Is the Stock Market Bounce Over?

Stock-Markets / Stock Market 2017 Apr 24, 2017 - 03:37 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: Uptrend continues.

SPX Intermediate trend: The correction from 2400 continues,

Analysis of the short-term trend is done on a daily-basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

Is the bounce over?

Market Overview

As anticipated, the market was ready for a rally, and SPX obliged with a 32-point bounce which came in three distinct phases and were a display of Fibonacci symetry. At first, the index retraced .382 of the decline from 2378 before pulling back. The second phase went to .50 before reversing, and finally, the third phase slightly exceed a .618 retracement before ostensibly putting an end to the bounce and tacking on another .618 retracement in the opposite direction. But it did not stop there and the Fibonacci sequence continued to rule the moves into the close.

The index ended the week without the indicators telling us clearly that it was resuming the downtrend, and it is possible that of the 2361 high will be re-tested and perhaps exceeded. A knee-jerk reaction to the French election results may take place, so this is not the time to make a concrete near-term forecast. We'll do that after Monday's opening. But I see no reason to expect a radical change in the intermediate forecast which should still be governed by the cycles bottoming in the next two or three weeks.

Analysis:

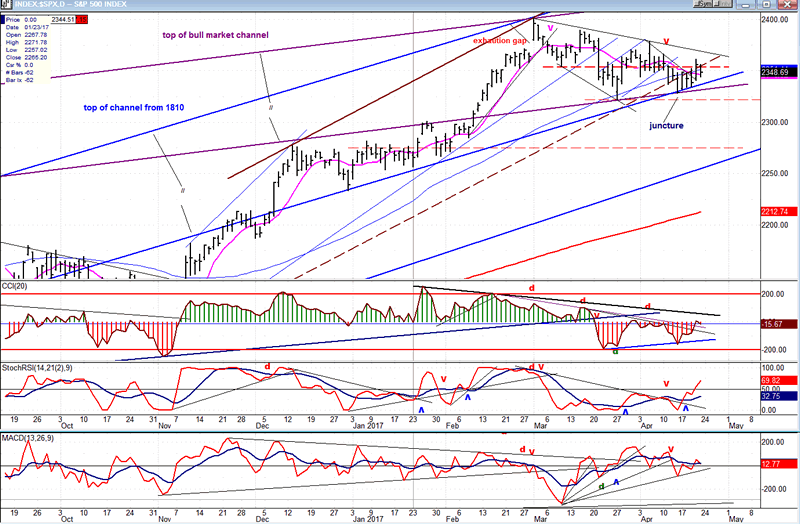

Daily chart

In the last letter, I mentioned that although the (dashed) lower channel line from 2084 had been penetrated, it was by a minimal amount, and we can see why the index did not continue lower. It found support at the juncture of two parallels of the top line of the two long-term channels, one being the bull market channel, and the other the channel formed by the price action since the 1810 low. For the past week, SPX has traded in a tight minor uptrend crawl against the lower channel line and will continue until those two paralells are breached. It could come quickly on Monday if the market reacts unfavorably to the French elections, or it could be delayed in case of an opposite reaction.

Next week is also loaded with other potential stimuli for the market to move in either direction, so we do not want to get too detailed in our prognosis until the week is farther along. The oscillators are mixed with the SRSI back in an uptrend unconfirmed by the other two; but the patterns could change quickly if next week turns out to be volatile.

This chart and subsequent ones courtesy of QCharts.com

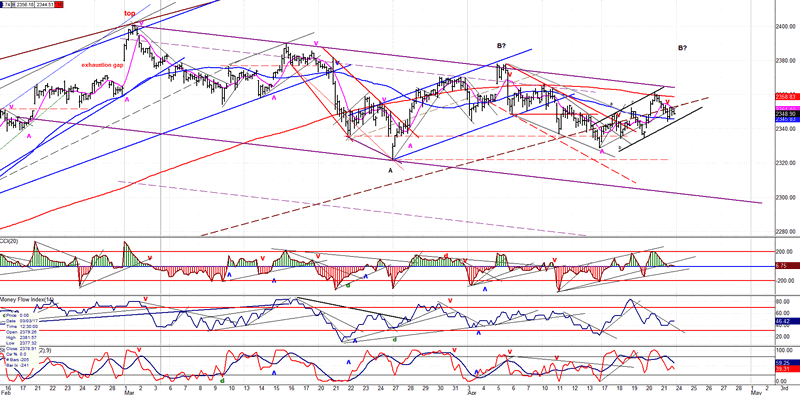

Hourly chart

The correction continues to be mild with the last minor downtrend finding support around the main channel line from 2084, unable – at least at this time – to move all the way down to the bottom of the corrective channel. Instead, it seems to want to challenge the top channel line again.

