USD Rolling Over, SPX Weakening

Currencies / US Dollar Feb 08, 2017 - 02:52 PM GMT Good Morning!

Good Morning!

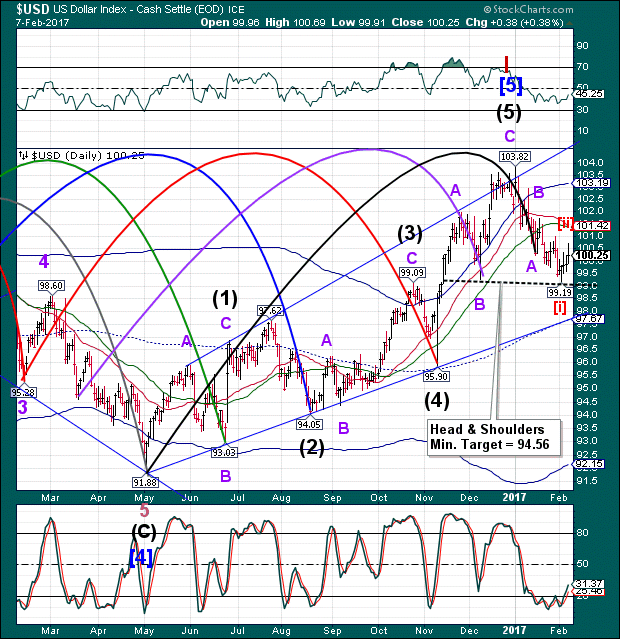

USD futures are fading this morning as a smaller overnight retracement failed to exceed yesterday’s high at 100.69.

ZeroHedge reports, “We're going to need another Fed speaker...

Harker comments overnight on March being live spiked the Dollar...

The USD plunge is being driven by Cable strength...ahead of The Commons Vote on Theresa May's "take it or leave it" Brexit vote amendment.

*U.K.'S MAY WINS COMMONS VOTE ON AMENDMENT TO BREXIT BILL

*AMENDMENT DEMANDED U.K. PARLIAMENT APPROVE BREXIT DEAL

*U.K.'S MAY WINS COMMONS VOTE ON AMENDMENT BY 326 TO 293”

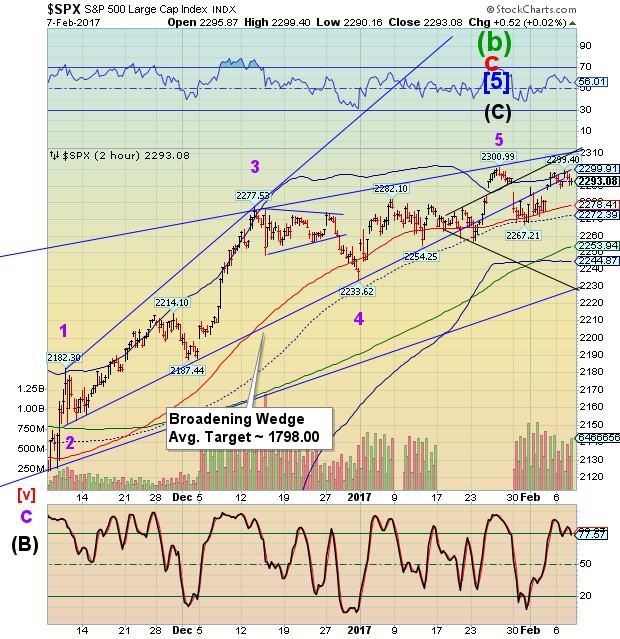

SPX futures, which held steady in the overnight market, appears to be giving way this morning as the USD weakens.

Earlier this morning, ZeroHedge reported, “In a mostly quiet Wednesday session, Asian stocks rose overnight along with European bourses, which were led higher by miners after Rio Tinto posted higher profits for the first time in three years and a bigger-than-expected dividend, while India’s Sensex extended declines after the central bank unexpectedly left rates unchanged. US futures were little changed as oil continued to fall after API reported a huge inventory build in the last week.”

The Cycles Model suggests two possible dates/times for a Master cycle low. They are either mid-day on Monday (4.3 days from yesterday’s high), or late AM on Wednesday (6.24 days, 43 hours from yesterday’s high). Wednesday happens to be a Pi date, but I cannot judge its importance, yet.

