Inflation Tsunami - Supermarkets, Retail Sector Crisis 2017, EU Suicide and Burning Stocks

News_Letter / Retail Sector Mar 13, 2017 - 12:35 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

5th March, 2017 Issue # 5 Vol. 11

Inflation Tsunami - Supermarkets, Retail Sector Crisis 2017, EU Suicide and Burning Stocks Dear Reader, In June 2016 the people of Britain voted against the interests of the establishment political elite that have played pass the parcel amongst themselves at each general election for at least the past 40 years, who in treaty after treaty have been systematically selling the sovereignty of the British people to the emerging european union superstate primarily for personal gain. Whilst the formal process for Britain leaving the European Union remains pending triggering of Article 50, which should occur by the end of this month. However, despite little so far having changed on the ground in Britain's relationship with the EU, there was one significant immediate reaction to the Brexit vote which was sterling's sharp 20% drop and which currently stands about 18% below its pre-brexit trading level.

The implications of sterling's sharp drop were obviously inflationary resulting in an an increase the price of imports and therefore has been exerting upwards pressure on shop prices as suppliers restock at the worse exchange rate. The most recent inflation data for January 2017 has RPI rising to 2.6% from 1.4% before Brexit and CPI at 1.8% against pre-Brexit CPI 0.6%. Whilst factory gate price inflation has risen to 3.5%.

Whilst my forecast expectations were for a far rapid rise in the rate of UK inflation towards an early 2017 peak of CPI 2.8% and RPI 4% before declining into the mid 2017 as the following video illustrates: However what's worse is that Britain's inflation trend goes beyond the Brexit sterling plunge, instead is becoming subject to a global inflation surge as a consequences of 8 years of central bank zero interest rates and rampant money printing as the US CPI inflation graph illustrates.

US CPI jumped sharply higher to 2.5% up from 1.7% the month before. Similarly Germany the bastion of price stability is also witnessing the early signs of an surge in inflation, rising to its highest level for 3 years to 1.7%, with the economic basket cases such as Spain not far behind on 1.4%, that collectively have sent euro-zone inflation soaring to 1.8% from 1.1% the month before, which is a far cry from the deflation expectations of economies that have remained in economic stagnation, even depression for the past 6 years. Meanwhile the euro-zone nation that has suffered the most from being tied to the German Economic Empire, Greece, whilst continuing to have a shrinking economy i.e. likely to experience a further contraction of about 1% for 2017, an economy some 25% smaller than where it was 7 years ago whilst at the same time having been loaded with $400 billion of bailout debt that ensures Greece remains permanently bankrupt. Nevertheless Greece is also witnessing a surge in inflation to 1.5% up from 0.3% the month before. Which illustrates that regardless of the fundamentals of domestic economies, the euro-zone nations are all tied to Germany, so if Germany experiences sharply rising prices then so will the whole euro-zone. The big question mark is the surge in global inflation temporary or are we about to finally see runaway inflation as a consequence of the world central banks collectively having conjured some $20 trillion out of thin air and printed about $100 trillion in additional debt (government bonds) to save the bankrupt banking crime syndicate. Rampant money printing that asset prices such as housing and stocks have already greatly leveraged themselves to in the mother of all bull markets, far beyond anything any one could have imagined back at the start of the bull run in 2009. Well we are clearly starting to see some seepage out of the banking / asset price system towards feeding the wage price spiral (including in work benefits), the consequences of which will be for the further loss of purchasing power of savings / bond investments and earnings. Whilst continuing to inflate the price of assets that cannot be easily printed such as housing. Which implies to expect a far higher and sustained spike in UK inflation during 2017 as the temporary Brexit Tsunami inflation wave becomes absorbed into a global rising inflation climate, the real world consequences will be one of a 10% hike in UK food prices during 2017 that will have a severe impact on consumers who are already facing energy price hikes of as much as 14% from the likes of NPower with city councils across England warning of hikes of 5% to 10% in council tax to cover the shortfalls in central government funding, all of which is leading towards a perfect storm for the retail sector that looks set to trigger thousands of job losses and store closures. Therefore the key indicator to watch for the inflation mega-trend driver for 2017 is wage inflation that has already surged higher to +2.6%, that I suspect will continue to trend higher resulting in pressure for UK interest rate hikes during 2017, for the one thing that central banks fear the most is triggering the wage price spiral. Retail Sales The latest retail sales data shows a continuing falling trend in consumer spending since its October 2016 peak, with volumes falling at the rate of 1% per month and the amount spent down by 2% in 3 months. This whilst shop prices have risen by 1.5% in 6 months.

