Buy Gold Because of Uncertainty Not Doomsday

Commodities / Gold and Silver 2017 Feb 02, 2017 - 02:53 PM GMTBy: The_Gold_Report

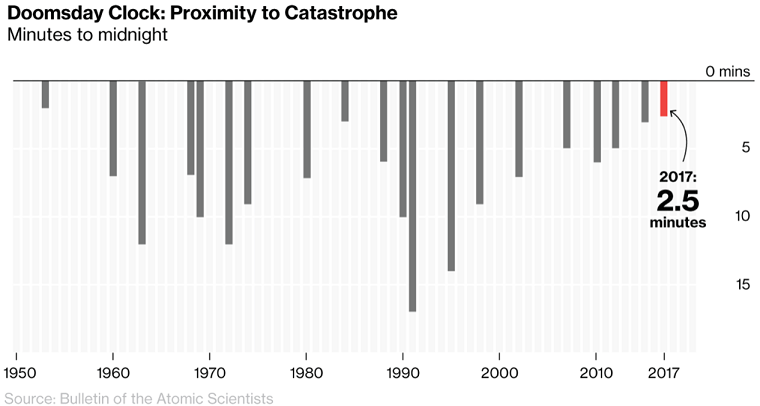

Doomsday Clock moves closer to midnight

Doomsday Clock moves closer to midnight- World not been as close to self-destruction since 1953

- Threat of nuclear powers, climate change and technology all considered heightened risks

- First time the Bulletin of Atomic Scientists have singled out an individual – President Trump

- Doom-mongering is arguably distracting and uncertainties should be more considered

- Gold and silver perform well during times of uncertainty and provide a safe-haven

- Wall Street’s largest fund managers have bet on gold in face of growing uncertainty

Buy gold because of uncertainty not Doomsday

It is two and a half minutes to midnight, the Clock is ticking, global danger looms. Wise public officials should act immediately, guiding humanity away from the brink. If they do not, wise citizens must step forward and lead the way. Bulletin of the Atomic Scientists, January 2017.

We hope you remembered to reset your clocks last week, not the timekeeping kind but the doomsday kind. And hopefully you’ve made a start on those bucket lists as apparently nuclear power, climate change, nationalist politics and technology have brought us one step closer to The End.

The Doomsday Clock, as kept and set by the Bulletin of Atomic Scientists, was moved forward last week by 30 seconds to two-and-a-half minutes to midnight. This is the closest the clock has come to 12am since 1953 when the Soviet Union tested its first hydrogen bomb, nine months after the US first tested their own version.

“The Clock has become a universally recognized indicator of the world’s vulnerability to catastrophe from nuclear weapons, climate change, and new technologies emerging in other domains.” Bulletin of Atomic Scientists

The movement of the clock by half a minute comes as the group of scientists believe that in 2016, “the global security landscape darkened as the international community failed to come effectively to grips with humanity’s most pressing existential threats, nuclear weapons and climate change.”

The statement acknowledges that the outlook for climate change has not changed in the last year, but is concerned with the lack of action. It is also concerned about technology and ‘the knotty problems’ in some fields of technological innovation that may or may not present a threat to humanity. Back in 1947, they say “there was one technology with the potential to destroy the planet, and that was nuclear power” but now there are multiple threats.

However it is the US Presidential election and comments from President Trump that appear to have really forced the issue of moving the clock forward. The Bulletin points to the rise in ‘strident nationalism’ that brought about the US election result and Trump’s comments on nuclear weapons and climate change.

Whilst nuclear codes access and climate change haven’t concerned the President too much, this is not the first time apocalyptic language has been used since he came to power. Trump himself has enjoyed painting a picture of the ‘American carnage’ he sees across the United States today – he did so in his own inauguration speech.

Scientists v. Trump

The Bulletin makes clear that it would normally focus on long-term trends (ie not the behaviour of a democratic leader who could be in power for just four years) but:

“…the statements of a single person—particularly one not yet in office—have not historically influenced the board’s decision on the setting of the Doomsday Clock.

