Stock Market Crash If Trump Doesn’t Push Through the Tax Reform by 2018

Stock-Markets / Financial Crash Feb 28, 2017 - 10:49 AM GMTBy: John_Mauldin

I’ve been doing a multipart series on the proposed tax reforms in Thoughts from the Frontline (subscribe here for free).

I’ve been doing a multipart series on the proposed tax reforms in Thoughts from the Frontline (subscribe here for free).

In part two, I talked about what I like about the Better Way proposal. In part three, I pretty much eviscerated the border adjustment tax (BAT).

I think it has the real potential to create a global recession. You’ll need to read the series to see why, but a lot of it has to do with simple game theory.

It holds that if you upset the equilibrium, the other partners at the table will change their strategies, too. This is a factor that the measure’s Republican proponents are ignoring.

Below is an analysis of the current tax proposal from my friend Constance Hunter, who is the chief economist at KPMG and wicked brilliant. She tries to be fair but comes up with many of the same negatives that I do (and a few more).

One of the things that Constance notes is that real, forceful change is required to get this reform through Congress. Without Democratic support in the Senate, there will be an automatic sunset provision in 10 years that would be devastating to the economy.

There needs to be a real effort to figure out how to create something bipartisan.

Again, it is not that the current proposal doesn’t have many good features. It is that the bad ones—which actually allow you to pay for the good tax cuts—go about it in the wrong way and create serious problems.

Why is this so important? Because if we don’t come up with a tax proposal that can get through Congress this year, then we’re looking at 2018; and do you really think the stock market is going to levitate, waiting until 2018 for a tax proposal that’s not even on the table yet?

Congress needs to focus clearly and figure out what they’re going to do—and not do things that would make the US and global economic situation even worse.

As investors and portfolio managers, we need to be paying attention to what Congress is saying and doing and figure out how their actions are going to affect the economy and our portfolios.

The right policies and programs could be very good for the markets. The wrong ones? You’d want to get out of the way of that train.

“Trump-O-Nomics” – An exploration of the proposals

By Constance Hunter and Jennifer Dorfman

As Donald J. Trump begins the presidency with promises of greater GDP growth and job creation, this report examines both the cyclical and structural backdrop that could impact the efficacy of his plans. The report will also discuss the border adjustable tax proposal and some possible implications. The analysis takes into account the more than 20 percent of U.S. imports that are priced in dollars, a unique situation that alters the normal currency adjustment assumptions economists make when assessing the impact of such a tax.

It is debatable how much influence presidents can have over near-term, cyclical, economic growth. Certainly expansionary or contractionary fiscal policy has some influence, but in the United States, discretionary government spending is a relatively small percent of GDP so this influence is minimal. Presidents have more influence over structural aspects of GDP via changes to regulation, changes to the tax code, and changes to total government spending and resulting debt levels.

In terms of the cyclical prospects for the UnitedStates, the recovery appears to be in about the 7th inning. The Federal Reserve Bank (the Fed) is hoping its policies can create some overtime innings and a soft landing; however, this is often the hope of central banks, yet few are lucky enough to achieve such feats. The largest constraint to the Fed’s goals is apparent tightness in the U.S. labor market. For example, the National Federation for Independent Business1 reports that the number of respondents who say there are few or no qualified applicants for job openings exceeds the long-term average of 42 percent. This suggests that even if the participation rate rose, the lack of labor market depth would still pose constraints for business expansion despite any new incentives from tax changes or other stimulative measures.

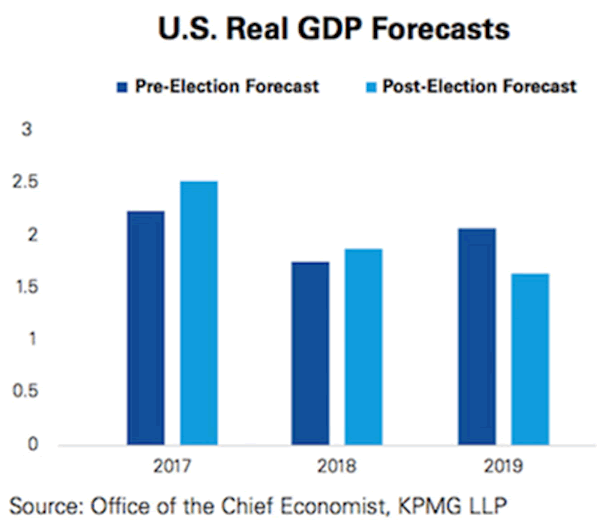

In addition to relatively tight labor supply, the Fed has just raised rates for the second time in the current cycle. Since the election, long-term interest rates have risen more than short-term ones due to anticipation of more frequent rate increases in 2017 and some possible increase in risk premia due to fiscal policy uncertainty. However, we believe the biggest contributor to higher rates is the stronger U.S. economy that was in train before the presidential election. In addition to cyclical momentum seen in jobs and consumption growth, higher oil prices are supporting a return of oil and gas investment. Our base forecast for growth in 2017 is now higher than before the election due to strong growth momentum.