What's more alarming is that retail sales fell during usually the strongest sales period of the year (December). Instead sales peaked in October and it was as though Christmas never happened! As normally one would expect a December spike followed by January weakness, instead a clearly increasing squeezed consumer has been cutting back on spending in the face of rising shop prices. This again does not bode well for the retail sector from the high street, to the super markets to the shopping malls and even the online retailers, all of which are battling between themselves to grab a slice of a contracting market, where the biggest losers are those least able to adapt and complete such as the Super market giants, Tesco, Morrisons, Asda and Sainsbury who continue to haemorrhage customers to the discount retailers such as Aldi and Lidl. Shrinkflation and Fake Prices The Supermarket giants that dominate Britain's retail sector have both delayed passing on most of the consequences of the sharp fall in sterling to consumer in the form of price hikes and by playing a game of hide the inflation with consumers, which is why the inflation indices have so far not quite spiked as sharply higher as I originally expected. Once such example of the game all major producers / super markets are playing is one of shrinking package contents. A 10% to 15% cut in pack contents achieves far more inflation than from sterling's drop which on average would equate to about 5% of the price of goods in the shops. For instance one real world example is of crisps multi packs that had been sold in packs of 6 are now suddenly being sold in packs of 5, that's an effective stealth price inflation of 17% on the item without impacting the inflation indices! Channel 4's Dispatches recently investigated the phenomena of 'Shrinkflation' : However, arrogance born of size has led the super markets to go one step further, perhaps one step too far as the recent BBC investigation into TESCO's FAKE Shelf prices revealed! Shelf prices that FAIL to convert at the checkout tills by virtue of Tesco having left expired offers on the shelf's, effectively fooling customers into buying products at literally DOUBLE the expected price. I covered Tesco's fake shelf prices in the following recent video, though again all of the major super markets play the same game to some extent, it's just that Tesco got carried away and triggered a BBC investigation: The delays in price hikes and the games the super market giants are playing that customers are eventually seeing through will continue to convert into rising food price inflation during 2017, perhaps by as much as 10% which will have a severe impact on consumers and the already depressed retail sector. UK Shopping Malls Death Spiral Huge expensive to operate Shopping Malls have been losing out to the online retailers for more than decade and it won't be long before we start to see Britain's first shopping malls turning into closed down dead zombie apocalypse backdrops as are littered across the United States. Here is an example of why large UK over priced shopping malls are likely to continue to suffer during 2017. Meadowhall, Sheffield’s 25 year old ageing shopping mall which has all but killed Rotherham and crippled Sheffield town centres is now itself facing a bleak future as the internet slowly kills it and many of the Britain's shopping malls. The death of Britain's shopping malls will be slow and painful, as increasingly more and more shops disappear from the mall's leaving behind boarded up painted backdrops, but death of many if not most shopping malls is inevitable as footfall and more importantly average spend continues to fall for the malls that just cannot compete on price against the likes of Amazon, which is what everyone with smartphone's at hand focus upon as the compare shop prices with online prices. Why waste time searching in a mall for items that could cost 30% more when it can be searched and bought online within a few minutes?