ZeroHedge reports, “The latest Investors Intelligence survey reports 62.7% of 'intelligent investors' are bullish the stock market - the highest level since 2004.”

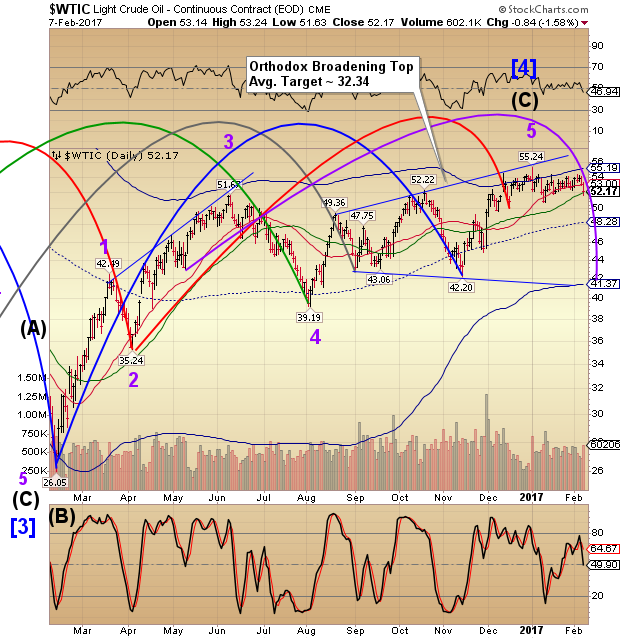

Crude Oil Futures challenged the 50-day Moving Average at 52.00 yesterday. This morning they slid even lower, confirming the sell signal given when crude dropped beneath Intermediate-term support at 53.00, also yesterday.

The Cycles Model suggests a Trading Cycle low is due early next week, just in time for a bounce during options expiration. However, the larger picture suggests that crude may be in for a two-month decline to its next master Cycle low.

Does this portend a similar outcome for SPX?

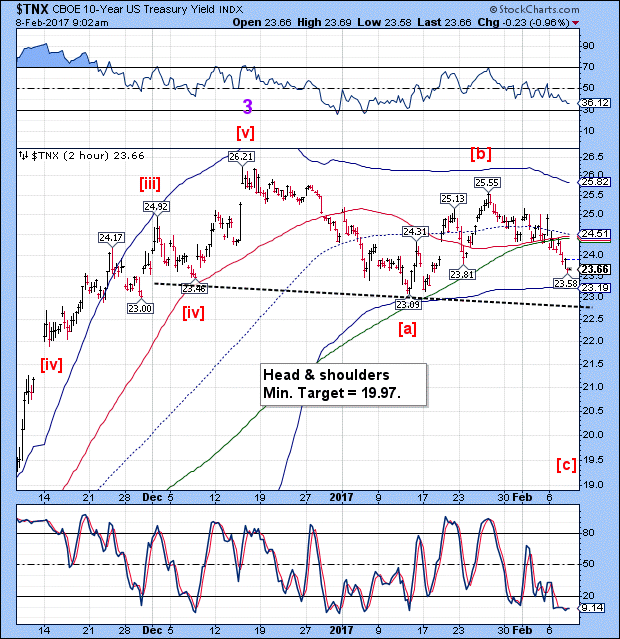

TNX is plunging toward its 2-hour Cycle Bottom at 23.20 and its Head & Shoulders neckline at 22.75. It appears to be due for a Master Cycle low in the next week, parallel to the expectations for the SPX.

VIX futures are flat-to-slightly elevated. There is every reason to believe that the February 1 low at 9.97 is the Master cycle low as well as the low for a decade. It is undetermined whether VIX has completed its retracement or not. A breakout will most likely be our guide.

ZeroHedge reports, “The latest Investors Intelligence survey reports 62.7% of 'intelligent investors' are bullish the stock market - the highest level since 2004.

Furthermore, it appears they are putting their money where their mouth is as net speculative positioning is at (or near) record extremes in VIX (short), Stocks (long) and Bonds (short).

What could possibly go wrong?”

You tell me!

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.