The Last Time This Happened, Gold Rallied 20%

Commodities / Gold and Silver 2017 Apr 20, 2017 - 10:38 AM GMTBy: HAA

John Grandits : With much of the price action in gold driven by sentiment and technical analysis, you should keep an eye on the broader trends, even if you consider yourself a buy-and-hold investor.

John Grandits : With much of the price action in gold driven by sentiment and technical analysis, you should keep an eye on the broader trends, even if you consider yourself a buy-and-hold investor.

Traders use technical analysis to predict future market moves based on recent price action. Most of it sounds complicated, but it really boils down to simple math.

One of the most commonly cited technical indicators is a moving average. Day traders often use moving averages based on very short time frames—sometimes as short as one minute—while longer-term investors refer to 50-day and 200-day moving averages to spot opportunities.

According to Newton’s First Law of Motion, a body in motion will remain in motion unless acted upon by an outside force. Investments work the same way: once a trend has gained momentum, it tends to continue—be it up, down, or sideways.

This has largely been the case for gold, which kept trending down over the past five years.

But now the trend seems to be reversing: gold is up over 20% since its December 2015 low of $1,050/oz. and over 10% since the beginning of 2017.

That means opportunities to get gold “on the cheap” may be dwindling, as the most recent price hike to $1,275/oz. this week indicates.

But How Can We Be Sure?

The short answer is, we can’t. But one technical indicator has proved extraordinarily reliable in forecasting larger trend changes. It’s known as the “Golden Cross.”

We see this cross (which has nothing to do with gold itself) when a shorter-term moving average crosses “up” through a longer-term moving average. Longer-term moving averages typically are better predictors of significant trend changes.

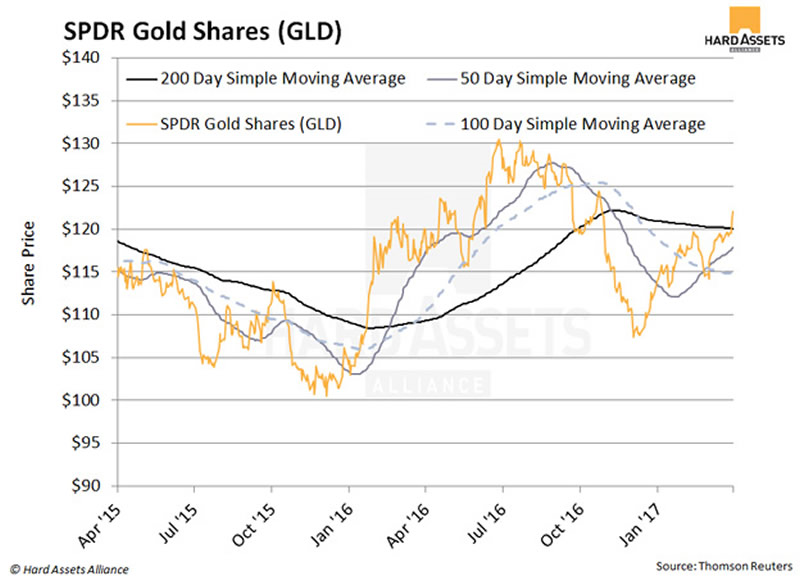

The following chart of GLD, a good proxy for the price of gold, contains three simple moving averages, 50-, 100-, and 200-day.

Note that the 50-day crossed up through the 100-day in mid-March, and gold subsequent rallied from $1,200 to $1,275/oz.

With the strong rise this week, gold has moved above its 200-day moving average.

The 50-day average is also getting close to crossing above this critical threshold. If the move materializes, it would form the above-mentioned Golden Cross.

This is a strong, supportive technical indicator for the coming months.

The last time gold crossed above its 200-day moving average, in early 2016, gold went on to rally $230/oz., from $1,130 to $1,360. The Golden Cross occurred a few weeks later.

While past is not prologue, the reasons for owning gold are as strong as ever. Whether it’s mounting tensions with Russia/Syria and North Korea, a US stock market looking more vulnerable to a correction, the Fed attempting to unwind its massive balance sheet and tighten monetary policy, or the upcoming election in France—there are ample catalysts to propel gold higher.

If the Golden Cross fails to materialize and gold consolidates some of the gains from this year, you should view this as a buying opportunity before the next move toward $1,400/oz.

Since December 2015, gold has consistently moved a few steps forward and then taken a step back, making higher lows in the process, a constructive view from a technical standpoint. I recommend you watch gold’s price action closely in the coming months and use the fluctuations to be opportunistic in building your position.

Free Ebook: Investing in Precious Metals 101: How to Buy and Store Physical Gold and Silver

Download Investing in Precious Metals 101 for everything you need to know before buying gold and silver. Learn how to make asset correlation work for you, how to buy metal (plus how much you need), and which type of gold makes for the safest investment. You’ll also get tips for finding a dealer you can trust and discover what professional storage offers that the banking system can’t. It’s the definitive guide for investors new to the precious metals market. Get it now.

© 2017 Copyright Hard Assets Alliance - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable,

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.