I expect increasingly desperate shopping malls management to employ ever more creative methods in an attempt at milking existing customers to encourage more spending by means of greater incentivisation of staff to push the hard sell for commissions. We already see this hard sell at work at the likes of Heathrow Airport, so called Heathrow Ambassadors who are little more than sales people pushing the sheepers to be fleeced of their cash in exchange for junk that they mostly don't really need. The only thing that I can see that could prevent a shopping malls inevitable demise if the shopping mall reinvented itself into something else, for instance an entertainment centres, or even a theme park, i.e. ton become a destination to be entertained for which people will be willing to pay premium, rather than just being a long line of over priced shops. Business Rate Hikes It's not only Britain's consumers who will soon to be hit with large council tax hikes but also retailers with large property portfolios such as the super market giants likely to be subject to huge business rate hikes that could total an extra annual tax bill of £1 billion, which again will translate into upwards pressure on shop prices. Retail Sector Impact Therefore the retail sector is facing a perfect storm of rising prices, falling consumer disposable earnings and haemorrhaging customers to the discounters. All of which will culminate in increasing pressure on profit margins and balance sheets. Whilst it is still too early to imagine another woolworth's moment, i.e. a retail giant going bust, nevertheless there will be an impact which will at the very least translate into more job losses and probably the mothballing of many unprofitable stores, the closure of huge super markets, something that is unthinkable to most will likely become a reality so as to bolster profit margins by cutting costs by closing super markets that are no longer able to operate at a profit. And one of the primary places to look for the degree of retail sector distress is at the stock price charts, for whilst the FTSE just set a new all time trading high then clearly relative underperformance shows the degree to which a stock is in distress, the further the deviation the greater the distress, with my focus mainly on how does today's stock price compare to the high of the past 5 years.

1. TESCO I have already been covering the unfolding crisis at Tesco, Britain's super market giant in a series of videos the first of which is - The Tesco stock price says it all of just how badly run Britain's super market giant has been for many years, which goes beyond the usual dynamics of a badly run businesses that over expanded during the good years, but one of actual fraud on a mega scale, a £326 million hole in the companies accounts that the mainstream press has covered to great extent during the past couple of years.

At £1.89 the Tesco share price is trading at about 50% of its 2013 high. That's a 50% LOSS of market capitalisation over the past 4 years, valuing the super market giant today at just £15.5bn. I am sure many inexperienced investors looking at the 50% drop in the Tesco stock price and imagine how cheap Tesco now is. We'll it's not cheap if it halves in price again! Tesco's valuation is now less than its estimated debt mountain of £16 billion resulting in a debt to capital ratio of 75%. However, there is even worse news for long-term Tesco stock holders, for the stock peaked at about £4.75 in 2007, so long-term investors will be lamenting on a whopping 60% LOSS in value! This whilst the FTSE is trading at all time highs says it all of just how big a basket case Tesco has become! Literally in a death spiral with no end in sight! Whilst investors looking for the dividend need not bother, for there is NO DIVIDEND! Tesco's revenues have already fallen from £64 billion a few years ago to £54 billion for 2016 as the super market giant continues to haemorrhage customers to other competitors and the discount retailers. And when companies find themselves in trouble in terms of losing revenue and market share then they tend to double down, so when faced with the prospects of further contraction in revenues then the name of the game is to artificially boost revenues and market share through acquisitions via debt fuelled purchases to give the illusion of revenue and market share stability. So it is no wonder that Tesco is showing signs of panic as illustrated by its recent purchase of Booker owner Budgens for £3.7 billion, despite the fact Tesco already had a huge debt mountain before this £3.7 billion purchase! Personal Experience- Whilst the large network of stores means that Tesco is by far the most convenient of all supermarkets for most shoppers, which tend to be well stocked in terms of product range. However, Tesco loses all of the advantages due to lack of adequate staffing especially in the evenings and prices tending to be at least 5% higher than the likes of Morrisons, and this without taking into account the recent disaster of the BBC exposing 'fake shelf prices', that fail to convert at checkouts. My Tesco big shops have over time become far less frequent, probably 1 in 5 shops of over £200. Which means Britain's super market giant is likely to continue to suffer and lose market share to its competitors such as Morrisons as big spenders increasingly shop elsewhere. 2. Sainsbury's Sainsbury may be Britain's second largest super market in terms of sales, but despite Tesco being a basket case there still remains a huge gap between Tesco and the rest. For instance Sainsbury's revenues are less than half that of Tesco's at £24 billion, and Market capitalisation is just £5.81bn. Though despite its much smaller size, Sainsbury currently generates's twice the profit as Tesco (£486mln against £240mln) which once more illustrates just how badly Tesco's is being run.

