SPX May be Completing its Corrective Pattern

Stock-Markets / Stock Market 2017 Apr 19, 2017 - 02:22 PM GMT Good Morning!

Good Morning!

It appears that SPX may be completing a Wave [c] of 2 this morning. This changes the structure somewhat, postponing the top of Wave 2 until today. My original thought that the low at 2328.95 was Wave [b] was because of overlap between the waves. Leading diagonal waves may overlap, so that description is being moved forward.

Yesterday SPX completed 62 hours in the current Cycle. There is a strong likelihood that the Wave [c] rally may end in 2-3 hours (64.5 total). The 11:30 closing of the European markets which are positive this morning may do the job. The upside target appears to be the 50-day Moving Average at 2353.77, the 50% retracement of the decline from the 2378.36 top.

ZeroHedge reports, “European stocks rebounded after the biggest one-day drop since November, alongside S&P futures, while Asian equities posted modest declines after yesterday's weak US close. Gold and yen slid, while the dollar gained on the latest Mnuchin comments to the FT according to which Trump was "absolutely not" trying to talk down the dollar.”

This is a look at the SPX denominated in Euros. A quick probe to the Wave [a] high at 22.33 would give it a 67% retracement value.

VIX futures are down this morning after breaking down beneath the prior day’s low in the final hour. A 50% retracement would decline to 13.12, while a 61.8% retracement would touch 12.93.

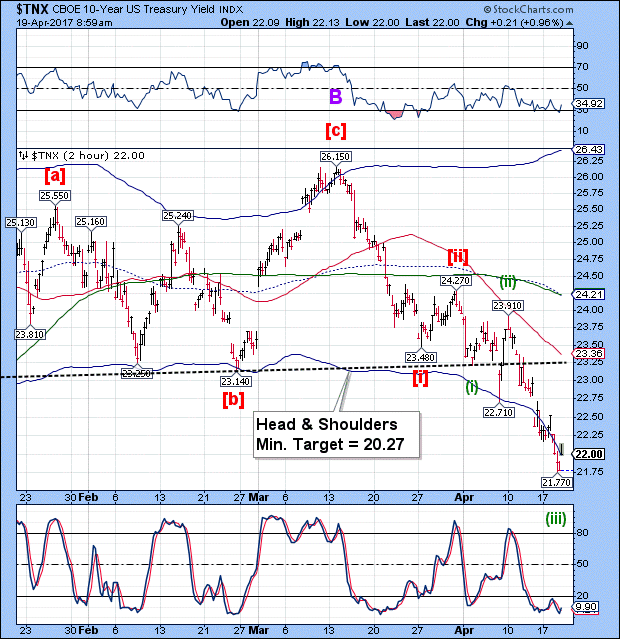

TNX is consolidating its decline. That does not mean that it is over. So far, Wave [iii] is 2.5 points, while Wave [i] is 2.67 points. By definition, Wave [iii] of C should not be smaller than Wave [i] of C. In addition, the Head & Shoulders target is often the target for a Wave [iii]. I am looking for a brief probe to the vicinity of 22.50 after which Wave v of (iii) resumes.

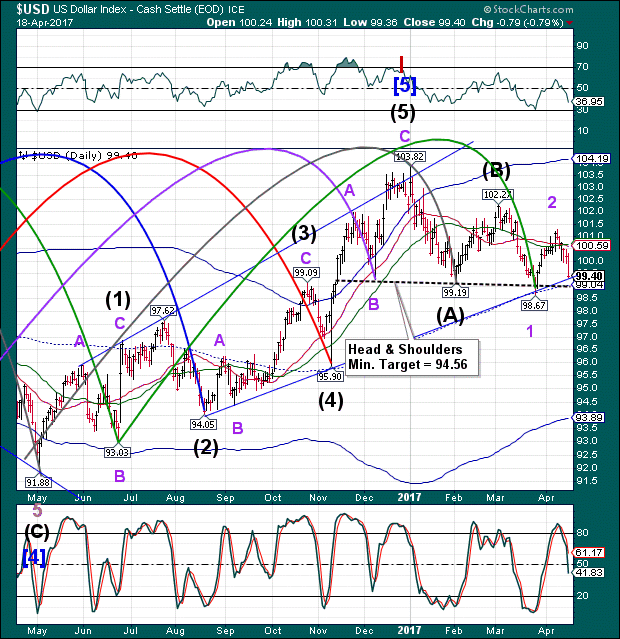

The USD futures bounced to 99.65 this morning, which would be expected at a trendline. The decline is by no means fully developed yet, so the upside should be limited at 99.90. Finally, the Cycles Model suggests a Master Cycle low on May 3, only two weeks away.

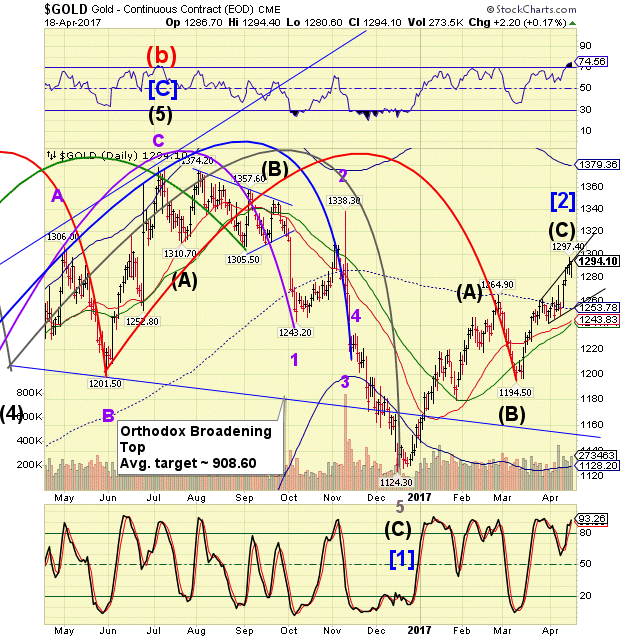

Gold attempted a bounce higher, but was stopped by its Broadening Wedge trendline. This morning’s futures appear to be in decline. Aggressive short positions may be taken beneath 1280.00. A confirmed sell signal may not come until it declines beneath its mid-Cycle support at 1253.78.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.