Therefore,Trump enters his presidency at the end of a long, if tepid, expansion with little capacity for faster growth in the near term.

Nevertheless, during the first 100 days, the Trump administration will want to achieve some quick wins. One way to start this would be to streamline regulation. A study from the conservative think tank, Heritage Foundation2 found the cost of new regulations implemented since 2008 amount to an average of $15 billion a year spent on compliance. The argument suggests this is money not spent on generating economic activity and it reduces productivity. Even if this number is off by 50 percent, given that U.S. corporate investment has averaged $130 billion a year since 2010, even $7 billion of extra investment could add up to 50 basis points a year to investment’s contribution to GDP.

In terms of fiscal stimulus from Trump’s tax policies, it is important to remember that in addition to lower personal and corporate taxes, there are proposals that would create offsets to pay for the cuts. At the moment, Republicans are united in saying that the tax cuts and offsets are part of the same proposal and cannot be separated. Therefore, their economic impact must be assessed in concert.

There is a good reason for the insistence by many Republicans that spending not simply stay the same while tax revenue declines due to tax cuts, as this would increase our already high 102 percent general government debt to GDP levels. Here one can turn to a well-established phenomenon in economics, the Ricardian Equivalence Theorem.3 Ricardian Equivalence states that the economic outcome between debt financing and increased private spending is equal.

Or put another way, there is no free lunch. If tax cuts cause the federal debt to rise, then companies and households spend and invest less than the amount of the cut. The greater the debt level at the initiation of the tax cut the smaller the portion that is spent or invested.

The first offset is a change to the deductibility of interest. Under the current House Republican proposal 4, interest would no longer be deductible unless it could be claimed against interest income.

While this is neutral for banks, in isolation it could hurt heavily indebted industries, many private equity structures, and companies that rely on debt versus equity financing. Proponents of the tax change argue that reducing the tax benefits of debt financing would allow better allocation of capital and would normalize the U.S. tax code with the rest of the world. Nevertheless, most U.S. companies will see an increase in their weighted average cost of capital (WACC). According to outside estimates of the GOP proposal, this would raise more than $1 trillion in additional tax receipts.5 However, this change comes at a price. A November 2015 paper by RLG Forensics in association with the Association for Corporate Growth predicts that “revenue neutral” in terms of the federal budget is not the same thing as “impact neutral” in terms of equity valuations or economic impact.6 Proponents of the change argue that investment expensing and the reduction of the overall corporate tax rate to 20 percent will offset the increase of the cost of WACC in many cases. While this may be true eventually, the transition period is likely to cause lumpiness in investment spending, which could well translate into some quarters of negative growth.

The second offset, implementing a border adjustable tax, is estimated to raise $1.2 trillion in tax revenue over 10 years. One main motivation for this tax appears to be that it would discourage corporate inversions. As A Better Way7 notes, “Taken together, a 20 percent corporate rate, a switch to a territorial system, and border adjustments will cause the recent wave of inversions to come to a halt.” However, other claims that the change will now favor exports over imports ignores linkages between imports, exports, and foreign exchange values. Perhaps more importantly, if the tax changes did reduce our imports, it would also reduce our standard of living, as more goods and services would be sent to foreigners while receiving fewer goods and services from them in return.8

Indeed the fact that in any given year 20–30 percent of U.S. imports are priced in dollars means the J-curve effects of the currency adjustment would likely take longer and could be adverse for importers of commodities in the short term. Additionally, the linkages in global value chains where many goods are priced in dollars, the long-term nature of contracts, and general price stickiness throughout the value chain mean the transition between implementation and complete currency adjustment could disrupt U.S. and global GDP growth.

Nevertheless, many economists make several arguments in favor of a border adjustable tax system.9

- It would align more closely with the VAT system in most of our trading partners where exports are not taxed but imports are.

- Border adjustments reduce the incentive to manipulate transfer prices by shifting to lower tax jurisdictions based on tax policy alone.

- Border adjustments reduce the incentive to shift profitable production activities abroad simply for tax benefits of lower tax jurisdictions commonly known as corporate inversions.

- Proponents argue that border adjustments are not trade policy, but rather create a level playing field between domestic and overseas competition.

- Border adjustments do not distort trade as exchange rates should react immediately to offset the impact of these adjustments.