Sainsbury stock price at £2.67 is trading at 70% of its 2013 high of £3.81. So whilst in much better shape than Tesco, nevertheless is significantly under performing the FTSE as clear sign of distress. Though unlike Tesco has managed to maintain its revenues above £23 billion for the past 4 years. So whilst not growing, Sainsbury is neither in a death spiral like Tesco in terms of losing of revenues. With a far healthier debt to capital ratio of 26%. And more good news for investors is its 4.5% dividend yield!

Personal Experience- Sainsbury is in a similar boat to Tesco, i.e. over priced, though it appears most customers are willing to put up with higher prices for better service and so could continue to maintain its revenues whilst witnessing some erosion of profits. That and Sainsbury stores on balance tend to be better located than Tesco stores which perhaps got carried away with its earlier expansion programme, building stores where customers lack purchasing power before the Tesco crisis started to hit some 3 years ago. So whilst Sainsbury tends to be more conveniently located, I don't do any big shops at Sainsbury. So whilst stock price downside may be limited, I can't see it catching up the FTSE any time soon. 3. Asda / Wal-Mart Asda in terms of sales is virtually neck and neck with Sainsbury's on £24 billion. Also Asda is part of the giant US Wal-Mart group,

Wal-Mart at $71.74, is 83% of its 2014 high of $86.01, the Wal-Mart stock price is obviously more influenced by US economic dynamics than its UK Asda subsidiary.

Personal Experience- Asda and Tesco have a lot in common in terms of store size, number of products on sale and in terms of generally being in poorer / cheaper locations. Which means in terms of whether to shop at a Tesco or Asda is dependant upon distance, so for most shoppers Tesco would be the more probable place to shop since there are far more Tesco stores out there. 4. WM Morrison Ranks fourth in terms of sales of £16 billion which have fallen from a 2013 peak of £18bn. A debt to capital ratio of 33% whilst not as low as Sainsbury, nevertheless is less than half that of Tesco. And despite having a market capitalisation of just £5.7bn had a net income very similar to that of the much larger Tesco.

The last close of £2.44 at 90.7% of its 2013 high of £2.69, on face value means that the stock market is signaling that Morrison to be the more robust of the big super markets. Though there is a fly in the ointment which is that about £3 tends to be the cap for the Morrison share price that has literally been sat in a £3 to £1.50 trading range for well over a decade. So whilst Morrison is doing well on a five year time frame, keep in mind that on an historical basis the stock does tend to top out at just over £3.

Current out performance of Morrisons is due to inhabiting a zone between that of the likes of Tesco, Sainsbury's, Asda and the discount retailers Aldi and Lidl. Which is what one experiences when shopping at Morrisons stores that are smaller and more tightly packed than the likes of Tesco's but have far more product lines than the smaller Aldi's and Lidl's, a half way house which is reflected in cheaper prices and thus Morrisons is clearly more able to retain customers than the likes of Tesco. Personal Experience- The stores tend to be significantly smaller then Tesco or Asda, resulting in a far smaller product range. So for big shoppers there is the question of having to get a number of items not on sale at Morrisons via a short trip to a Tesco. Nevertheless, smaller stores also convert into quicker shops, as long as checkouts are available, especially at night. Also, Morrisons is significantly cheaper than either Tesco, Asda or Sainsbury's, which on a big shop typically results in saving of at least 5%. So in terms of personal preference then Morrisons wins most of the time, which is reflected in the relative strength of its stock price on a 5 year basis. 5. John Lewis - Partnership 6. Marks and Spencer Marks and Spencers is the second department store (Ignoring John Lewis because it is not listed on the LSE) after the big super markets with sales of £10.5 billion generating a healthy net income of £407 mln and a market capital of £5.3bn. Whilst debt ratio stands at 42%.

