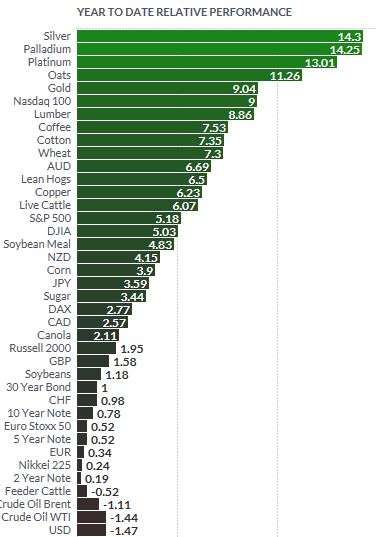

Gold Up 9%, Silver Up 14% YTD - Trump, Le Pen, Hard Brexit, Currency Wars Support

Commodities / Gold & Silver Stocks 2017 Feb 24, 2017 - 04:51 PM GMTBy: GoldCore

- Gold up 1.5% in euros and dollars this week

- Silver up 1.4% this week and now up 14.3% and is the best performing market YTD

- Gold up 9% year to date – fourth consecutive higher weekly close and breaks resistance at $1,250/oz

- Gold up 9.4% in euros year to date as Le Pen’s lead in polls widened

- Gold up another 6.4% in sterling pounds year to date as ‘Hard Brexit’ looms

- French and Dutch elections pose risks to Eurozone itself and the entire European Union project

- Euro contagion risk on renewed concerns this week about new debt crisis due to extremely high public debt and very fragile banks in Greece, Italy and Portugal

Finviz.com

Gold pushed to near a four month high amid heightened political uncertainty in the U.S. and the EU this morning.

Gold rose another $6.40, or 0.5%, to $1,258 an ounce and is currently set for a 1.5% gain this week. It is higher for a second day today and looks set for a fourth consecutive week of gains which is positive from a technical and momentum perspective.

All precious metals have made gains, gold, silver, platinum and palladium, as both the euro and the dollar weakened.

Silver jumped another 1% to $18.25 an ounce. Silver was set for a weekly gain of 1.3%, a ninth straight week of advances and is now 14.3% higher year to date. The best performing market in the world.

Geo-political worries and political concerns in the EU continue which is leading a flight to safety bid in gold futures market and gold exchange traded funds (ETFs) and demand for safe haven gold bullion.

The dollar looks vulnerable due to the uncertainty about US President Donald Trump and the new U.S. administration’s policies. Overnight Trump attacked China and accused the Chinese of being ‘grand champions’ of currency manipulation (see gold news below).

This alone is quite bullish for gold. It does not create confidence about trade relations between the world’s two biggest economies and it suggests that we may be about to embark on the next phase of the global currency wars.

Reduced expectations of a US rate hike in March following the release of the minutes from the US Federal Reserve’s last meeting are also helping gold.

Gold in Euros (1 Week)

Gold is up 9.4% in euros year to date as Le Pen’s lead in polls has widened. Gold is 6.4% higher in sterling pounds year to date as the feared ‘Hard Brexit’ looms.

The French and Dutch elections pose serious risks to the Eurozone itself and indeed the entire European Union project. There is a real risk of contagion and renewed concerns this week about new debt crises due to extremely high public debt and very fragile banks in Greece, Italy and Portugal – See GoldCore News

Gold Prices (LBMA AM)

24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce

23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce

22 Feb: USD 1,237.50, GBP 994.21 & EUR 1,178.22 per ounce

21 Feb: USD 1,228.70, GBP 988.86 & EUR 1,166.16 per ounce

20 Feb: USD 1,235.35, GBP 991.49 & EUR 1,163.21 per ounce

17 Feb: USD 1,241.40, GBP 1,000.57 & EUR 1,165.55 per ounce

16 Feb: USD 1,236.75, GBP 988.41 & EUR 1,163.29 per ounce

Silver Prices (LBMA)

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

22 Feb: USD 18.00, GBP 14.47 & EUR 17.14 per ounce

21 Feb: USD 17.89, GBP 14.41 & EUR 16.97 per ounce

20 Feb: USD 17.98, GBP 14.42 & EUR 16.92 per ounce

17 Feb: USD 18.01, GBP 14.50 & EUR 16.91 per ounce

16 Feb: USD 18.10, GBP 14.49 & EUR 17.02 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.