Many economists agree with most of these points. We concur largely with points 1-3 and in the long run with point 5, although the implementation phase could cause disruption that may have a significant near-term impact on GDP. On point 5, the reserve currency status of the United States blunts this negative impact. Our research suggests that the reserve currency status of the United States and integrated global value chains could slow the rate of currency adjustment with adverse unintended consequences for world and U.S. growth. The stronger U.S. dollar will raise prices of dollar priced goods for the rest of the world which will, at some point, if not immediately, lower demand for these goods. No immediate adjustment will take place on the 20–30 percent of imports priced in U.S. dollars, and it will raise prices and lower demand of these goods worldwide.

Raising $1.1 trillion in taxes means that cost must be borne by some part of the economy either domestically or by trading partners. In the example below, the tax law change simply shifts the burden of the tax to different types of businesses.

Auerbach and Holtz-Eakin assume that the world price of the goods remains the same and that the dollar appreciates to offset the border adjustment. They also appear to assume that the good is priced in foreign currency and no long-term contracts or integrated value chains are in place. Economic theory suggests that the higher import tax cost in the example below does not mean that the firm does worse after tax under the new system once the currency adjustment is completed and the cost of imports falls due to the higher value of the U.S. dollar. Under the new law, the firm in the example below can deduct only 20 of its purchases rather than 30 because 10 represents the imported amount. However, as Auerbach and Holtz- Eakin’s paper explains, the import costs will adjust to be 8 in dollar terms, rather than 10, if the tax rate is 20 percent. This means that the firm’s after-tax cash flow will be the same in the two cases; 80 percent of 15 = 12 under the current system, and 80 percent of 25 = 20 – nondeductible expenses of 8 = 12 under the new system.

We worry that this assumption is a bit too neat and the real-world adjustment will be less smooth and not immediate. As the home of the reserve currency, U.S. importers have the significant advantage of never having to worry about currency price fluctuations (in particular a devaluation of the dollar) impacting the purchase cost of commodities and many other goods that are part of the global value chain. There are other advantages such as significant demand for U.S. Treasuries keeping U.S. borrowing costs lower than they otherwise would be. But the chief advantage for the purpose of analyzing the border adjustable tax is that commodities trade in U.S. dollars.

The example put forth by Auerbach and Holtz-Eakin assumes the exchange rate absorbs the tax change and the cost evaporates in currency fluctuations. The tax law change would then encourage investment as its full expensing regime makes this activity more attractive; it would also blunt the impact from the import tax. It is implicitly assumed that this greater investment will translate into greater economic activity and yield a higher growth rate. One may also assume one has a can opener.10

Over the long term, it seems reasonable that the proposed tax law change would simplify the code, which in and of itself could allocate scarce resources to better use thereby improving GDP. However, the transition to the new system as laid out in A Better Way does raise some questions, a few of which are outlined below.

- The assumption that all traded goods are priced in foreign currency is a key part of most exchange rate models that one can apply to this situation. Examples such as the Bickerdike-Robinson-Meltzer Model assume the supply and demand schedules shift downward by the same proportion as the appreciation.11 It also assumes the good is priced in foreign currency terms, which for the United States is not the case for 20–30 percent of its imports in a given year.

- The demand elasticity is not the same for each imported product so the currency adjustment on a good-by-good basis may not be equal to the tax change. Therefore, some importers would be more or less advantaged as would some exporters.

- With no offsetting tax cut, a rise in the value of the dollar would hurt exports. With the reduced corporate tax, exporters would presumably have room to lower the price of their goods in line with the amount of the appreciation of the currency. However, this transition is likely to be “lumpy” and could reduce exporters’ revenues during the transition period and beyond.

- Not all importers are engaging in corporate inversion or are importing goods because of tax reasons. Global value chains (GVCs) have become increasingly integrated. In 2011, nearly half of world trade in goods and services took place within GVCs, up from 36 per cent in 1995.12 This is due in part to labor cost differentials, in part to sourcing of raw materials, and in part to expertise in certain products and services. Thus, changing the way imports are taxed for U.S.-domiciled companies is likely to cause disruption to globally linked supply chains many U.S. multinational companies have in place.

- The J-curve effect means that there is a lag between when a currency change takes place and the physical change in imports or exports is realized in the current account balance. Usually orders that existed before the currency move have yet to be paid for, thus the J-shaped change in the trade balance immediately following a substantial currency move. A stronger dollar should increase the current account deficit over time as U.S. dollar exports become more expensive to our trading partners. Additionally, the immediate effect would be a reduction in the current account deficit. This would be an addition to GDP but it would also correspond to a significantly smaller capital account surplus and would likely negatively impact the U.S. equity market and increase U.S. interest rates, all other things equal.

