Yellen’s Setting Up the Markets For Their Third Fed-Fueled Financial Crash

Stock-Markets / Financial Crash Apr 14, 2017 - 10:09 PM GMTBy: Graham_Summers

Janet Yellen is playing with matches next to a $20 Trillion Debt Bomb.

Janet Yellen is playing with matches next to a $20 Trillion Debt Bomb.

During her speech at the Gerald R. Ford School of Public Policy in Michigan, Yellen stated that the biggest risk to monetary policy is for the Fed to “get behind the curve” regarding inflation.

To that end, the Yellen Fed has already raised interest rates twice in the last six months. And it is pushing for yet another rate hike in June.

However, Yellen as usual is missing the bigger issue: the risk of DEBT deflation triggered by the Fed’s rate hikes.

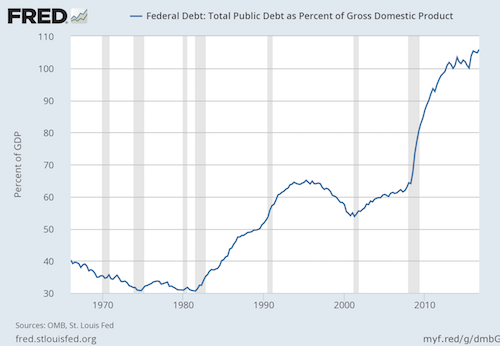

Since the 2008 Crisis, the US has been on a debt binge unlike anything we’ve ever seen before. Thanks to seven years of ZIRP and $3.5 TRILLION in QE, the US’s debt load has nearly doubled, bringing our Debt to GDP ratio well over 100%.

Now Yellen wants to raise rates even more, in her hopes of catching up with inflation…

But what happens to the US’s massive debt pile as the Fed keep’s raisings rates, making the debt MORE expensive to pay off?

In 2016, when rates were still 0.5%, the average US interest payment was already 1.9%. What happens to this when the Fed keeps raising rates, pushing the yield on the debt even higher?

The markets are already “smelling” this.

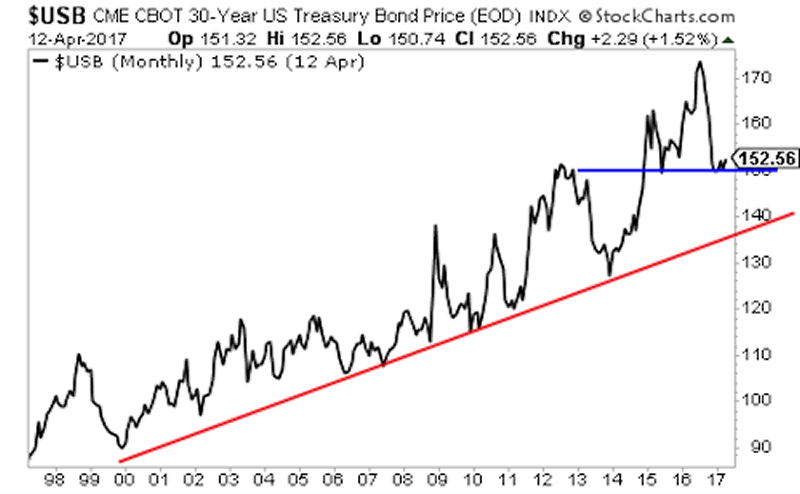

Already the 30-Year US Treasury bond has dropped sharply to critical support (the blue line). And that’s before the Fed even raises rates in June, let alone pushes to start shrinking its balance sheet later this year.

Truth be told, we’re not that far off from a debt crisis. Greece’s Debt to GDP was 109% when it first began imploding in 2010. We’re only a hair’s breadth away from that now. And given the Fed’s track record with asset bubbles (the Tech Crash in 2000, the Housing Crash in 2008), what are the odds the Fed’s going to blow the system up once again, due to mismanagement of OBVIOUS risks?

We are already preparing our clients for how to make money from this. If you’d like to learn three simple investment strategies on how to navigate the coming US debt bomb, you can pick up a free Investment Report here:

http://phoenixcapitalmarketing.com/bondbubble2.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.