But wavering public confidence in the democratic institutions required to deal with major world threats do affect the board’s decisions. And this year, events surrounding the US presidential campaign—including cyber offensives and deception campaigns apparently directed by the Russian government and aimed at disrupting the US election—have brought American democracy and Russian intentions into question and thereby made the world more dangerous than was the case a year ago.

This move by the Bulletin of the Atomic Scientists is very much a statement, Lawrence Krauss, chairman of the group’s board of sponsors, told Bloomberg, “It’s only six days into the new administration and actions do speak louder than words, and we wanted to send a message that things are not going in the right direction.”

Absence of facts and Moral narcissism

Yesterday we talked about the alternative facts of government. The Bulletin of Scientists are also worried about such hyperbole affecting the decisions regarding existential threats:

Wise men and women have said that public policy is never made in the absence of politics. But in this unusual political year, we offer a corollary: Good policy takes account of politics but is

never made in the absence of expertise. Facts are indeed stubborn things, and they must be taken into account if the future of humanity is to be preserved, long term. Nuclear weapons and climate change are precisely the sort of complex existential threats that cannot be properly managed without access to and reliance on expert knowledge.

There is arguably an element of moral narcissism here, on both sides of the coin – Trump and the scientists. Both believe that they know better than the other and that they should influence policy and the thinking of others.

Nassim Taleb writes about this phenomenon in a blog, Intellectuals but Idiots “that class of paternalistic semi-intellectual experts with some Ivy league, Oxford-Cambridge, or similar label-driven education who are telling the rest of us 1) what to do, 2) what to eat, 3) how to speak, 4) how to think… and 5) who to vote for.”

As ever, Taleb’s words might be bit too harsh, but it speaks to how this kind of authoritarian groupthink from the likes of the scientists that has lead to the rise in nationalist politics, and put Trump in power.

But we are also seeing this on Trump’s side as well. He is reinforced by those he has positioned around him. People are unlikely to feel that those influencing policy are looking out for them and what really matters day-to-day.

Roger Simon writes in I Know Best “It is a narcissism of groupthink that makes you assume you are better than you are because you have the same received and conventional ideas as your peers, a mutual reward system.”

This is about uncertainty, not scientific or political doom-mongers

It can be argued believe that the scientists’ warnings and groupthink, along with the same brand moral narcissism of Trump’s calls to work ‘for the people’ are counterproductive. Will Boisvert writes;

“Apocalypticism can systematically distort our understanding of risk, mesmerizing us with sensational scenarios that distract us from mundane risks that are objectively larger. Worse, it can block rather than galvanize efforts to solve global problems. By treating risks as infinite, doom-saying makes it harder to take their measure — to prioritize them, balance them against benefits, or countenance smaller ones to mitigate larger ones. The result can be paralysis.”

In many ways we couldn’t agree more. The latest tick-tock on the Doomsday clock has gathered a lot of media attention, but to what end? What does this information really tell people other than the group of scientists doesn’t like Trump? It provides no useful information for the man or woman on the street.

Anders Sandberg a Research Fellow at Future of Humanity Institute & Oxford Martin School, University of Oxford writes about the distortions in trying to place a probability on man-made dangers and how this can skew our perception of risk. “The chance of at least one of them being wrong is high. It may be better to explicitly acknowledge the uncertainty”.

Sandberg is right, we are far better to acknowledge both the existent of uncertainty at any given moment as well as the known risks. We only really know things are risks, after the fact and even then we are not always able to find the true cause or catalyst to whatever disastrous event the supposed risk lead to.

What we do know, is that nothing is certain and at the moment it feels we have more uncertainties than ever before. What we also know is that gold and silver both perform well during times of heightened uncertainty and we expect it to push higher as both Trump’s presidency and the shifting of economic plates is felt around the globe.

Feeling uncertain? Buy gold.