The last close of £3.29 is 55% of its 2015 high of £5.92. The stock price does not match its far healthier financials and are clearly discounting future bad news. So whilst on the basis of the financials M&S looks robust, in reality the stock price is saying its likely to experience a very tough a 2017 much like Tesco! Whilst I am tempted to be seduced by the M&S high 5.65% dividend yield, however, I have a sneaky feeling that when the going gets tough they will cut the dividend as they have in the past. 7. KingFisher Britain's home improvement retailer, owner of B&Q and Screwfix in the UK and numerous DIY brands across the Europe. Generates profits of £813mln on sales of £10.5bln. With the debt ratio standing at a low 5%. So on face value Kingfisher financially appears to be the more robust of the major retailers.

The last close of £3.30 puts Kingfisher at 85% of its £3.90 high. However the 5 year chart shows that Kingfisher has clearly been stuck in a £4 to £2.60 trading range for some time. So just like Morrisons the stocks not about to play catchup to the FTSE anytime soon, at best all investors can hope for to gamble on a takeover bid. Though on the plus side a 3% divided yield is good for the sector.

Personal Experience - The B&Q stores are great, well stocked with a bewildering range of product lines to choose from. However, the prices are very high, so I only tend to shop at B&Q when they have an offer on i.e. spend £50 and get a £10 voucher. Whilst my preference for most things DIY is Screwfix, far cheaper though less convenient since the order needs to be confirmed online first, else there is a good chance an item on your to get list will NOT be in stock if you just turn up at Screwfix. I'll skip Dixon's and the Co-op to get the first discounter. 10. Aldi Ranks 10th in terms of sales of £7 billion. Aldi is a privately held company not listed on an stock exchange so no stock chart to evaluate. However sales continue to rise at a robust rate of 12% per annum, generating profits of £255mln and unlike the rest of the sector continues to open new UK stores at the rate of about 70 per year, aiming to achieve 1000 by 2022 up from 659 for the year to December 2015 as Aldi continues to erode the super market giants market share.

Retail Sector Conclusion Clearly the retail sector is suffering with all of the established stocks badly under performing the FTSE. Worse still they have all been stuck in a rut for well over a decade with no sign that they are likely to breakout into new ground anytime soon. Tesco clearly is in for a lot more pain this year as it loses market share to other major competitors and the discounters, thus will likely translate into job losses and store closures. Whilst Asda and Morrisons should fair much better, probably because Aldi and Lidl whilst expanding by about 10% per annum still only represent about 10% of the groceries market so are gaining market share at the rate of about 1% per annum. Meanwhile the likes of M&S and Kingfisher will also take a battering. Whilst if I had to pick one stock, I would probably go for Sainsbury given it's great dividend yield of 4.5%, it may not catch up the FTSE but will likely significantly out perform the rest. The gamble play would be Marks and Spencer given it's 5.65% yield, though it really is a gamble because I suspect the dividend will be cut. The bottom line is that most of the retail sector looks set to have a very tough 2017 as inflation bites. With all eyes on the big elephant in the room, Tesco that continues its downwards death spiral. Is EU BrExit Hard line European Union Committing Suicide?

