Trump 100, Margin Debt Stock Bubble and Gold

Stock-Markets / Stock Market 2017 Apr 27, 2017 - 02:34 PM GMTBy: GoldCore

– Stocks and the dollar look vulnerable due to Trump’s policies, America’s civil war politics and economic vulnerability

– Stocks and the dollar look vulnerable due to Trump’s policies, America’s civil war politics and economic vulnerability

– Stock bubble on margin debt – ‘Powerful time bomb’

– “There is no alternative” to stock bubble? Gold?

– Bank Of America sets a date for the market’s “Great Fall”

– Even uber bull Cramer compares 2000 dotcom bubble bust to today

– Gold to stay elevated on safe haven demand – Economist

– Gold’s tempered climb makes gains more ‘sustainable’

Trump’s first 100 days in office have been a whirlwind but so far the ‘Trump Trade’ of being long stocks has worked for investors and speculators. Will markets continue to be so forgiving of the many foreign and domestic policy failures including the failure to repeal ‘Obamacare’?

So far during his Presidency, markets have remained high on the cocaine of massive monetary stimulus and still near o%, ultra low interest rates and record margin debt.

There remain hopes of a further “Trump bump” from aggressive fiscal easing and deregulation and this and increasing “irrational exuberance” has seen the S&P 500 move back towards record territory, driven by increasingly bubble like technology stocks and a Nasdaq at all time record highs above 6,000.

The smart money continues to be be concerned about the bubbles that continue to inflate. Risk appetite is near record highs and even bearish news is greeted as a buying opportunity. The mantra is ‘TINA’ – ‘there is no alternative’ to stocks and bonds.

The obvious alternative in these uncertain and volatile times is a diversification into gold. A very similar mantra was heard in 1999 and 2007 and this is typical of bubbles. The obvious alternative in 1999 and 2007 was a diversification into gold.

Our advice is that, a la 1999 and 2007, it is time to become more risk averse and become more rigorous in your asset allocation. Our clients and more risk aware and averse investors are slowly and prudently placing themselves besides the fire exit and reducing allocations to stocks and bonds and increasing allocations to cash and gold.

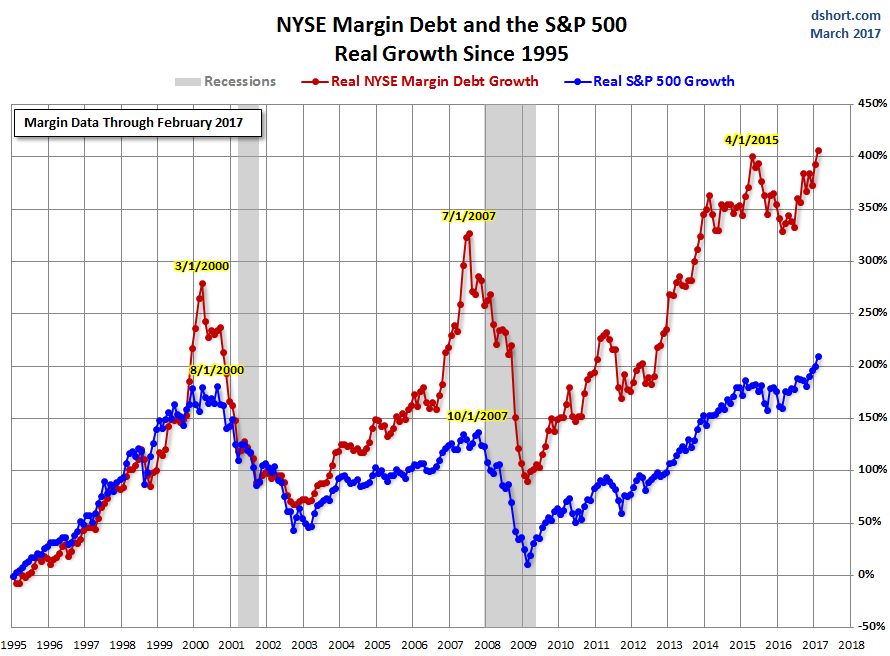

Wolf Richter of the Wolf Street blog says the market “sits blithely on a powerful time bomb” and “no one knows the full magnitude, but it’s huge.” The time bomb he’s referring to is the explosive growth of margin debt (see chart above), a trend that usually eventually leads to a market crash or at the very least a severe market correction.

The question is when and from what levels.

Stock market margin debt, as reported by the NYSE, has now surged to a record high of $528 billion. That’s not including loads of unreported margin, or “shadow margin,” that Richter says could put the total figure somewhere near $800 billion.

“Margin debt is in an uncanny relationship with the stock market … It soars when stocks soar and crashes when stocks crash. They feed on each other.”

Clearly, the stock market has become crazy leveraged. And, also clearly, that often leads to big losses when it starts to fall apart.

“Margin debt … has the unnerving habit of peaking right around the time the bubble turns into a selloff … While it’s a terrible predictor of a crash — no one knows if February was the peak or just another stage on the way to an even more dazzling peak — it is associated with enormous risks.”

Quite.

In this context we believe, like Bank of America, that the stock market may be set for a “Great Fall” and that gold will begin to outperform and build on the 10% gain in 2016 and 10% gain YTD 2017 when this happens and risk aversion returns as it inevtiably does.

Even uber stock market and America bull, Jim Cramer of CNBC compares the 2000 dotcom bubble bust to today. Cramer has advocated diversifying into gold.

Gold’s 10% gain year to date in 2017 is a “tempered climb” which makes the gains very ‘sustainable’ according to State Street’s Milling-Stanley.

Gold is likely to stay elevated on safe haven demand according to most gold analysts including the economist Barnabas Gan of Singapore Bank OCBC, as reported by Frank Holmes.

It is hard to argue with Bank of America, Cramer, Milling-Stanley and Barnabas Gan on this one.

Gold Prices (LBMA AM)

21 Apr: USD 1,281.50, GBP 1,000.85 & EUR 1,197.31 per ounce

20 Apr: USD 1,279.90, GBP 996.91 & EUR 1,188.00 per ounce

19 Apr: USD 1,282.05, GBP 999.74 & EUR 1,196.79 per ounce

18 Apr: USD 1,285.00, GBP 1,025.82 & EUR 1,205.46 per ounce

13 Apr: USD 1,286.10, GBP 1,025.28 & EUR 1,208.42 per ounce

12 Apr: USD 1,272.30, GBP 1,018.22 & EUR 1,199.02 per ounce

11 Apr: USD 1,255.70, GBP 1,011.47 & EUR 1,183.75 per ounce

Silver Prices (LBMA)

21 Apr: USD 17.98, GBP 14.05 & EUR 16.80 per ounce

20 Apr: USD 18.19, GBP 14.21 & EUR 16.91 per ounce

19 Apr: USD 18.22, GBP 14.19 & EUR 16.99 per ounce

18 Apr: USD 18.42, GBP 14.56 & EUR 17.27 per ounce

13 Apr: USD 18.56, GBP 14.80 & EUR 17.45 per ounce

12 Apr: USD 18.31, GBP 14.65 & EUR 17.27 per ounce

11 Apr: USD 17.94, GBP 14.44 & EUR 16.91 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.