Earlier this week we brought you a brief synopsis of “Reassessing the Role of Precious Metals As Safe Havens – What Colour Is Your Haven and Why?” by Dr Brian Lucey and Sile Li, of Trinity College Dublin and Trinity Business School. The paper examines the “safe haven properties versus equities and bonds of four precious metals (gold, silver, platinum and palladium) across eleven countries.”

We outlined that the authors, Dr Brian Lucey and Sile Li had attempted to “identify robust economic and political determinants of precious metals’ safe haven properties.” Lucey and Sile’s work finds that ‘Economic Policy Uncertainty’ is found to be a “positive and robust determinant of a precious metal being a safe haven” and that this “holds across countries”.

The Bulletin of Atomic Scientists have failed to address the financial system in their latest statement, but in the same way they point to the rise in nationalist politics forming the backdrop to nuclear way, climate change and cyber issues, we would argue that economic risks should also be seriously considered.

We’re not the only ones who think so, Reuters recently reported that gold has become a favourite safe-haven of some of Wall Street’s biggest fund managers:

Some of Wall Street’s largest fund managers have taken a contrarian bet on gold, wagering that U.S. President Donald Trump’s governing style and upcoming elections in Europe will combine to create more stock-market volatility and boost the prices of a metal long seen as a safe haven.

Fund managers from IVA, Ridgeworth and Fidelity are among those who are bullish on gold at a time when the VIX, Wall Street’s main measure of volatility, is near two-year lows amid a stock market rally that has pushed the S&P 500 up 6.5 per cent since election day in November.

Conclusion – heightened uncertainty is certainly good for gold

In the concluding paragraphs of the Bulletin of Atomic Scientists, the group say that “This year’s Clock deliberations felt more urgent than usual. On the big topics that concern the board, world leaders made too little progress in the face of continuing turbulence.”

We would argue the same in the case for the financial system and the systemic, global disaster it has become in the last decade. As we wrote about in the days following Trump’s inauguration, we expect some serious uncertainty and volatility in the months and years to come. Despite us getting a feel for how Trump will run his government, there is a lot that remains unknown both in the US and around the world.

Investors should ignore the moral narcissism of the elites, the politicians and the scientists, and instead prepare for uncertain times by diversifying and owning gold and silver. In recent years and throughout the ages, both precious metals have protected investors and savers from uncertainty, both economic and political.

KNOWLEDGE IS POWER

10 Important Points To Consider Before You Buy Gold

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold Prices (LBMA AM)

02 Feb: USD 1,224.05, GBP 966.14 & EUR 1,131.88 per ounce

01 Feb: USD 1,210.00, GBP 960.01 & EUR 1,122.03 per ounce

31 Jan: USD 1,198.80, GBP 964.91 & EUR 1,119.20 per ounce

30 Jan: USD 1,189.85, GBP 949.38 & EUR 1,112.63 per ounce

27 Jan: USD 1,184.20, GBP 943.81 & EUR 1,108.77 per ounce

26 Jan: USD 1,191.55, GBP 945.14 & EUR 1,111.95 per ounce

25 Jan: USD 1,203.50, GBP 956.90 & EUR 1,119.62 per ounce

24 Jan: USD 1,213.30, GBP 972.22 & EUR 1,130.07 per ounce

Silver Prices (LBMA)

02 Feb: USD 17.71, GBP 13.95 & EUR 16.38 per ounce

01 Feb: USD 17.60, GBP 13.91 & EUR 16.29 per ounce

31 Jan: USD 17.29, GBP 13.86 & EUR 16.07 per ounce

30 Jan: USD 17.10, GBP 13.65 & EUR 16.03 per ounce

27 Jan: USD 16.70, GBP 13.32 & EUR 15.61 per ounce

26 Jan: USD 16.86, GBP 13.39 & EUR 15.71 per ounce

25 Jan: USD 16.93, GBP 13.46 & EUR 15.74 per ounce

24 Jan: USD 17.10, GBP 13.73 & EUR 15.92 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.