday's 33 percent was the lowest since December 2013.

We generally don’t see as strong a relationship between the recent actions of the Chinese regulator and the price level. Sure, the ban on leverage and the prospect of fees have probably been detrimental to the number of investors or traders actively selling and buying bitcoins through Bitcoin exchanges. On the other hand, Bitcoin had already seen the sharpest rise in months and the highest levels since 2013. This was precisely the environment where declines could occur. So, while the new regulations hit the volume, the move in price needn’t have been driven by them. In reality, the decline was most likely a combination of both market exhaustion and new trading restrictions.

The more interesting part of this analysis is the drop in the volume of transactions completed in yuans. Our take here is that the current decline is unlikely to last. Perhaps, the Chinese investors panicked and pulled out of Bitcoin. We would expect the number to go up in a matter of weeks. Whether it goes back close to 100% is another matter. This depends on whether the People’s Bank of China will deem it necessary to further control Bitcoin trading. At present, it seems that there is a good chance of Chinese trading going back close to where it was before the PBOC’s intervention.

For now, let’s focus on the charts.

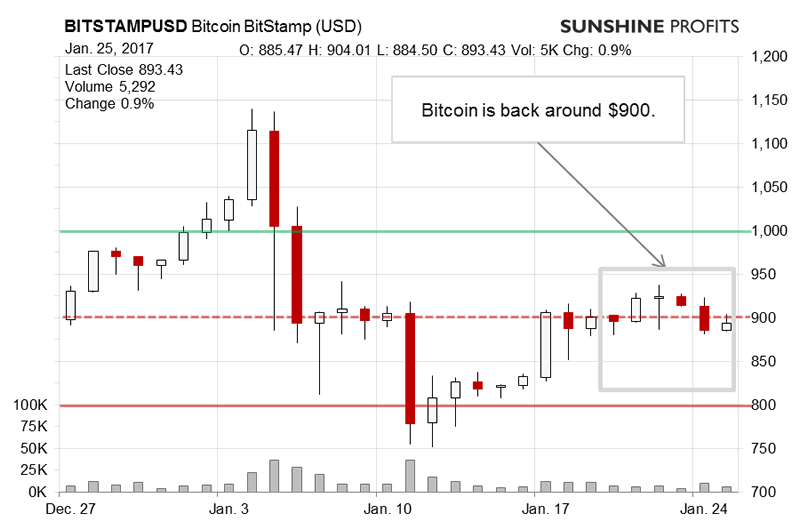

Bitcoin has moved up a bit but the drop in volume is more than palpable. Does this mean that the currency is likely to go down from here? Recall our recent comments:

We actually saw a move up but it took place on volume that was not very convincing relative to the size of the move. So on one hand, we saw a strong move up in terms of the exchange rate but not necessarily in terms of the volume. This weakens the bullish indications.

Bitcoin has stayed above $900 (...). This is a mildly bullish development. More importantly, Bitcoin is still above the 38.2% retracement level (more on that below). Generally, there hasn’t been much movement since our previous alert was posted. To add to that, the move up we saw earlier took place on relatively weak volume. This reads as a possible bearish indication.

Our previous comments are largely up to date. Bitcoin is still above $900 but whatever movement we have seen since our previous alert was posted has been unconvincing. Unconvincing either way: Bitcoin hasn’t jumped visibly higher but it hasn’t broken below the 38.2% retracement either. This means that from the short-term perspective the situation is muddled.

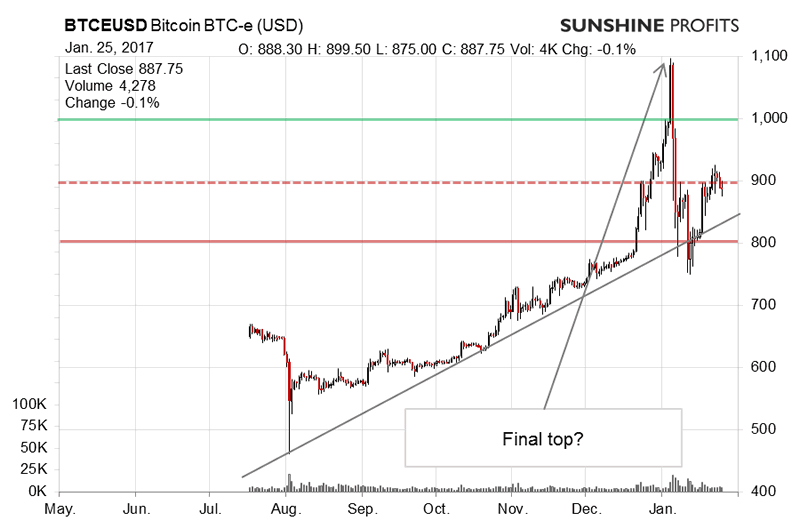

On the long-term BTC-e chart the action is still very much tied to the 38.2% retracement level. In our previous alerts, we wrote:

[Alert 1] The main point here is that the move above $800 hasn’t reached the 38.2% Fibonacci retracement which might be an indication that the move is not something to call home about (...). Because of the lack of such move, the general situation is unchanged, in our opinion. This is further confirmed by the falling volume and the fact that the RSI hasn’t really reached oversold level. This might mean that there’s still room for further depreciation.

[Alert 2] The 38.2% retracement level is still very much in play. We saw a move above this level and above $900. This is a bullish development but one that is more of a short-term nature. If we see a slip below the 38.2% retracement, which we would generally expect, the situation might tilt to bearish once again and we might consider hypothetical short positions at that moment again. (...)

[Alert 3] Almost all we wrote previously is still up to date. The most important part of the equation now, in our opinion, is the fact that Bitcoin is still above the 38.2% retracement level. This still keeps the potential decline in check. At the same time, Bitcoin didn’t really hit oversold levels, which suggests that the currency might still slide considerably. The $1,000 level and the recent tops above this level provide strong resistance levels if Bitoin shoots up from here. Additionally, it wouldn’t take very much in terms of price for Bitcoin to go below the 38.2% retracement which could open up Bitcoin to more declines. In the current situation, we prefer to wait on the sidelines until we see a confirmation of a move below the 38.2% level or a top forming.

The situation is still evolving according to this script. Bitcoin moved to the retracement level but failed to break back below it. At the same time, all the movement to the upside has been limited. Our take here is that we might see a move lower soon, since Bitcoin might have exhausted the knee-jerk move up after the initial decline from the recent top. Having said that, the fact that the currency has held up above the 38.2% retracement level opens it up to yet another violent move before the decline. We would prefer to wait for a confirmation before considering hypothetical short positions.

Summing up, in our opinion not having speculative positions might be favorable at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.