Friday's close left the index in a neutral position, apparently waiting for the results of the French election to make its next move. Even if it should spike briefly out of the top trend line, this would not likely be the beginning of anything significant, but perhaps another placement for the B-wave, as discussed in the previous letter.

There is no good reason for the correction to stop here. The cycles which have governed the correction are still scheduled to make their lows two or three weeks from now, and we could get some action similar to the sudden decline that completed wave A, marking the bottom of the 20-week cycle. The top oscillator found support on the zero line and may bounce off it before breaking through, especially since there was no divergence at the previous top. So, could Fibonacci dominance continue to prevail and follow up with a 100% retracement to the 2378 top? (This is not a prognosis, by the way!)

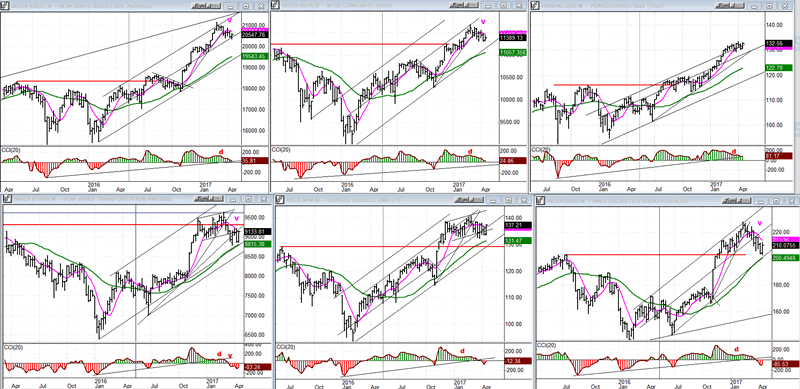

An overview of some important indexes (Weekly charts)

All six indexes rallied last week, with the strong remaining strong, and the weak remaining weak. QQQ was again outstanding by very nearly making a new high. If you want to get a good perspective on the relative strength between the top and bottom tier, look at the distance between the index price and the (green) 34-dma.

Since nothing significant happened last week, we don't have to dwell on this group for now.