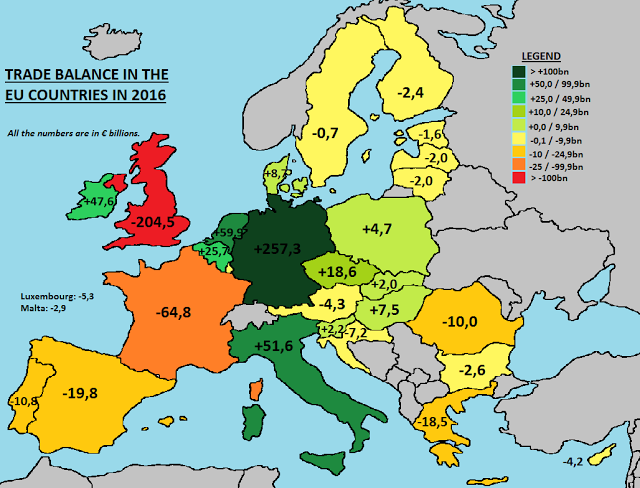

In practice a EU hard line translates into no access to the single market, which in trade terms will result in a World Trade Organisation tariffs regime that typically range from between 5% to 15% tariff for most goods and services. “The British should know this, they know this already, that it will not be at a discount or at zero cost. The British must respect commitments they were involved in making, so the bill will be, to put it a bit crudely, very hefty.”- EU Commission President Jean-Claude Juncker warns - 21st Feb 2017 “We have to avoid that the British example will be followed by other member states. That’s been the position of the German government.” German Finance Minister Wolfgang Schäuble - 20th Feb 2017 "Britain must not be better off outside the European Union after Brexit" - French Senate - 19th Feb 2017 In response to the near daily avalanche of warnings emanating out of the EU our shy Prime Minister Theresa May has mostly gone dark, only offering the occasional speech which is in stark contrast to the 24 hour news cycle spin machines of the past 20 years that offered a near immediate response to whatever story the manic mainstream media were running with at a particular hour, not so for Theresa May where it is a case of the exact opposite - SILENCE! Which actually makes a refreshing change from the lying spin machines of Blair and Cameron's governments as it now implies that the PM is actually getting on with running the country than pandering to the self absorbed mainstream media that seeks to exaggerate and see's controversy in every event. However, as I have covered numerous times over the years that the EU taking a hard line against Britain in terms of access to the single market can only hurt Europe far more than Britain and especially the likes of Germany - UK Government EU Referendum Propaganda Leaflet Backfires as Anger Spurs BrExit Support Apr 11, 2016 - 01:16 PM GMT A stronger economy paints a picture of 4 million UK jobs reliant on the EU. Which even if true has a gaping omission which is that Britain has an annual trade deficit with Europe of over £90 billion per year! What does this mean? It means that Britain employs net several millions more German, French and other EU workers at an annual cost of £90 billion a year. So the truth is that the European Union would bend over backwards to retain this net annual jobs subsidy from Britain that supports so many millions of European Union jobs, for if there were trade balance rather than the current imbalance then that £90 billion could create and sustain 3 million UK jobs if Britain stopped paying for EU jobs effectively bringing jobs home from Europe. The following map further illustrates the state of the European Union's single market in terms of trade imbalances between member states that clearly shows Britain is the sucker in the room, being conned to the tune of Euro 200billion that are going towards employing a net several millions of German, Italian and Eastern European workers. So the only additional thing to note to that which I have written before is that Italy also hugely benefits at Britains expense.

