Trapped Longs In Miners As Gold Poised For Fed Fuelled Fall

Commodities / Gold & Silver Stocks 2017 Mar 06, 2017 - 02:50 PM GMTBy: Bob_Kirtley

The Fed will hike rates this month and signal further hikes to come. Gold prices have yet to fully digest this reality, and therefore there is a strong case for a major move lower in the yellow metal. A Le Pen victory in France could derail the Fed’s plans for a follow up hike in June, but in the short term the gold market is vulnerable to a sharp move lower. There are a number of trapped speculative longs in the futures and mining stocks and we are approaching a period of seasonal weakness. We target a move to $1050 initially, and see merits in a larger move to $720 should the Fed persist with further hikes.

The Fed will hike rates this month and signal further hikes to come. Gold prices have yet to fully digest this reality, and therefore there is a strong case for a major move lower in the yellow metal. A Le Pen victory in France could derail the Fed’s plans for a follow up hike in June, but in the short term the gold market is vulnerable to a sharp move lower. There are a number of trapped speculative longs in the futures and mining stocks and we are approaching a period of seasonal weakness. We target a move to $1050 initially, and see merits in a larger move to $720 should the Fed persist with further hikes.

March Hike A Done Deal

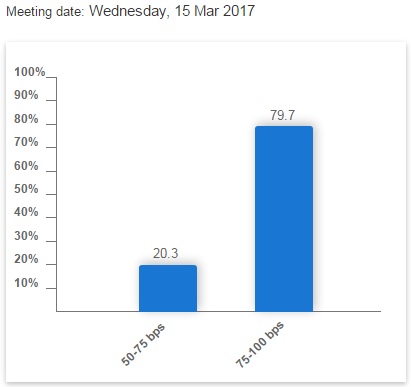

The Fed speakers last week unequivocally signalled a March hike. Yellen’s speech to cap the week off confirmed this, and we therefore expect the Fed to hike at next week’s FOMC meeting. Although we still have an employment print before then, the Fed can look through the weakness of one print given the strength of the rest of the data and their clear preference to raise rates.

The Fed has made it clear that is never wishes to surprise the market with a hike. Therefore the explicit signalling last week was meant to prepare the market for a hike this month. Markets have adjusted, now pricing an 80% probability that rates will rise.

Even more importantly than signalling a March hike, the Fed speakers made it clear that more hikes are set to come. The last guidance we got from the Fed (in December) was for 2-3 hikes over 2017. However now that the Fed is taking the first opportunity to lift rates this year, there is a risk that they are now considering more than 2-3 hikes.

Whether or not these hikes will be delivered remains to be seen, but the first definitely will be, hence the risk profile has shifted in favour of more hikes rather than less. In fact, there are only a few scenarios that we see derailing a follow up hike in June.

Le Pen Could Stop June

The economic data is obviously very important to the Fed’s decision making progress. However economic data is often sluggish and given the solid backdrop of data over the last year, a few soft prints could probably be looked through by the Fed given their long term bias to move rates to a more neutral level. It would take a rapid deterioration in the data between now and June to stop the Fed hiking again.

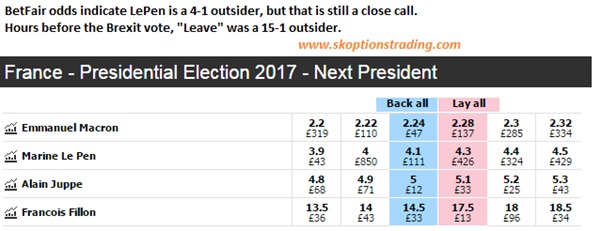

However unlike economic data, a severe change in the geo-political landscape can happen very quickly. The prime candidate for a large disruption in the geo-political environment is the French elections. The first round of the 2017 French presidential election will be held on 23 April. Should no candidate win a majority, a run-off election between the top two candidates will be held on 7 May. It looks likely that we will go to a runoff and that Marine Le Pen, the National Front candidate, will be one of the two candidates.

Polls still show a Le Pen victory as unlikely, but anybody putting too much weight on polls after their woeful predictions in the Brexit referendum and US presidential elections, is being incredibly naïve. We are largely ignoring the polling statistics. As far as we are concerned, we have a two horse race for the presidency and that means there is enough of a chance of a Le Pen victory to be concerned with, especially given the consequences.

Regardless of the precise probability, the risk is asymmetric into this election. Le Pen is a strong opponent of the Euro and advocates France leaving the common currency. She has pledged to take France out of the Eurozone and, unless the EU agrees to revert to a loose coalition of nations with neither a single currency nor a border-free area, to hold a referendum on France’s EU membership. Therefore this election is more important for the EU than Brexit. Britain held a referendum on EU membership, but if Le Pen is elected then France could leave the EU and Euro with no referendum. This would arguably signal the end of the European Union.

This is the biggest risk to our view on Fed policy. A June hike is off the table should Le Pen win. All hikes may be off the table. It would see us cut our short positions on gold. However, unless this happens, the path is clearly set for more hikes from the Fed and lower gold prices.