- The idea of wanting to stimulate exports, reduce imports, and reduce our current account deficit ignores the other side of this accounting identity, the capital account. As Ruddy Dornbusch wisely noted, “The flow of investment and the changes in the value of real capital potentially dominate the effects of current account imbalances. A good week on the stock market produces a change in wealth that is several times the magnitude of an entire year’s deficit in the current account. Although it is true that the current account is important because persistent current imbalances accumulate, exactly the same argument can be made for investment.” A persistently lower current account deficit would equal a persistently lower capital account surplus and over time higher interest rates and lower stock market returns. Conversely, a high current account deficit means there is a higher capital account surplus and an abundance of capital in the U.S. market. This is also a function of our reserve currency status; foreign holders of U.S. dollars need to invest their holdings in U.S. assets. Therefore, one can argue that the benefit to the economy overall of running a current account deficit and a capital account surplus not only outweighs the costs, but is a corollary to reserve currency status.

- While it is commonly known that commodities trade in U.S. dollars, it is likely less widely known that much of the global value chain of intermediate goods also trades in dollars. This is in part because the U.S. consumer base is the largest in the world which reinforces the United States’ reserve currency status. If at the margin a border adjustable tax caused fewer goods to be priced in dollars, it could have the unintended consequence of pushing the U.S. dollar further from reserve currency status.

There are of course other aspects of the A Better Way blueprint that could have unintended consequences. The list above is meant to stimulate thought and improvement of the plan and its implementation.

While some theory does support the idea that it would improve U.S. GDP, there are a lot of assumptions that cannot be counted upon. It cannot be overstated that while a major tax overhaul of this kind could in the long run benefit the U.S. economy, the transition is likely to be lumpy and could even see some quarters of negative growth as adversely impacted firms or industries suffer or go out of business.

The comprehensive and sweeping nature of the proposed tax changes and the fact that they will be much more effective if they are permanent means that the GOP will want to be strategic in the way they pass the bill.

There are two options that would eliminate the need for a sunset provision. The first would require at least eight Democrat senators to sign on. This means that compromise will alter the current proposal. It also means that passage before the end of 2017 will be difficult. Reagan’s 1986 tax law change took three years to negotiate and this tax bill will take time as well. The second way the GOP could make the law permanent is the so-called reconciliation process. This is only possible if the law does not increase the deficit in any year beyond the official 10-year budget window. Some believe this is their current plan—to construct the bill in such a way to be revenue neutral or positive in years 11 and beyond. This too would require significant changes to the current law. The Tax Policy Center assumes the current plan adds to current deficit levels by $3.3 trillion over the first decade.

In the meantime, it is expected the U.S. dollar to be the most immediate asset to anticipate this change in policy over the course of 2017. Any move in the dollar will be buttressed by the interest rate differential between the U.S. and other high- grade government debt markets. Higher interest rates will put pressure on Trump to achieve GDP wins early as it will reduce U.S. exports, increase imports, and have a negative effect on GDP. Therefore, as stated above, regulatory changes are expected to be sweeping withinTrump’s first 100 days. However, even this is not a panacea as many of these changes will be seen in the energy space where the value of a barrel of oil will be just as important in determining investment levels as regulatory changes. Remember, a stronger dollar reduces the demand and price for oil in foreign currency terms, all things being equal.

Therefore, it is fair to say that Trump’s 4 percent growth target faces challenges from both structural and cyclical factors. Streamlining regulation is Trump’s best bet for a quick win on increasing GDP.

Subscribe to John Mauldin’s Investment Newsletter, Outside the Box

In this weekly newsletter, John Mauldin shares controversial essays from fellow economic experts. Whether you find them inspiring, upsetting, or outrageous… they’ll make you think Outside the Box. Get it free in your inbox every Wednesday.

__________1 NFIB, Haver Analytics

2 Gattuso & Katz, (2016) “Red Tape Rising,” Heritage Foundation

3 Buchanan, James M. (1976) “Barro on the Ricardian Equivalence Theorem,” Journal of Political Economy

4 A Better Way (2016) Better.gop

5 Nunns, Burman, Page, et al (2016) An Analysis of the House GOP Tax Plan, TaxPolicyCenter.org

6 Morris, (2015) Eliminating the CIT Deduction: Valuation Implications for Middle Market Enterprises. RLG Forensics

7 A Better Way (2016) Better.gop

8 Viard,(2009) Border Tax Adjustments Won’t Stimulate Exports, AEI.org

9 Auerbach and Holtz-Eakin, (2016) The Role of Border Adjustments in International Taxation, AAF.org

10 A can of soup washes ashore. The physicist says, "Lets smash the can open with a rock." The chemist says, "Let's build a fire and heat the can first." The economist says, "Let’s assume that we have a can opener.” Crickets.

11 Bickerdike-Robinson-Meltzer (1975), Vol 65, no 5 American Economic Review

12 Trade in value-added and global value chains: statistical profiles, WTO, wto.org

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.