U.S. Dollar Exorbitant Privilege At Risk?!

Currencies / US Dollar Feb 08, 2017 - 12:55 PM GMTBy: Axel_Merk

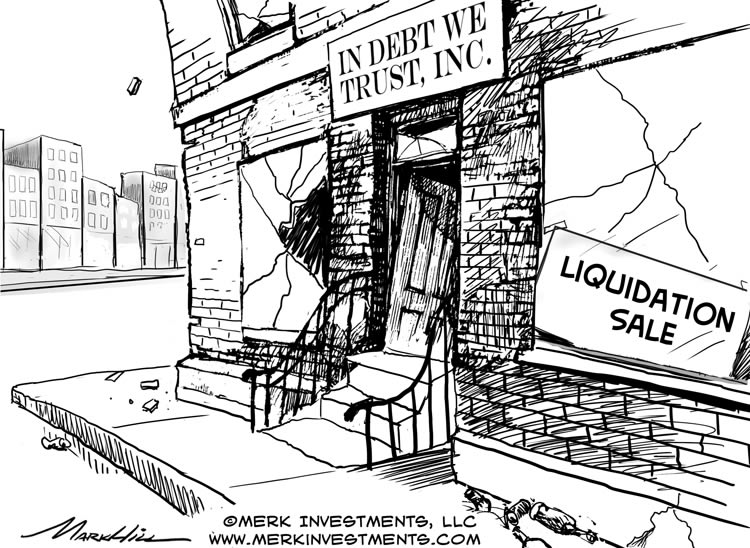

If the road to hell is paved with good intentions, American's exorbitant privilege might be at risk with broad implications for the U.S. dollar and investors' portfolios. Let me explain.

If the road to hell is paved with good intentions, American's exorbitant privilege might be at risk with broad implications for the U.S. dollar and investors' portfolios. Let me explain.

The U.S. was the anchor of the Bretton Woods agreement that collapsed when former President Nixon ended the dollar's convertibility into gold in 1971. Yet even when off the remnants of the gold standard, the U.S. has continued to be the currency in which many countries hold their foreign reserves. Why is that, what are the benefits and what are the implications if this were under threat?

Let me say at the outset that the explanation I most frequently hear as to why the U.S. dollar is the world's reserve currency - "it is because of tradition" - which is in my opinion not a convincing argument. Tradition only gets you so far - it ought to be policies and their implementation that guide investors.

Wikipedia's definition of exorbitant privilege includes:

"The term exorbitant privilege refers to the alleged benefit the United States has due to its own currency (i.e., the US dollar) being the international reserve currency.[..]

Academically, the exorbitant privilege literature analyzes [..] the income puzzle [which] consists of the fact that despite a deeply negative net international investment position [NIIP], the U.S. income balance is positive, i.e. despite having much more liabilities than assets, earned income is higher than interest expenses."

In the context of today's discussion, I would like to focus on what I believe may be the most under-appreciated yet possibly most important aspect of the so-called exorbitant privilege: what makes the U.S. so unique is that it is de facto acting as the world's bank. A bank takes on (short-term) deposits and lends long-term, capturing the interest rate differential.

Applied to the U.S. as a country, investors borrow cheaply in the U.S., and seek higher returns by investing in the rest of the world. In the investment world, we also refer to this as carry, i.e. one might say the U.S. engages in an amazing carry trade. As long as this 'carry trade' works, it is quite a charm. That said, there are those who are concerned that the party cannot last forever. To quote from our own past writings, the former head of the European Central bank Wim Duisenberg said in 2003: 'We hope and pray the global adjustment process will be slow and gradual." -- In fact, a reference to a "disorderly adjustment of global imbalances" was a risk cited by the ECB every month in its statement until about the time current head, Draghi, took over. This "adjustment process" is a thinly veiled reference to a potential dollar crash.'

So is there reason to believe the U.S. may no longer be serving as the world's bank? At first blush, the answer would be no, as the U.S. has deep and mature financial markets. However, there are developments of concern:

-

The first has already happened. Due to a regulatory change, our analysis suggests it is less attractive to issue debt in U.S. dollars for anyone other than the U.S. government. The regulatory change might look arcane at first, but in our Merk Insight "The End of Dollar Dominance?," we argued that a quirk in money market fund rules that could be interpreted as an implicit subsidy for issuers of debt has gone away. It's more than a quirk because funding cost for just about everyone other than the U.S. government has gone up, as evidenced by elevated intra-bank borrowing rates (LIBOR rates) independent of the rise in Federal Funds rate. If our analysis is correct, it means that the U.S. dollar is a less attractive currency to raise money in than it had been. These days, issuers might as well issue debt in euros, a trend exacerbated by the extraordinarily low interest rates in the Eurozone.