Therefore in terms of trade flows Britain has a major card up its sleeve that it should play, that of a net 2.5 million EU workers Britain pays for as in Germany, and Italy alone Britain probably employs more than 1 million workers servicing its trade deficit with these two nations whilst also being a heavy employer of Spanish, Belgium, French and Polish workers. In totality Britain employs approaching 3 million EU workers on mainland europe who produce goods for the British consumer, whilst at best UK exports to the EU probably employ some 1/2 million UK jobs thus technically a clean break resulting in total collapse of trade with Europe would result in UK demand for nearly as many as a net 2.5 million jobs whilst the EU would LOSE a net 2.5 million jobs with Germany, Spain, France and Italy being the hardest. Furthermore EU share of Britain's exports has been on a declining trend trajectory for more than decade, falling from a peak of about 54% 10 years ago to 44% today which illustrates that economic growth has been coming from OUTSIDE the EU, whilst remaining within the EU PREVENTS Britain from entering into trade negotiations, which was made clear when the EU warned against Britain attempting informal trade talks with the Trump administration. “I do not like that member states of the European Union, including those that are still a member state, are negotiating free trade agreements. This is an exclusive matter of the European Union.” - Juncker “It’s very clear that in order to sign and have a bilateral agreement with third countries, the UK first needs to reach a settlement with the EU." - Muscat This is just one example of how if the EU holds true to its threats of punishing Britain then it is the EU that would be the big loser! Yes there would be short-term turmoil as the UK economy adjusts to loss of access to the single market, but against this Britain would enjoy a short-term windfall from tariffs charged on trade of about £300 billion converting into a £30 billion tax revenue boost for the UK Treasury. Another card to play is NATO, as Britain once more has been scammed by the EU to play a disproportionately large role in the defence of Europe with troops stationed on Europe's Eastern borders, that Britain could use against threats from the take-take states such as Poland and the Baltic states who repeatedly warn of tough negotiations because they want Britain to be forced to continue to pay its subsidy as part of the £11 billion annual EU black hole that UK tax payers fund. So in conclusion the UK has many trump cards to play, not least of them President Trump who likens himself to being "Mr Brexit", which means that if the EU does carry out its threats that the remoaners such as Tony Bliar so vocally keep regurgitating then it would be tantamount to Europe committing economic suicide which could even trigger a BrExit recession for the likes of Germany and far worse for an economically more fragile Italy that would further weaken the European Union increasing the risks of disintegration that would make itself manifest in the bond markets. At the end of the day Brexit for the EU is a lose, lose situation, and it all boils down to just how badly does the EU want to lose. For clearly punishing Britain, which whilst hurting Britain will nevertheless exact a far higher price on the European Union as any pain for Britain would be temporary whilst the consequences for the EU could be existential i.e. risk triggering a collapse of what remains of the European Union as the series of crisis triggered from a German and Italian recession snowballing out of control, having unintended consequences such as other anti-EU political movements being elected to push more nations to follow Britain's Brexit's lead. Brexit Implications As for the implications of BrExit on the UK economy and markets then see see my extensive analysis that looked at ten major drivers for the UK economy, of what to expect to happen next:

Is Trump Delirium Burning the Stocks Bull Market? And as for the stock market, the Alt-Reality President Trumps' election victory induced delirium rather than dissipating is clearly intensifying. The stock market rallying from 20k to beyond 21k is akin to a market literally being on FIRE! Find out what this means for the future prospects for the stock market in my latest video. Ensure you are subscribed to my always free newsletter and youtube channel for forthcoming analysis and detailed trend forecasts aimed at capitalising on the Trump Reset. Source and Comments: http://www.marketoracle.co.uk/Article58336.html By Nadeem Walayat Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Some 8 months on from the British people voting against the interests of the establishment elite, most notable of which was for the emergence of an undemocratic european super state that further concentrated power into their own hands to the detriment of ordinary people. Britain is counting down to the triggering of Article 50, the formal request to LEAVE the European Union within a technical 2 year time limit for completion of but in practice may extend to several more years beyond. However, the EU elite even before the June 23rd 2016 vote, have been persistently warning the British people that they will be punished for voting for freedom from the EU super state, where the unsaid reason being so as to prevent a total collapse of the European Union as other states take Britians cue to rush for exit freedom.

Some 8 months on from the British people voting against the interests of the establishment elite, most notable of which was for the emergence of an undemocratic european super state that further concentrated power into their own hands to the detriment of ordinary people. Britain is counting down to the triggering of Article 50, the formal request to LEAVE the European Union within a technical 2 year time limit for completion of but in practice may extend to several more years beyond. However, the EU elite even before the June 23rd 2016 vote, have been persistently warning the British people that they will be punished for voting for freedom from the EU super state, where the unsaid reason being so as to prevent a total collapse of the European Union as other states take Britians cue to rush for exit freedom.