USD Decline Continues, Pull SPX Down as well?

Currencies / US Dollar Mar 21, 2017 - 03:06 PM GMT Good Morning!

Good Morning!

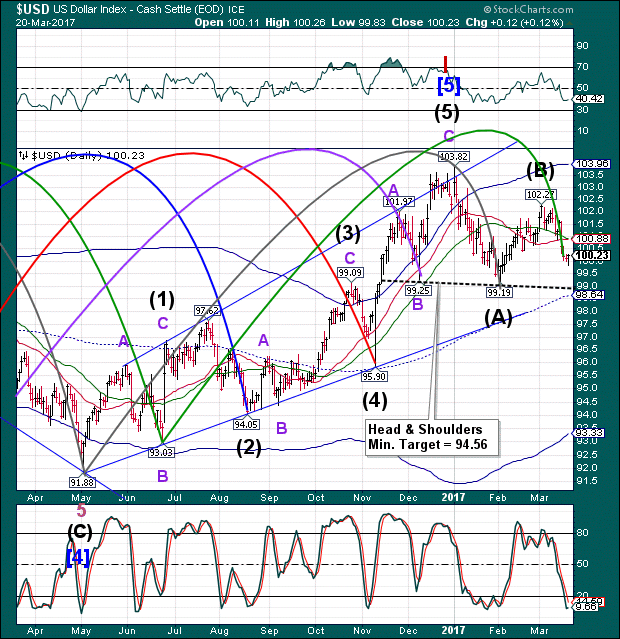

USD futures are still on the move as the dollar declined to a low of 99.59 this morning. We are still looking for the expected master Cycle low, but it is late in coming.

Today is day 271 of the current Master Cycle and a possible Primary Cycle turn date. While it can turn here, the USD appears to be too close to the Head & Shoulders neckline and mid-cycle /support to ignore them. Counting today’s decline, the USD has 7 declining waves, which is corrective. If my label is correct, the decline is more likely to be impulsive, suggesting yet another probe lower after today.

USD/JPY is in decline but must fall beneath 111.60 to have a bearish breakdown. The overdue Master Cycle low suggests that 111.60 may be support for a bounce.

The question is, will the USD decline enough to pull SPX down as well…or will it remain above the neckline?

SPX futures had a positive overnight session, but appear to be weakening. The declining USD has had an influence on SPX. But will it be enough to cause a breakdown?

I have examined the Cycles Model and there is a chance that this decline may end in a flash crash. SPX has spent 3 days in decline from the 2390.01 high. The chances are slim that we could see a flash crash in the next 1.3 days (a total of 4.3 days or 30 hours). However, it may decline in 6.14 days (43 hours), the same amount of time it took for the March 1 to March 9 decline. That puts a potential low in the first hour of Friday morning on day 270 of the Master Cycle.

That suggests if the USD persists in its decline and we see sell signals given in the VIX and Hi-Lo we may brace ourselves for another low on Friday.

So far, the SPX is giving no indication of of its intent, other than closing under Short-term support/resistance. ZeroHedge reports, “European stocks are modestly in the green as gains in banks and oil companies offset declines in miners. Asian stocks and S&P futures rise with Emerging-market stocks extending their longest winning streak since August on the back of the 5th consecutive daily drop in the USD.”

VIX futures are modestly lower as I write. As mentioned earlier, we should see a breakout above the 50-day Moving Average and, in the case of a flash crash, a breakout above the Head & shoulders neckline, as well.

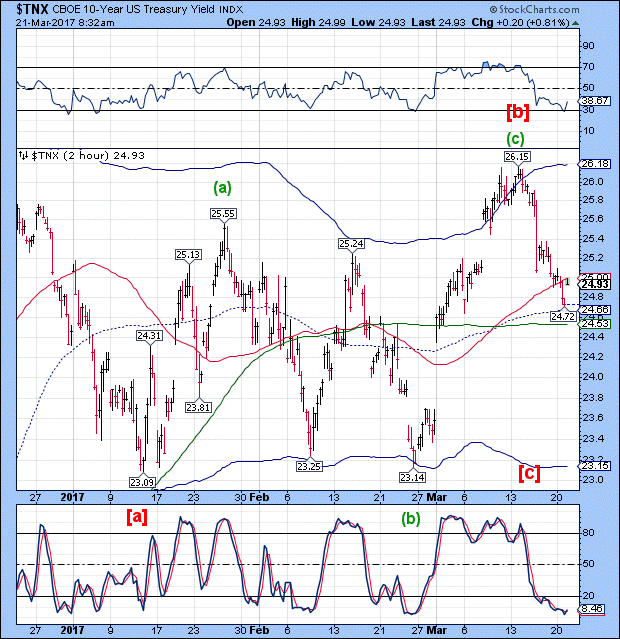

TNX popped higher this morning as it reached day 259 of its Master Cycle. However, it also has a Pi date on Thursday. Being this close to a projected Master Cycle low suggests that the TNX Cycle may favor the Pi date for its low. That would fit with a potential low on Friday for SPX.

ZeroHedge observes, “There has been no shortage of sellside reactions to last week's Fed rate hike, which have run the gamut from congratulatory as per BofA and Credit Suisse, to the outright critical, as we showed last week in a note from Goldman Sachs, RBC and SocGen, all of whom accused the Fed of either misleading the market, or soon being being forced to double down on its hawkish message as a result of the dramatic easing in financial conditions as a result of a rate hike.”

In other words, there could be a short squeeze developing in Treasuries, where the decline in yields is fed by short covering in bonds.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.