Let me provide the link to U.S. Treasuries as reserve holdings: take an emerging market corporate issuer raising money in U.S. dollars because of what used to be a funding advantage: upon issuing debt (raising cash), they might sell dollars to buy the emerging market currency to fund their operations. In the meantime, their government buys U.S. dollars and subsequently U.S. Treasuries to sterilize the corporate issuer's sale of the dollar. Due to regulatory changes in U.S. money market, it may now be no longer advantageous to issue debt in U.S. dollars, eliminating the downstream effects, including the holding of Treasuries as a reserve asset.

-

A second change is under consideration: the House GOP tax proposal would eliminate the deductibility of net interest expense. If passed, it could have profound implications on how issuers around the globe get their funding, as we shall explain below.

If corporate America can no longer deduct net interest expense, we believe it will make the use of debt less attractive. It would discourage the use of leverage. Banks use a lot of leverage. And, as we are pointing out, one can look at the U.S. as a whole as if it were a bank. A system with less leverage may well be more stable; however, a system that uses less leverage may also have less growth.

From the point of view of America's exorbitant privilege, the key question in our view is how the world reacts. A plausible scenario to us is that American CFOs will move leverage to overseas entities where interest continues to be deductible. Similarly, to the extent that foreign issuers in the U.S. used U.S. legal entities to raise money, they would likely raise funds through foreign entities where interest expense would still be deductible. The question then becomes whether the money raised from these (newly minted) foreign entities would be in U.S. dollar or in foreign currency. If they raise money in foreign currency, the U.S. dollar would be cut out as the "middleman," jeopardizing American exorbitant privilege.

If you take a U.S. firm, if they decide to use foreign subsidiaries to issue debt, they might want to also report more revenue overseas to make it worthwhile to deduct more. CFOs are highly paid, in part we believe, because of their ability to engineer where to recognize revenue and expenses. We would expect CFOs to rationally optimize shareholder value in the context of the regulatory and tax framework they are presented with. Once you take the step of recognizing more revenue abroad, it would only be prudent to match the liability, i.e. the interest expense, in the same currency.

But won't the U.S. be a more attractive place to invest if the entire GOP tax plan gets passed? What about if the U.S. changes to a territorial tax system? What about the border adjustment tax (or a variant thereof)?

-

If the U.S. were to move to a territorial tax system, i.e. no longer tax corporations on their global income, it may provide a further disincentive to issue U.S. debt. In the current tax system, corporations issue U.S. debt to fund domestic operations while avoiding the repatriation of foreign earnings.

-

The concept of a border adjustment tax still needs to take shape before we can have a more definitive opinion about it. From what we see, it appears to foremost provide a one time shock to the system (possibly causing a one time inflationary impact as the cost of higher imports gets passed on to consumers); that said, corporate America might come up with a variety of tricks to mitigate the impact of such a tax (e.g. exporting fuel to their plant in Mexico, thus being able to deduct the cost of energy from imported goods).

-

Not much discussed, but a potential U.S. dollar positive would be if indeed investments could be fully expensed the first years rather than a requirement to amortize expenses over many years, as in the current tax code. That is, if the U.S. incentivized investments over spending. We'll discuss this in more detail once we have more clarity on the actual tax reform.

There's still one more component: a U.S. government that needs to issue a lot of debt to fund its budget deficits. To the extent that foreign governments have less of a need to hold U.S. dollar reserves, funding costs for the U.S. government might rise. While some may believe higher borrowing costs might be a positive for the dollar, the opposite may be true if the Federal Reserve has to keep rates artificially low to prop up an economy that would otherwise deflate; or because government deficits would otherwise be unsustainable. The point being here that the U.S. dollar might become more vulnerable should fiscal and monetary policy not be sound...

In summary, providing a disincentive for debt might make the world more stable, but lead to lower growth. It might encourage more issuance of debt in local currency, something that might also be healthy for global stability, but might leave the U.S. and the greenback behind.

To expand on the discussion, please register for our upcoming Webinar entitled 'Trump or Dump Gold?' on Thursday, February 16, to continue the discussion. Also make sure you subscribe to our free Merk Insights, if you haven't already done so, and follow me at twitter.com/AxelMerk. If you believe this analysis might be of value to your friends, please share it with them.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.