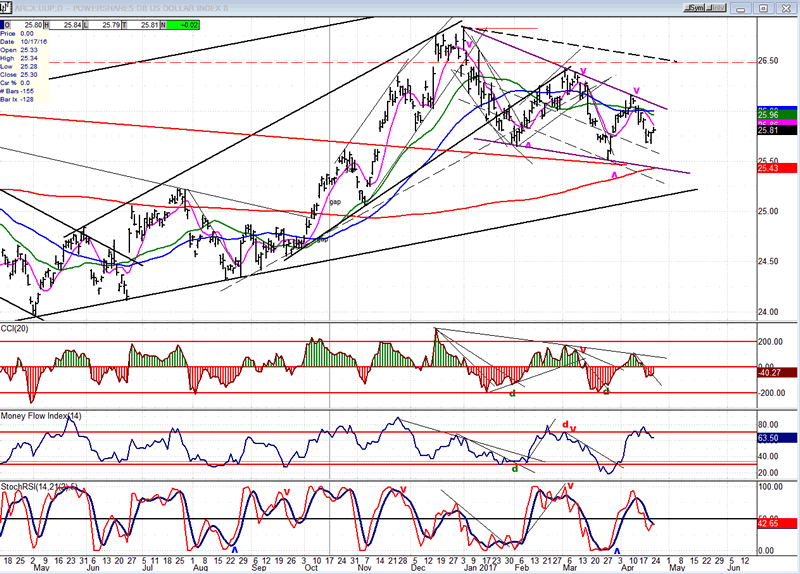

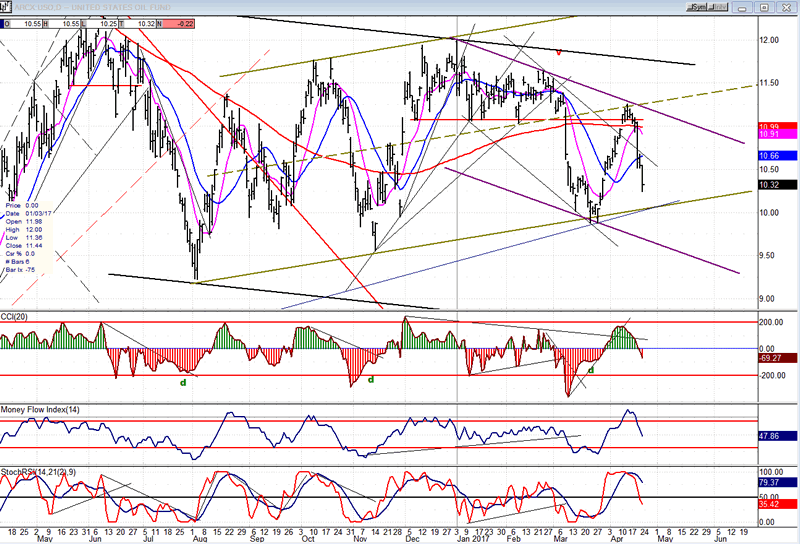

UUP (dollar ETF)

Last week, UUP extended its correction but, by the end of the week it had recovered and may be ready to challenge the pink MA which, if overcome, would be an indication that the correction is over and that it is ready for another joust with the downtrend line. Holding at this level and starting to move up would be a positive, and breaking through the downtrend line would be a sign that the quest for a new high continues. As stated earlier, the P&F chart is projecting new highs.

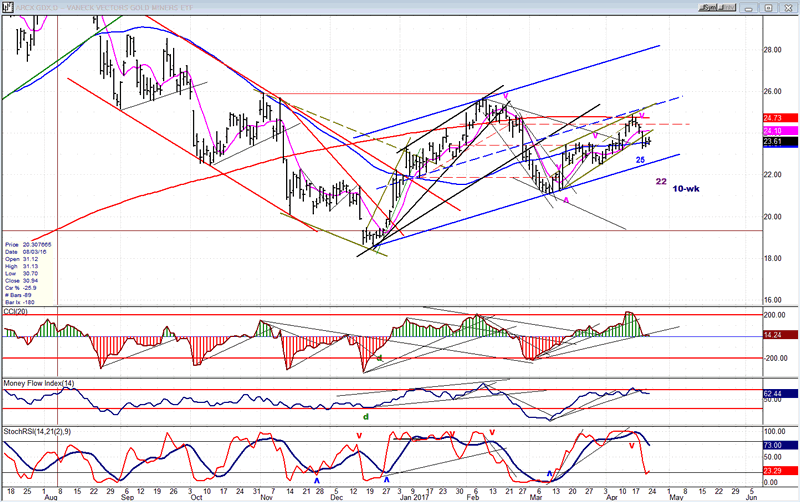

GDX (Gold Miners ETF)

GDX has started to react to the downward pressure exerted by the cycle lows which lie ahead. It prevented the advance from going past the half-way mark of the bullish channel that had formed since the December low, and the drop into the 25-28 low has already pulled it back .618 of the distance achieved by the secondary rally within the channel. The pattern that it has made over the last two days is a weak hold, and it's likely that a new near-term low will be made into the 22-day cycle low due this week. After that, it will have to deal with the bottoming action of the largest of the three cycles: the 9/10-week cycle, which may not end until the middle of next month.

Note: GDX is now updated for subscribers throughout the day, along with SPX.

USO (U.S. Oil Fund)

USO was expected to find resistance at the junction of the two trend lines and at the bottom of the congestion level, but the degree of retracement is a bit of a surprise, suggesting that the index may be starting another bearish corrective pattern. Need more time to asses.

Summary:

SPX ended the week in a near-term neutral position as it probably awaits the result of the French election to decide on its next move. Whatever it turns out to be, the intermediate correction is still in force, and lower prices are expected before it ends.

Andre

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.