Roses Are Red... and So's Been EURUSD's Trend

Currencies / Forex Trading Feb 17, 2017 - 10:08 AM GMTBy: EWI

Learn what indicator foresaw the euro's recent reversal to a one-month low

Learn what indicator foresaw the euro's recent reversal to a one-month low

Today, February 14, is Valentine's Day. But instead of chocolate hearts and red roses, we're going to give investors and traders the ultimate gift -- namely, the gift of knowledge.

According to mainstream financial wisdom, market trends are driven by news events much in the same way a lover's heart is controlled by Cupid's arrow. A "shot" of positive news lifts prices; a "shot" of negative news hurts them.

Simple, right?

Not exactly. See, we believe the main force driving market trends is that of investor psychology, which unfolds as Elliott wave patterns directly on the market's price chart. These patterns are not beholden to the current news cycle, and therefore, often run counter in nature to the mainstream outlook for future price action.

Take, for instance, the euro's recent performance. On January 31, the euro was on cloud nine, having started the month at a 14-year low only to end it at a two-month high.

"Why the Euro is a Buy?" asked one January 31 news source.

And, according to the mainstream experts, the answer included a raft of positive economic data released on January 31, such as:

- Eurozone inflation soared to its highest level since February 2013

- Euro area's GDP rose at a faster pace than the U.S. for the first time since 2008

- Euro area registered its lowest unemployment rate in 7 years

- The U.S. dollar suffered its worst January in 30 years

Also in the euro's favor was supportive political rhetoric expressed on February 1 by U.S. President Trump's top trade advisor, who on that day called the euro "an implicit Deutsche mark that is grossly undervalued."

Everything was coming up red roses in the euro's fundamental backdrop.

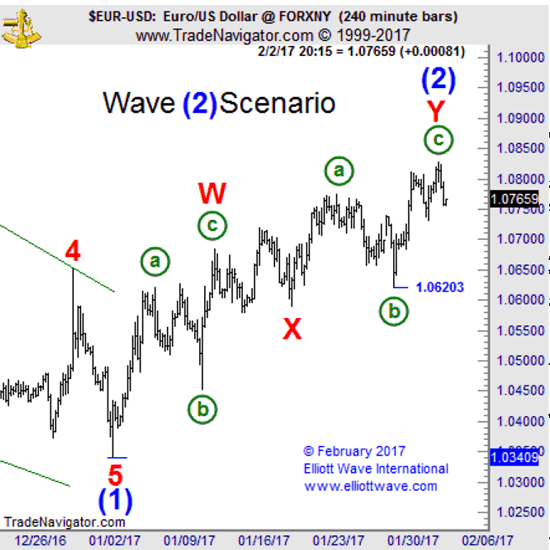

But, according to the analysis our Currency Pro Service posted on February 2, a major bearish development was underway in the EURUSD's technical backdrop -- namely, the end of an Elliott second wave, and start of a powerful wave 3 decline.

"EURUSD poked to a new recovery high before closing lower when compared to Wednesday. The possible reversal day might signal the second wave recovery is finally at an end. An impulsive decline would bolster that idea...

"A decline beneath 1.0620 would signal the turn might have occurred."

So, what happened next?

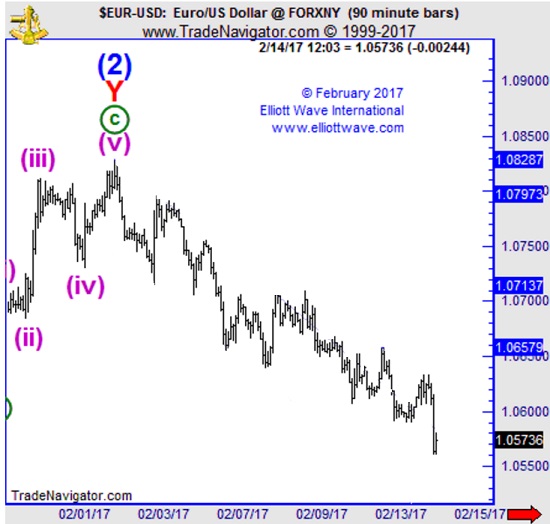

Well, despite the rosy fundamental backdrop, the EURUSD indeed turned down (falling euro, rising dollar), plunging rapidly to a one-month low on February 14. Here, the next chart captures the dramatic decline:

Now, the February 14 Currency Pro Service reveals whether ample evidence is in place of a bottom -- none of which, by the way, comes from the day's news.

Free eBook

|

This article was syndicated by Elliott Wave International and was originally published under the headline Roses Are Red... and So's Been EURUSD's Trend. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.