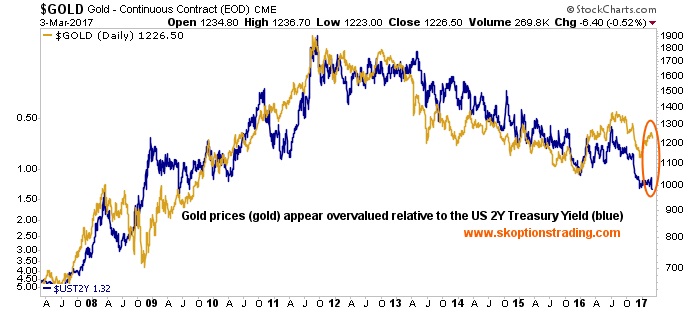

Multiple Hikes Will Cripple Gold

Gold has enjoyed a large bull run as quantitative easing programs around the world, particularly in the US, kept interest rates low and made the yellow metal a comparatively great investment. Whilst it’s been a stuttering start, the unwind of this easing and beginning of a tightening is underway. The tightening of monetary policy in the US will drive gold prices much lower.

We have not ever been, and will never be, perma-bears nor perma-bulls. We trade gold from a macro-economic viewpoint and at present the macro trend implies much lower gold prices. In fact, our best year on record (2010: +167%) came from being aggressively long gold in anticipation of QE from the Fed. Our second best year on record (2013: +93%) largely came from aggressive short positions in gold in anticipation of the tapering of QE programs by the Fed.

We are potentially at the very start of a large macro driven decline in gold prices. Multiple hikes from the Fed and potential unwind of the QE inflated Fed balance sheet down the road could see a multi-year bear market in gold. Looking years into the future is beyond our scope, but it is with high conviction that we express our view that multiple Fed hikes this year will drive gold prices to re-test the lows. A March hike should test $1125 and a follow up in June will question the $1050 support. If the Fed is still intent on further hikes, then $720 is not out of the question.

Seasonality A Further Blow To Bulls

The seasonally weak time of the year for gold, and gold miners is also upon us. On average over the last decade, gold has lost 3% in March. Whilst there is sometimes some fightback in April, the “Sell in May and Go Away” adage kicks in hard for gold and mining stocks. Gold mining stocks haven’t made gains in May for eight years, losing an average of 5.5% in May over that time.

These so called “summer doldrums” are often tough on the yellow metal and associated stocks. The pressure of Fed hikes over this period will only make this worse. Our preference is hold shorts over the next few months before re-evaluating following the June FOMC and towards the end of the European summer.

Momentum Is Gone

The yellow metal has been sluggish to react to the Fed’s signalling of a March hike. This is not out of the ordinary, with gold often slower to respond to changes in the macro landscape than larger highly reactive markets such as fixed income, which dominate much of the focus.

It has reacted enough to take the bullish momentum out of its sails though. Technically, gold has tested the $1225 support zone which we expect to break this week. The rising wedge formation so far this year has been broken, and gold looks primed for a $100 fall, with only minor support around $1185.

The loss of bullish momentum is evident from the declining RSI and a bearish MACD cross adds weight to the bearish technical arguments. We had been noting for the last couple of months that whilst gold had bearish fundamental pressure, the technical set up was bullish and gold had plenty of momentum. We now have a bearish technical set up to match the bearish fundamentals

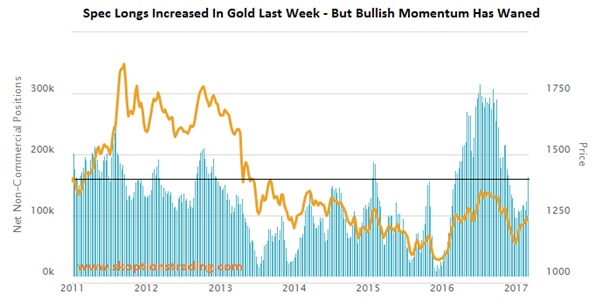

Speculative Longs Are Trapped

At the end of February the speculative long positioning in gold jumped, as leveraged accounts increased their long exposure, attracted by gold’s bullish momentum. However such accounts will begin to cut their longs should gold lose its momentum. This week saw gold lose its momentum and therefore we expect to see these accounts sell their positions, especially ahead of the Fed hike, creating downward pressure on gold.

Chart from www.oanda.com

The price action in miners this week exposed just how long the market is in this sector. Speculative money has flooded back into miners after their speculator rise. At the end of January we wrote an article entitled “ Gold Mining Stocks Could Halve In 2017” and the sheer volume of negative feedback we received following this made the positioning glaringly obvious. Since then GDX is down -4.1%.

Whilst we could see a bounce in miners from here on a technical basis, it will be short lived. The trapped longs will be looking to sell into strength to lighten positions, as opposed to buying. We will be initiating short positions into a bounce and still hold the view that gold mining stocks could halve in 2017.

Stay Short, Sell Rallies

Our own capital is at risk in all the trades we make. We are short gold with no intention of taking profits any time soon. We intend to stay short and sell rallies from here. Whilst we acknowledge the possibility of a long term move to $720 in gold, we are not yet positioned for such a drop. We are targeting a re-test of $1050 and have expressed our short via various option strategies. The specifics of these are available to subscribers only, so if you wish to become a subscriber please do so via either of the buttons below.

The main risk to our view is a Le Pen victory that rocks the Fed off course. Should the Fed remain on course then we will look to re-position for a major move lower in gold to $720 over the next year. Looking at the macro economic landscape, gold is simply the best asset to be short into Fed hikes, offering compelling reasons from a relative value, positioning and technical basis.

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

www.gold-prices.biz

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.