Bitcoin Making Waves In China and Japan

Currencies / Bitcoin Feb 11, 2017 - 03:00 PM GMTBy: Jeff_Berwick

As we’ve said here many times, bitcoin is not a revolution in money and banking. A revolution means returning to where you came from. Instead, bitcoin is an evolution in money and banking.

As we’ve said here many times, bitcoin is not a revolution in money and banking. A revolution means returning to where you came from. Instead, bitcoin is an evolution in money and banking.

It changes the game so massively that the entire financial, monetary and political systems have no idea how to deal with it. For this reason, nearly every country in the world has a different “policy” when it comes to bitcoin.

What should their policies be? Well, they shouldn’t have any policies on bitcoin at all. In fact, government don’t even exist…they are nothing but immoral, illegitimate, superstitions. Yet, people still continue to pay their extortion fees (taxes) and bow to illegitimate authority by lining up in curtained closets every few years to tick a box to legitimize the state. Such a shame.

Every county has a different view on how to deal with bitcoin which is the currency that could end all central banking, wars and big government if not stopped.

It’s like the bankers are all grasping in the dark trying to figure out how to stop the one thing that can destroy them.

In the last week, we’ve seen two totally different approaches in China and Japan.

CHINA

No country has gravitated towards bitcoin more than China.

While China is now more capitalist in many ways than the US and has had a subsequent boom in wealth, they still have heavy capital controls. Chinese people, unless they pay off their local government officials under-the-table, can only take a certain amount of money outside of the country each year. Capital flight was estimated at $700 billion in 2016.

Because of this, the Chinese have moved into bitcoin en masse and view it as a currency without borders that cannot be controlled.

The Chinese central bank, the PBC, has been trying to slow down the bitcoin trade as much as possible. Unfortunately for them, many bitcoin users don’t care what the government says. And even as China has tried to shut down bitcoin exchanges, they just keep operating.

On February 9th, OKCoin, one of China’s largest exchanges, announced a suspension of bitcoin and litecoin withdrawals. The announcement indicated that the People's Bank of China (PBC) has requested the exchange deal with “Anti Money Laundering” (AML) issues.

Of course, money laundering is not a real crime… it is an attempt to avoid extortion (taxes)...but that is the purported reason for the suspension.

The Chinese exchanges will spend the next 30 days updating their systems, after which bitcoin and litecoin withdrawals will, supposedly, be permitted. We wouldn’t be so sure of that, however.

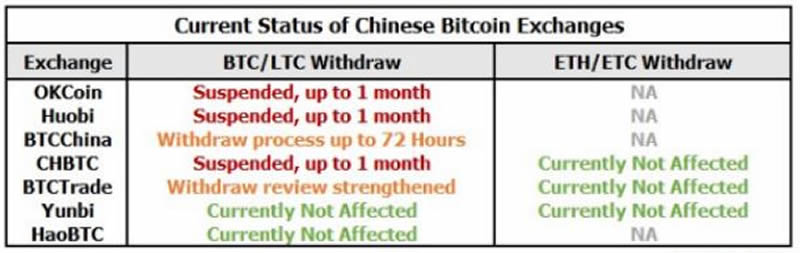

Here is the status of the major bitcoin exchanges in China.

The Bitcoin Price index dropped nearly four percent on Wednesday and the PBC crackdown will have a major impact outside of China as well. That’s because China’s bitcoin trading platforms – China, Okcoin and Huobi – managed over 90 percent of bitcoin global trade.

JAPAN

Meanwhile, in Japan, recent events with bitcoin would seem to indicate almost the opposite governmental reaction. Japan has a new law that will make bitcoins usable, for some, as legal tender. Companies hoping to deal in the new currency must submit to a long list of regulations to ensure that the ‘coins’ are not being used for “criminal activity”.

Companies must have $100,000 in reserve currency to use bitcoin. Additionally, they must pay around $300,000 just to begin with. They must also tell the government about their activities on a regular basis and submit to regular external audits by the Japanese National Tax Agency

After doing all this, there still is no guarantee they will receive a license, even if they abide by government edicts. Plus, only the large corporations can afford to adhere to the requirements. That’s often the way it is with regulatory authority.

In fact, many are comparing the Japanese regulation with the fascist New York State bitcoin licenses that all but make it impossible for almost any company to comply.

CONCLUSION

While governments worldwide try to find ways to slow down or stop bitcoin, bitcoin sits near all-time highs and could be on the verge of spiking much higher. I’ll be outlining my reasoning why bitcoin could go much, much higher, as you’ll see very soon, in our next issue of the TDV newsletter (subscribe here).

As well, we’ve recently published a book that provides you with the nuts and bolts of bitcoin. You can see it HERE.

Bitcoin will also be a big topic of discussion at the TDV Internationalization & Investment Summit on February 24th.

After that, we invite you to stay a bit longer for Anarchapulco itself, the largest voluntaryist conference in the world HERE. It starts the following day and will be held under the same roof of the five-star Hotel Mundo Imperial and finishes on February 28th with an entire day devoted to cryptocurrencies and blockchain technology, called Cryptopulco.

The currency wars are here and we are at the front lines and winning!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.